Swaps data: Sonia growth spreads down the curve

New figures show boom in sterling OIS swaps is not limited to short-dated trades

Last month’s article looked at some of the products that – if regulators have their way – will replace Libor-linked instruments before Libor itself can die. It was a popular piece, but the analysis was hampered by the absence of recent data on global cleared swap volumes by tenor. On its face, rapid growth in Sonia-referencing interest rate swaps looked encouraging – but to say how encouraging, you’d need to see liquidity propagating along the curve, rather than pooling exclusively in the shortest tenors.

As luck would have it, I have since managed to get my hands on such data – so, let’s go back and take a closer look.

Sonia swaps

In sterling, the Bank of England took over as the administrator of Sonia in April 2016. Two years later, it reformed the benchmark by including bilaterally negotiated transactions alongside brokered transactions, with a resulting three-fold increase in the underlying population, averaging £50 billion ($65.4 billion) daily.

At the same time, the working group on sterling risk-free reference rates selected Sonia as its preferred benchmark and has been working to catalyse a broad-based transition to Sonia. Let’s see what the data reveals about the progress so far.

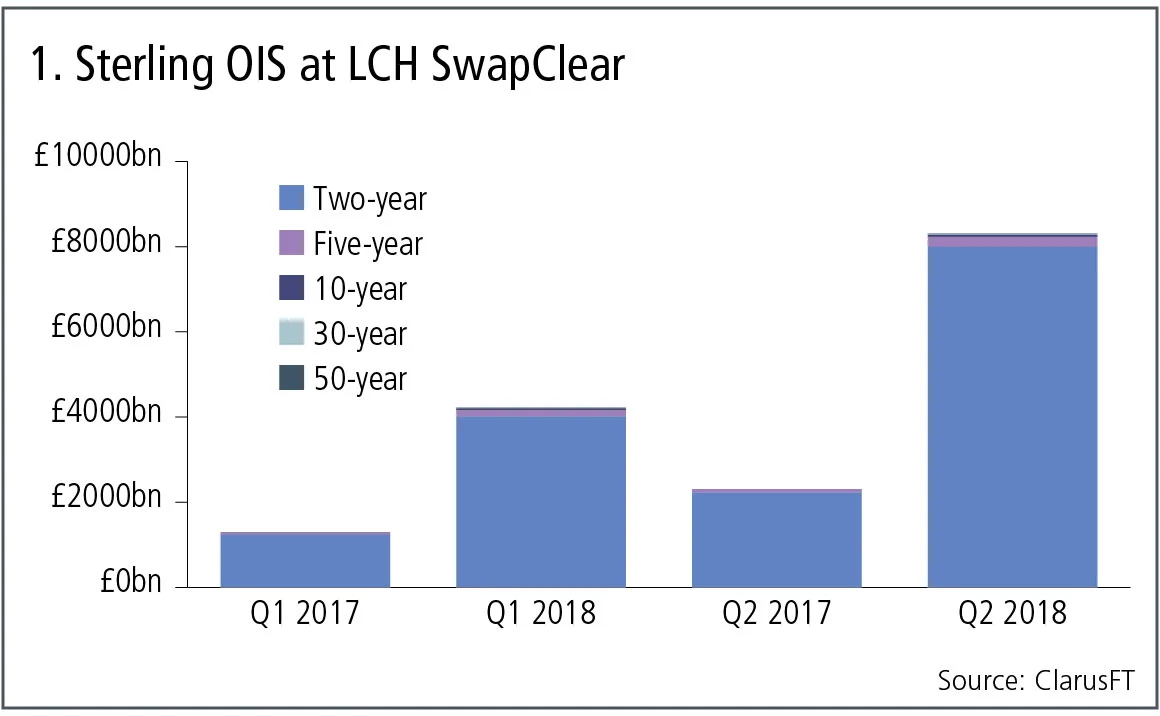

Figure 1 shows:

- Large increases, comparing quarters in 2018 with a year earlier.

- The first quarter of 2018 with £4.2 trillion gross notional, massively up from the first quarter of 2017.

- The second quarter of 2018 with £8.3 trillion gross notional, also much higher than the year-earlier quarter.

- Volumes massively dominated by tenors below two years, but larger slivers for tenors between two- and five-year and above starting to become visible in this year’s data.

Let’s exclude the sub-two-year bucket and focus on volume in the longer tenors.

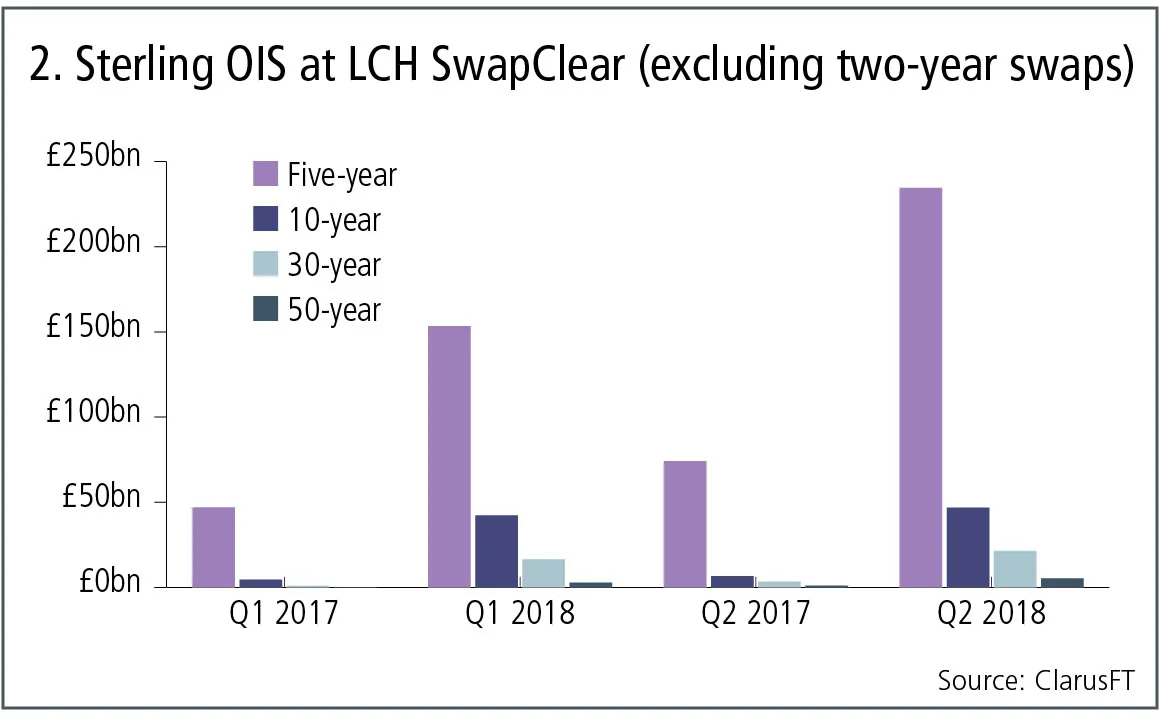

Figure 2 shows:

- The two- to five-year tenor showing strong growth and volumes reaching £235 billion in the second quarter of 2018.

- The five- to 10-year, 10- to 30-year and 30- to 50-year all showing much higher volumes year-on-year, with £47 billion, £22 billion and £5 billion respectively.

So, not huge volumes, but good increases and encouraging growth in longer-dated swap tenors. That looks like a good first step, but is it evidence of the transition regulators are looking for?

Sterling swaps

To answer that we need to look at the volume of sterling Libor swaps for the same quarters.

Figure 3 shows:

- Good increases, comparing quarters in 2018 with a year earlier.

- The first quarter of 2018 with £2.6 trillion gross notional, up 60% from the first quarter of 2017.

- The second quarter of 2018 with £3.2 trillion gross notional, up 80% from the second quarter of 2017.

- Much more even distribution – relative to Sonia swaps – of gross notional by tenor, with the two- to five-year tenor the largest, generally followed by the five- to 10-year tenor.

So, no categorical evidence of a transition from sterling Libor to Sonia swaps; for that we would need to see flat or falling Libor swap volumes. But the respective rates of growth are very different, with Sonia swaps racking up over 200% growth, compared with 70% for Libor. That augurs well for Sonia’s future, but the tenor distribution shows the challenge ahead – it’s a long way from posting comparably meaningful volumes in tenors above two years.

Europe

The situation in Europe is very different. Declining Eonia volumes since the European Central Bank launched its large-scale asset purchase programme have resulted in the ECB working group recently selecting Ester – a brand-new rate – as the replacement for Eonia. For Euribor, the jury is out while reform efforts are underway.

Let’s take a look at euro swap volumes for both indexes to size the task ahead.

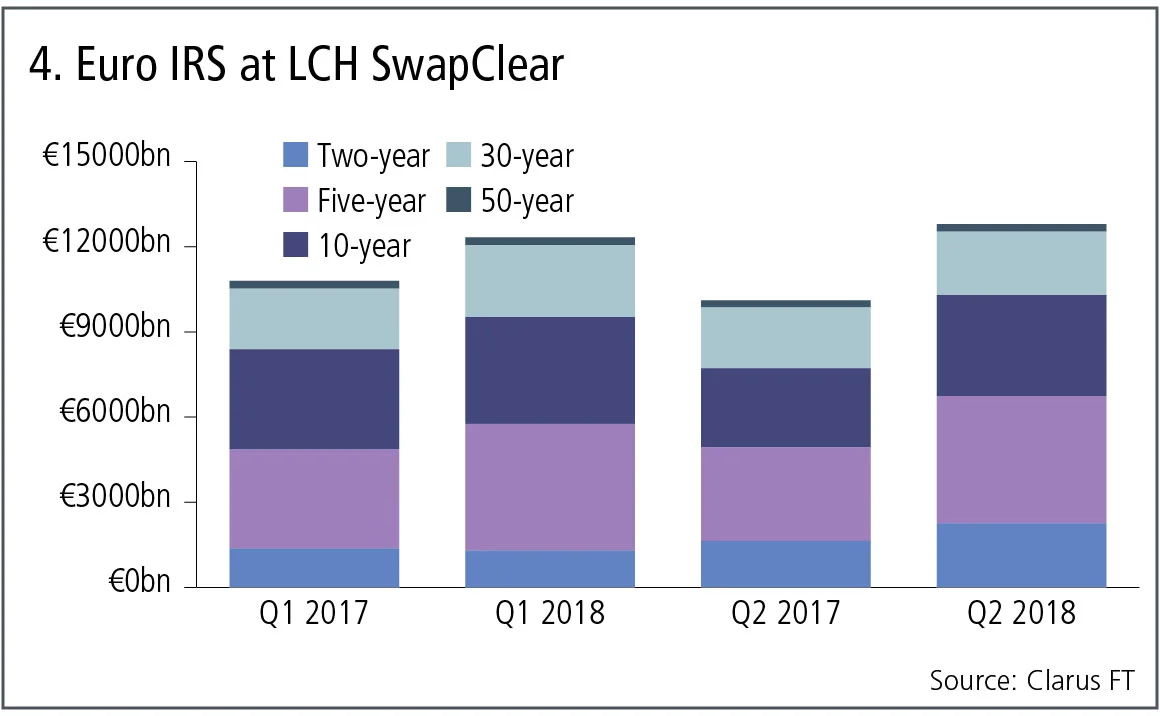

Figure 4 shows:

- Modest growth, comparing quarters in 2018 with a year earlier for Euribor swaps.

- The first quarter of 2018 with €12.3 trillion ($14.1 trillion) gross notional, up from €10.8 trillion in the first quarter of 2017.

- The second quarter of 2018 with €12.8 trillion gross notional, up from €10.1 trillion in the second quarter of 2017.

- The two- to five-year tenor is the largest, followed by the five- to 10-year tenor, with both the sub-two-year and 10- to 30-year tenor also showing massive volume.

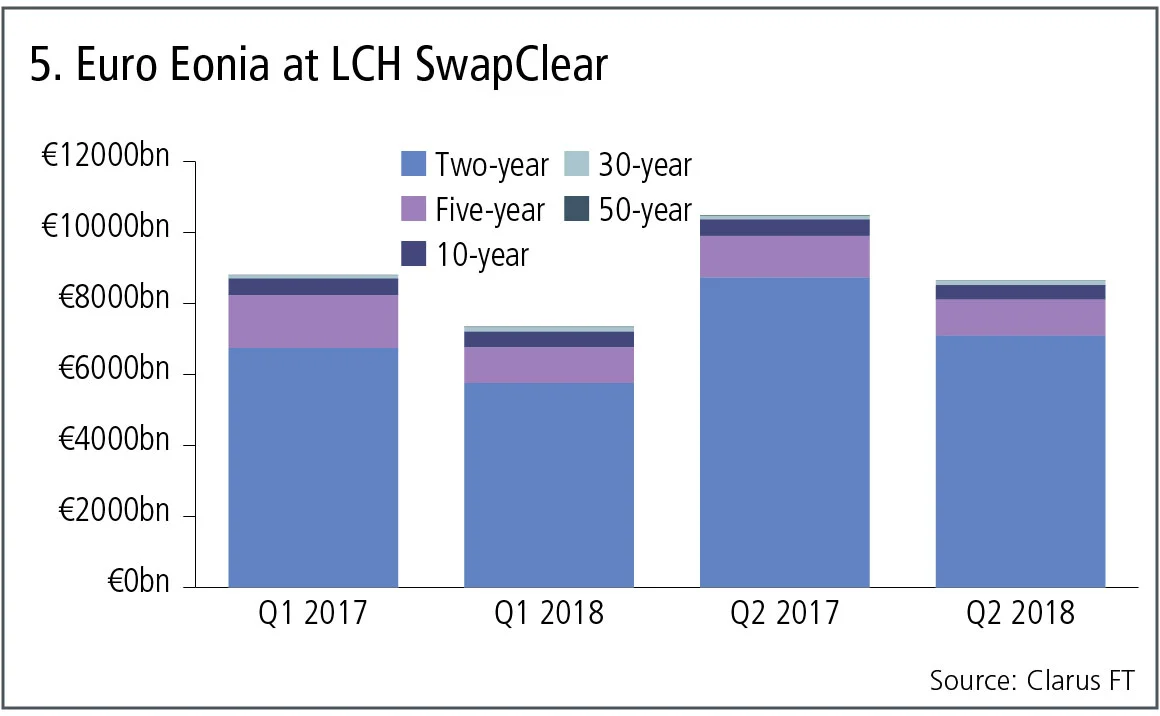

Figure 5 shows:

- Declines in Eonia volumes from a year earlier.

- The first quarter of 2018 with €7.3 trillion gross notional, down from €8.8 trillion in the first quarter of 2017.

- The second quarter of 2018 with €8.6 trillion gross notional, down from €10.5 trillion in the second quarter of 2017.

- While the sub-two-year tenor volumes dominate, there is substantial volume in the two- to five-year tenor and reasonable volume in the five-to 10-year tenor too.

Given the massive size of these volumes and the fact the ECB will only commit to publishing Ester by October 2019 – currently only a 10-day lagging pre-Ester is published – there is a lot of work to do. I’m not sure if the connotation here is more carrot or stick, probably equal measures of both are in order.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

市場は決して忘れない:平方根則の持続的な影響

ジャン=フィリップ・ブショー氏はトレードの流れは資産価格に大きく、かつ長期的な影響があると主張する。

ポッドキャスト:ピエトロ・ロッシ氏による信用格付けとボラティリティ・モデルについて

確率論的手法とキャリブレーション速度の向上により、クレジットおよび株式分野における確立されたモデルが改善されます。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。