Risk magazine - Mar 2022

Articles in this issue

Private equity’s insurance innovation needs a risk check

Regulators need to look closer at private equity’s rush to reinsure pension assets in Bermuda

‘Dead’ derivatives market leaves big Russia dealers unhedged

VTB and Sberbank face directional exposure to local corporates after mass unwinds by foreign banks

Credit default swaps on Russian companies face uncertain future

With CDS auctions on sanctioned companies unlikely, traders may have to rely on dealer estimates

Russia sanctions throw derivatives market into disarray

Lawyers say western banks face illegality terminations; industry groups plan deliverable ruble workaround

Ruble NDF pricing rupture alarms traders

Conflict sparks big dislocation between ruble NDF and spot, threatening hedges and clouding valuations

Russia’s foreign currency debt pile at risk of default

Sanctions could block coupon payments on $200bn of externally held foreign currency bonds

Moscow Exchange closure leaves equity swap contracts in limbo

Isda plans to issue guidance on the application of commonly used disruption event clauses

People moves: CME reshuffle, BlackRock’s new CRO, and more

Latest job changes across the industry

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

Banks offer crypto clearing but, shhh, don’t tell

Top dealers clear crypto futures for select clients despite smorgasbord of risks

Adia wealth fund is building supergroup of quant investing

Abu Dhabi Investment Authority wants to turn systematic investing into a ‘good science’

Russia sanctions put spotlight on banks’ dirty laundry

As punitive measures against Moscow increase, so do the risks to banks from financial crime

Risk Awards 2022: the winners

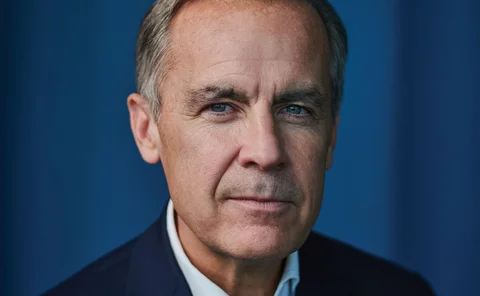

JP Morgan claims top derivatives house, lifetime award for Mark Carney, BofA wins rates

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

Derivatives house of the year: JP Morgan

Risk Awards 2022: Big bet on AI is delivering results

Interest rate derivatives house of the year: Bank of America

Risk Awards 2022: Bank ducks US vol problems that plagued peers, while continuing European expansion

Currency derivatives house of the year: UBS

Risk Awards 2022: T-Pricer platform enabled bank to gain technological edge

Equity derivatives house of the year: JP Morgan

Risk Awards 2022: US dealer filled flow gaps with a little help from some robots

Credit derivatives house of the year: BNP Paribas

Risk Awards 2022: Relative value trades propel French dealer into US top tier for index and single names

Inflation derivatives house of the year: BNP Paribas

Risk Awards 2022: Bank helps clients target eurozone inflation amid global surge in consumer prices

Structured products house of the year: Citi

Risk awards 2022: Future-proofing against jack-knife market moves gives US giant the edge with clients

Risk solutions house of the year: Santander Corporate & Investment Banking

Risk Awards 2022: Multi-jurisdiction transactions saw the bank solve three-way currency conundrum and take on litigation risk

Flow market-maker of the year: Citadel Securities

Risk Awards 2022: ‘Meme factor’ and sturdy systems helped Ken Griffin’s firm cope with huge volumes – and post record revenues

Bank risk manager of the year: Deutsche Bank

Risk Awards 2022: Seasoned risk team put on a masterclass in how to manage margin risks

Credit portfolio manager of the year: Intesa Sanpaolo

Risk Awards 2022: Italy’s largest lender is one of the EU’s strongest thanks to smart securitisations

SSA risk manager of the year: European Commission

Risk Awards 2022: EC debt programme skyrockets to fund recovery package of up to €800 billion

Investment house of the year: LGIM

Risk Awards 2022: LGIM wins mandates from investors looking to limit their contribution to warming

Quant investment house of the year: Transtrend

Risk Awards 2022: Commodities long shot pays off for trend follower

Exchange of the year: Intercontinental Exchange

Risk Awards 2022: Amid Brexit and benchmark transition, Ice fulfils Abu Dhabi exchange ambition

Clearing house of the year: OCC

Risk Awards 2022: Risk management reforms help clearing house weather meme stock volatility

OTC trading platform of the year: TP Icap

Risk Awards 2022: Interdealer broker reinvents itself with Fusion platform and Liquidnet acquisition

Derivatives client clearer of the year: BNP Paribas

Risk Awards 2022: Europe’s clearing powerhouse hoovers up mandates at home and forges a US beachhead

Prime broker of the year: Barclays

Risk Awards 2022: Focus on risk management helps UK bank win client trust – and balances – in wake of Archegos collapse

Law firm of the year: Allen & Overy

Risk Awards 2022: law firm takes pivotal role in bond market’s DLT vision

Technology vendor of the year: Bloomberg

Risk Awards 2022: Data giant delivered risk analytics, while playing key role in Libor transition

Innovation in technology: International Swaps and Derivatives Association

Risk Awards 2022: Isda takes a fintech turn with quant analysis tool Perun, leveraging data standards legacy

Rising star in quant finance: Silvana Pesenti

Risk Awards 2022: New approach allows portfolios to be optimised and aligned with benchmarks

Buy-side quants of the year: Matthew Dixon and Igor Halperin

Risk Awards 2022: New machine learning tool tackles an age-old, old age problem

Quant of the year: Hans Buehler

Risk Awards 2022: Architect of deep hedging aims to supplant orthodox models with method based purely on data

How do you solve a problem like the lira?

Asset managers diverge in their approach to managing Turkish currency turmoil as FX hedging costs soar

FRTB capital quirk for sovereign bonds bewilders banks

EU treatment of govvies under internal models is worse than standardised approaches

EU banks fear outlier status on non-modellable risk charges

Dealers face disadvantage if EU implements more granular and costly version of FRTB than US, UK

Boost for deal contingent hedging as M&As face waiting game

With M&As subject to regulatory delays, banks see renewed demand for deal contingent hedging

Can Clobs level the playing field in OTC FX options?

Electronification could be a “game changer” for smaller liquidity providers, say participants

Bookstaber: past performance is no guide to future risks

Veteran risk chief says trading gains in wake of LTCM’s demise forged love of agent-based modelling

For OTC derivatives, the pricing (still) isn’t right

Financial instrument expert Dirk Schubert on how post-GFC rules have caused prices and valuations to diverge

New GFXC chair aims to keep up reform on last look

SNB’s Andrea Maechler urges more liquidity providers and trading venues to address hold times

On Russia, finance needs to find its moral compass

The looming risk of big write-offs should prompt investor rethink

SG, UniCredit, RBI most exposed to Russia as sanctions loom

EBA data shows €47bn of exposure to Russia from five most-exposed EU banks

JP Morgan incurs eight VAR breaches, triggering capital hike

Largest trading loss in Q4 reached 207% of the bank’s VAR limit

Sanctions threaten top pension funds’ Russia assets

Top global pension funds might dump Moscow-linked holdings in response to Ukraine invasion

SOFR swaps surge past $1 trillion weekly

OIS make up the majority of SOFR-referencing swaps

Russia sanctions risk putting $105bn out of foreign banks’ reach

But international claims on the country have fallen by half since 2014

Regulation triple-whammy lops 63bp off StanChart’s CET1

January 1 saw the introduction of SA-CCR, curbs on IRB modelling and the reversal of software capitalisation benefits

Kurtosis optimisation gives portfolios a shock absorber

Hedge fund quant shows how an alternative to PCA makes risk management more robust

Deep hedging: learning to remove the drift

Removing arbitrage opportunities from simulated data used for training makes deep hedging more robust

Fat-tailed factors

Independent component analysis is proposed as an alternative to principal component analysis

Sec-lending haircuts and indemnification pricing

A pricing method for borrowed securities that includes haircut and indemnification is introduced

Benhart: banks should start revising for OCC’s climate exams

US agency’s climate chief says firms will need more data from clients if they’re to make the grade