Risk magazine - May 2025

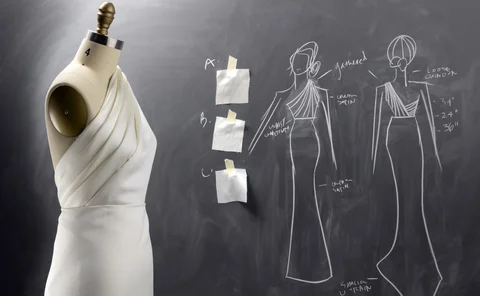

Cover detail:

Michael Falzoni, Theatre

Watercolour and ink on paper, 15 x 30 cm

www.michaelfalzoni.com

Instagram: @michaelfalzoniart

Articles in this issue

Hedge funds burned as Hong Kong dollar bets implode

Carry trades and call spreads unwound after Trump tariffs pushed spot to edge of currency peg

European investors ramp up FX hedging as ‘dollar smile’ fades

Analysts at one bank expect average hedge ratios to jump from 39% to 70% within six months

Citadel exec questions regulatory findings on repo haircuts

Isda AGM: OFR analysis didn’t account for excess collateral held against cleared positions in related trades

US has got what it wanted from Basel, say former regulators

Calls to stay at the table come after US Treasury Secretary condemned “outsourcing” of regulation

Academics call for tenfold jump in CCP capital cover

New framework finds mono-layer clearing houses may require biggest skin-in-the-game

EU banks want the cloud closer to home amid tariff wars

Fears over US executive orders prompt new approaches to critical third-party risk management

CLO market shakes off ETF outflows

Despite record redemptions, exchange mechanics and relatively small volumes cushioned impact

People: CFTC in exit spree, new NatWest Markets CRO, and more

Latest job changes across the industry

Repo on Execute: unlocking liquidity with innovations in market structure

Execute is driving the digital transformation of the repo market, creating a new standard for the industry

Mr Bessent goes to Basel: the fate of global bank regulation

US resistance to international standards could spark greater fragmentation of prudential rules

What drove the Taiwan dollar surge?

Foreign speculators, carry unwinds and central bank inaction fuelled the 10% move, not just life insurers, say traders

US Basel equivalence questioned as EU patience wears thin

MEPs say unfaithful US implementation of Basel III could trigger review of third-country capital treatment

Back-to-back hedging is back on the table for autocall issuers

Deal activity is picking up as prop shops compete with hedge funds for structured products risk

Leverage ratio reform: the good, the bad and the Treasury

A simple cut would be less likely to stoke interest rate risk than exempting US government bonds

Why Basel’s push to overhaul PFE is a wake-up call for risk teams

The regulatory push, lessons from Archegos and why a unified PFE/XVA framework is becoming the new standard

Why US banks are not taking their eye off reputational risk

The concept may be removed from supervisory exams, but the 2023 crisis showed the risk is real

Op Risk Benchmarking 2025: the FMIs

Exchanges and CCPs respond to regulatory scrutiny and evolving threats with tighter vendor management and scenario refreshes

Risk managers brace for night shifts as 24-hour trading looms

Questions swirl around how margin breaches and defaults will be handled during overnight hours

Disclosed trading an oasis in the FX liquidity ‘mirage’

LPs say growth of relationship-based trading bolstered market during April volatility

Wait in the Q: US banks hold back on tariff-related provisions

Lack of data on supply chain vulnerabilities creates challenges for early CECL adjustments

Rising systemic risk demands a new risk management paradigm

Reinsurers need insurance-linked securities to share burden of climate-related catastrophic risk

Volatility and geopolitical risk fuel new approaches to energy trading and risk management

Energy market participants seek new tools and signals to navigate near-term volatility and long-term uncertainty

JP Morgan’s VAR limits blown twice during haywire Q1

Breaches add to the two regulatory backtesting exceptions sustained the previous quarter

BNP Paribas’s CVA risk charges swell 56% on Basel III overhaul

Impact of new formulas is largest yet for a G-Sib

Basel III switch sends BNP Paribas’s op risk charges up 60%

Blow-up follows shelving of AMA model previously underpinning over two-thirds of op RWAs

UBS hit with $761m capital add-on for uncollateralised hedge fund lending

Finma imposes Pillar 2 buffer over Archegos-style exposures

JP Morgan’s equity VAR hit GFC levels in March

Bank blames now-matured client position for temporary risk surge

Investors find smoother path with smart beta

In the face of evolving volatility, investors are demanding a smarter approach to strategic asset allocation

A mix of Gaussian distributions can beat GenAI at its own game

Synthetic data is seen as the preserve of AI models. A new paper shows old methods still have legs

Gaussian GenAI: synthetic market data generation

A method to generate financial time series with mixture models is presented

Option market-making and vol arbitrage

The agent’s view is factored in to a realised-vs-implied vol model

Podcast: Fabrizio Anfuso on computing for Archegos-like event exposures

BoE quant discusses top-down counterparty risk framework using Gaussian distributions and copulae

Fixed income finesse: striking a balance amid shifting rates

An increasingly unpredictable economic environment leads investors to look for a wider range of products to satisfy evolving strategies