Swaps data: the race to replace Libor

Sonia swaps and SOFR futures are growing fast, says Amir Khwaja of Clarus FT

Over the past 12 months, regulators in the UK and US have been pushing harder and harder for market participants to move away from Libor. Their work is starting to have a visible effect, with growing volumes in swaps and futures – and debt issuance – that reference the chosen replacement rates.

The regulators have a strong case for wanting the market to move, as the death of the interbank lending market has deprived Libor of the transactions on which it is supposed to be based, turning it into an index of expert opinion.

Despite the absence of underlying transactions, though, it’s worth noting that there is a massive liquid market in money market futures, such as CME’s Eurodollar contract, which provides a market consensus forecast of Libor. As this volume is massively in the first contract and as this contract nears expiration, the price of this contract casts a greater and greater influence on the Libor fixing itself, narrowing the range that this will be determined at.

The valuation of interest rate derivatives depends on a money market futures strip of prices to build a curve to forecast Libor. It also depends on swaps that reference Libor to extend this curve and these swaps are liquid and well traded.

Consequently the situation is not as stark as some would paint; it is not that the whole derivatives market is built on a Libor index that is rotten at the core. It is more that in the absence of checks and balances, in a time of systemic market stress, Libor has been found wanting.

The regulatory solution to guard against that happening in the future is to require benchmark indexes to be based on actual transactions, of which there should be a decent number – so providing an objective and transparent index. That policy means probable doom for Libor and the arrival of new risk-free rates such as Saron in Switzerland, Sonia in the UK and the Secured Overnight Financing Rate in the US. On the terms laid out by the regulators, these new benchmarks will only succeed if new products referencing the rates are being created and are trading in meaningful, reliable volume.

US dollars

Let’s start with the largest currency, US dollars and the SOFR index that has been chosen by the Alternative Reference Rates Committee of the Federal Reserve.

CME has been quick out of the gate with SOFR futures; a one-month and three-month contract.

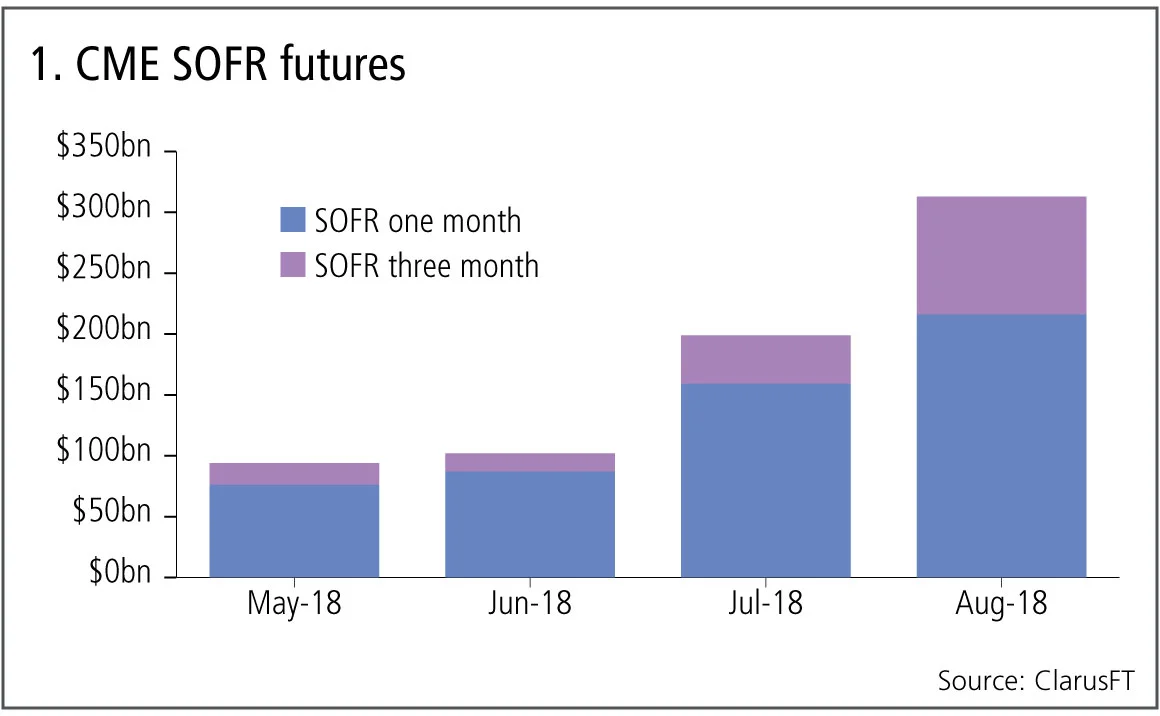

Figure 1 shows:

- The start of trading in May 2018.

- August 2018 with more than $300 billion equivalent notional traded (140,000 contracts).

- That is up 60% from July 2018, which itself was up more than 100% from June 2018.

- August 2018 with an average daily value (ADV) of just over 6,000 contracts.

So, an excellent start to a new derivatives contract on the brand-new reference rate chosen by the industry as a replacement for US dollar Libor.

Of course, there is a long way to go to get anywhere near the 1.9 million ADV of the Eurodollar market, but 100% month-on-month growth rates add up very quickly.

And what of swaps that reference SOFR?

These are at a much earlier stage. In mid-July we saw the first SOFR swaps trade, brokered by Tullett Prebon and cleared at LCH SwapClear. The handful of trades were more a test of market structure – reporting and clearing – so we need to wait and see how these products develop.

Sterling

In sterling, the Bank of England chose to reform the existing Sonia index as the chosen rate, consequently there was already well-established volume in Sonia swaps. These volumes have been growing.

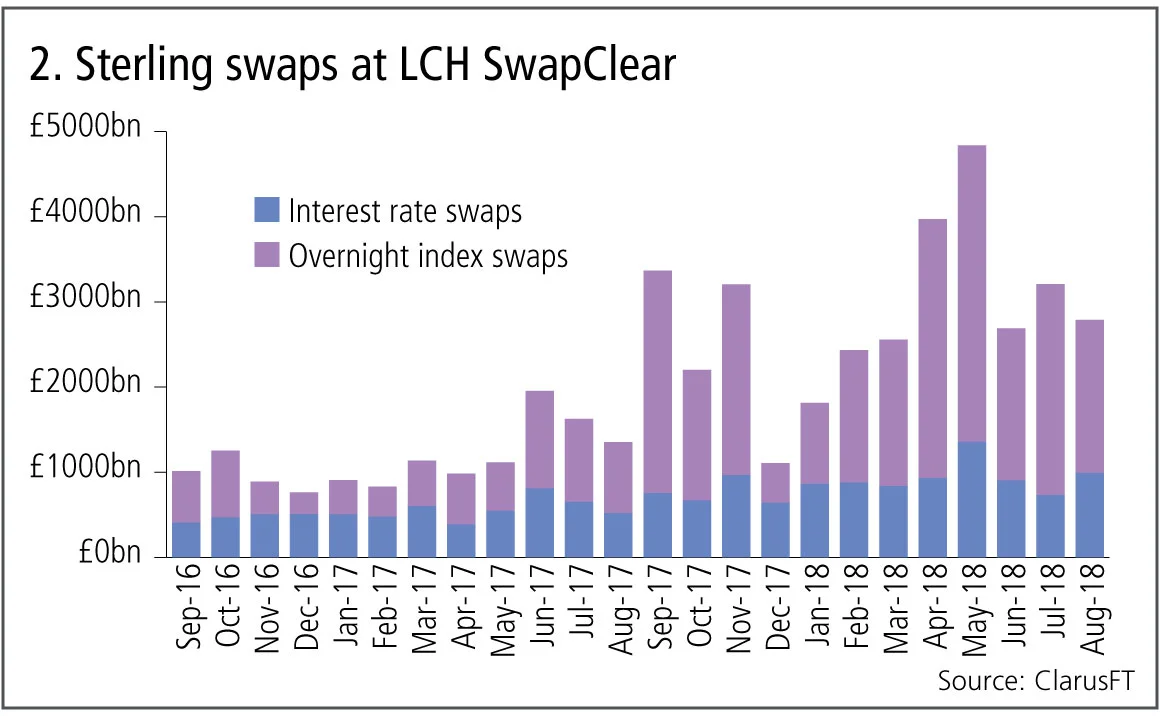

Figure 2 shows:

- Monthly gross notional cleared at LCH SwapClear over the past two years.

- Overnight index swaps volume – referencing Sonia – increasing far more than interest rate swaps, which are Libor-linked, over the past year.

- August 2018 with £1.9 trillion ($2.44 trillion) of OIS gross notional compared with £1 trillion of Libor interest rate swaps.

- Since May 2017, OIS monthly volume has exceeded Libor swaps in each month with the exception of Dec 2017.

While we do not have the tenor of these products, we know OIS traded are much shorter maturity than interest rate swaps, predominantly below one year, so in risk-equivalent terms, far more risk is traded in the Libor product. In notional terms, OIS volumes outweigh interest rate swaps by around 70% to 30% – but we estimate that the balance is more like 15% to 85% in terms of interest rate sensitivity, or DV01.

Even so, swap volumes in sterling referencing Sonia are clearly on the up and up.

And what of futures that reference Sonia?

In this case, futures are lagging swaps but the battle to own the market standard contract that everyone trades has commenced, with CurveGlobal, Ice and more recently CME joining the fray; making it one to keep a close eye on in the upcoming months.

Europe

In Europe, the situation is at a far earlier stage where a European Central Bank working group still needs to select a euro risk-free rate. A public consultation ended in July 2018 and the group expects to make a recommendation in the third quarter of 2018.

Candidates include Eonia, Stoxx GC Pooling, RepoFunds rate and the new and untested euro short-term rate, or Ester. From this list, Eonia has very decent volume in swaps, while the rest are not used in the swap market at all.

Figure 3 shows:

- Monthly gross notional of euro swaps cleared at LCH SwapClear over the past two years.

- Gross notional for Euribor-linked interest rate swaps higher than Eonia-referencing OIS swaps in each month, except March and April 2017.

- OIS with a monthly average over one year of €2.3 trillion ($2.66 trillion) compared to interest rate swaps with €3.7 trillion.

- So, large numbers in Eonia swaps, but even on a gross notional basis – let alone DV01 terms – some way short of Euribor swaps.

We will need to wait to see if Europe follows the US approach and choses a new index or follows the UK one to pick an existing OIS rate. Your guess is probably as good as mine, but if I had to choose, I would bet on the ECB recommending a new index.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance

Allocating financing costs: centralised vs decentralised treasury

Centralisation can boost efficiency when coupled with an effective pricing and attribution framework