Hedge Funds Review - October 2009

Articles in this issue

Investors show more diligence

Has the process of due diligence changed? Are investors taking this more seriously and is it having any impact on hedge funds or funds of hedge funds and their operations or structure?

Lehman fallout still causing concern

How did firms deal with assets held at Lehman?

Farmland offers opportunities

Population growth and climate change are driving a change in the way the world uses land. As a consequence there is a shortage of good-quality farm and forest land.

See you in court?

Will there be increased litigation in the coming months/year related to the events of 2008? In general do you expect to see more litigation relating to hedge funds over the medium to longer term? What do you think will be the main issues/areas of…

Systematic investment

Formed through a spin-off from JWM Capital Partners, Episteme Capital’s inaugural fund went live in July this year.

Liquidity goes down the drain

Liquidity: investors want it and funds need to provide it. But what this actually means in practice covers a multiplicity of meanings and motivations. Hedge Funds Review finds out what mistakes were made in 2008 and how these can be avoided in future.

Limited opportunities for expansion

What new services will the legal profession offer over the next 12–18 months? Will legal firms continue to diversify into other hedge fund-related activities (such as fund administration, marketing support, provision of directors) or should they focus…

Accounting Round Table

A report looking at the quality and reputation of auditors has become an even more critical selection criterion; valuation issues thrown up by illiquid assets are set to be a permanent part of the industry; the collapse of Lehman caught many hedge funds…

Enterprising investment

TTP Ventures’ chief executive David Gee believes clean technology is set to be the highest growth economy in the UK over the next 10–20 years.

Simple strategies are the best

Investors were shocked in 2008 when they discovered diversifying a portfolio could not get rid of risk. Economists were less unsettled. They tend to look at a whole range of views, examining data and information domestically and globally in order to form…

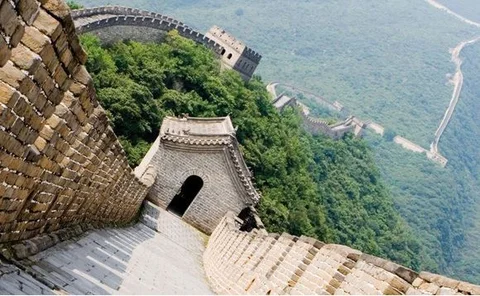

Chinese opportunities

Of all the world’s emerging markets, none has boomed so quickly as China. While the developed world struggles with the financial crisis, China is forecasting continued strong growth.

Man on a mission

With a background that has taken him through banking and global institutions, Todd Groome may seem at first glance an unlikely champion of the hedge fund industry. This varied experience, however, is just what has given him a deep appreciation of what…

Determining fair value comes under attack

What are the issues around valuations?

Making the right choice

What are the main considerations of a hedge fund when it chooses its legal counsel? Under what circumstances should a fund consider in-house legal services?

On/offshore convergence

Do you think the regulatory requirements between jurisdictions – both on and offshore – will narrow? Will there be growing convergence between onshore and offshore documents and regulation of funds?

Pricing in volatility and global reach

Are costs going to change over the medium and long term? Is cost a factor in a hedge fund’s choice of legal firm? Is there any real cost difference between law firms with a global reach and those with only a few offices?

Increased responsibility of auditors expected in future

What are some of the issues and opportunities for the future of auditing?

Emerging markets offer promise

Where are the new or expanding markets for hedge fund legal services? Will law firms need a global presence or will they be able to offer only local or regional services to hedge fund clients in future?

Building a concrete hedge

JP Morgan Asset Management global multi-asset group managing director Jeffery Geller sees hedge funds as a way of actively managing investments rather than an asset class in their own right.

Future of diversification

Family offices are increasingly looking at tangible assets as a way to diversify their portfolios away from purely financial risk.

Making money from a macro-economic shift

The world is in the midst of “one of the great macro-economic shifts of the last 100 years”, according to DTAP Capital Advisors partner Hugh Warrender.

Need for audit seen as essential

How important is it to have an auditor for a fund? Should all funds be audited?

Pricing problems

What are the legal concerns resulting from valuing instruments? What are the main legal pitfalls and challenges concerning illiquid instruments?

Risk needs new clothes

It is not often the financial markets are compared to fairytales but that is how economist Roger Nightingale sees the way risk has been sold over the past few decades.

Reputation and independence key to auditor selection

How important should the choice of an auditor to the fund be to an investor? What criteria should a fund use to choose an auditor?

Regulation adds level of complexity

What issues and challenges may new regulations pose for auditors of hedge funds and funds of hedge funds?

Madoff continues to influence industry

What lessons have been learned from Madoff? How is the approach to the audit of fund investments and funds of funds changing?

Staying afloat

What can funds do to protect themselves from liquidation?

Watch for the bond bubble

The credit markets have avoided becoming the next bubble waiting to burst. Nevertheless, investors should be cautious of government bonds.

Entrepreneurial spirit drives success

EXCLUSIVE

Structured for success

In just six years, structured product specialist TFS has launched 750 bespoke products for clients.

Liquidity concerns drive demands

Are the redemption and liquidity requirements demanded by investors affecting hedge fund and fund of hedge fund structures and documentation?

Warming up to Cuban investment

Alex Schmid thinks there is a rare, niche opportunity for investors in one of the few remaining territories standing outside the world’s financial markets.

Credit fund looks set for another good year

Founded in 2000 to take advantage of the opportunities in the European markets with the introduction of the euro, Liontrust Credit Fund has seen continued growth. Simon Thorp, head of fixed income at the company, remembers the fund managers saw great…

Why does Madoff matter?

Since the arrest in December last year of Bernard Madoff on charges of fraud, questions have been asked as to how both the authorities and investors failed to spot the investment manager’s Ponzi scheme.

Commercial property set to rise

The economic forecast for the commercial property market is clearing, says Standard Life Investments’ investment director Andrew Jackson.

Be prepared for anything

What can law firms do to help a hedge fund avoid or survive a crisis?

Sub-custody and counterparty risk in the spotlight

What are the main issues around custody of assets and how is this changing?

Family Office Leadership Summit

September 2009, London

Two accounting standard setters dominate

The International Accounting Standards Board (IASB) is an independent standard-setting board, appointed and overseen by a geographically and professionally diverse group of trustees of the International Accounting Standards Committee (IASC) Foundation…

Digging into due diligence

With the industry quaking from the shock of the financial crisis, due diligence has never been such a hot topic. Hedge Funds Review finds out what investors want to know about funds and managers.

Investors drive structure

How do the legal needs or requirements of investors influence the setting up of hedge funds? What, if any, are the differences between different types of investors, say family offices and institutional investors?

Regulation challenges

What are the key challenges facing the legal profession working with hedge funds over the next 12 months? What are the likely challenges to impact hedge funds and the legal profession for the short and medium term?

Offshore future

Is there a future for offshore legal practices specialising in hedge funds?

Emerging markets, emerging assets

Investors must be wary of a still-volatile economy and pick investments accordingly. However, emerging markets are a good bet and will continue to be so, concludes Cayzer Trust Company director Dominic Gibbs.

Legal Round Table

The main issues and challenges for the legal profession on and offshore are explored in the latest legal round table.

On or offshore? Pros and cons

What are the pros and cons of on/offshore hedge funds from a legal perspective? How do the options vary among on/offshore jurisdictions?

Flexibility and tax dominate structure

What are the main legal considerations in choosing a structure for a hedge fund?

Tax concerns remain top of the agenda

What are some of the key concerns and issues about the tax structure of a fund? What advice do you give on the tax structure of a fund or fund of hedge funds?

Devil is in the detail

What are the most important legal lessons learnt from the financial crisis for hedge funds?

Fading memories

How soon we forget. Markets are rising and could end the year higher than before the financial crisis, despite the fact fundamentals that should underpin and logically support prices are absent. Governments, the public and even the media appear to have…

Ticking the boxes

Suggestions of what investors should include in a due diligence questionnaire vary. The Alternative Investment Management Association’s (AIMA) illustrative questionnaire covers most aspects of a fund’s operation – from the basics, such as address,…

Future planning for succession

There are a number of different structures that can be used to manage a family’s wealth, but the most important requirement is adequate succession planning.

Inside story of family offices

Duncan Straughen, director of Wates Family Office, was recruited to work closely with family members to help create the infrastructure and support needed for an actively engaged owners group. The family was just completing a transfer of ownership between…

Changing times for diverse family

A family that began in the early 1900s faced moving into the new century with an expanded and diverse family where the present generation needed to take control and start planning for the next.

Profession struggles with varying models

What are the challenges from the accounting standards’ (IFRS versus US GAAP) different valuation models – mark to market versus mark to comparators versus mark to model and different types of assets and jurisdictions?

Disputes spotlight ways to deal with illiquid assets

What are the main issues affecting practices such as side pockets, synthetic side pockets, gates and suspension of redemptions?

Defining a family office

“Any ex-UBS banker these days starting up their own shop is calling themselves a family office,” says Reyl Private Office director Pierre Condamin-Gerbier, discussing the question of the optimum structure for a family office.