Latest on 投資

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

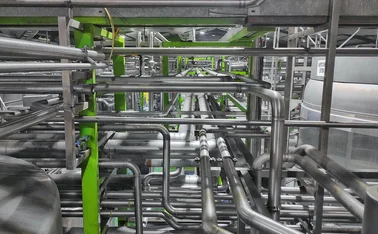

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

NBFIs dominate US cross-border credit growth in Q3

Cross-border lending to US shadow banks rose $157 billion, second-highest level in five years

Latest

Quotes

How does a creature with a few hundred thousand neurons compared to the 87 billion neurons that humans have, make decisions so differently?

Charlie Drew, Swarm Technology, on what investors can learn from ants

There’s a lot of stuff that can happen in the marketplace that just can’t happen at a poker table

Todd Simkin, Susquehanna, on using game theory in trading

[Pensions] advisers were quite quick to push private assets. [Some schemes] are probably ruing those decisions.

Pavan Bhardwaj, Ross Trustees

Editor's Choice

Stablecoins: good as the buck, or breaking the buck?

Collateral concerns and iffy auditing have raised fears of a ‘de-pegging’ event – and possible contagion across crypto and beyond

Big Figure

Libor mismatch stings CLO investors

The basis between one-month and three-month US dollar Libor widened from 11 basis points to an average of 71bp during November. Distributions for CLO equity tranches, whose holders only receive payment once more senior debt holders are paid, reached their lowest since the onset of the Covid-19 pandemic.

Read the full article

Comment

How to stop stablecoins from hoarding precious collateral

The $1 trillion shortfall if private equity bets turn sour

Our Take

Gamma zero: an overlooked signal of volatility is flashing red

How to hone NLP’s detection skills: a cue from a super-sleuth