Credit data: rising tide lifts fund houses – but can it last?

Strong revenue growth masks structural problems in the funds industry, writes David Carruthers of Credit Benchmark

By most accounts, these are tough times for asset managers. Margins have been battered by the double whammy of rising costs and falling fees. Firms of all stripes are cutting headcount and consolidating operations in a frantic bid to build scale and improve efficiency.

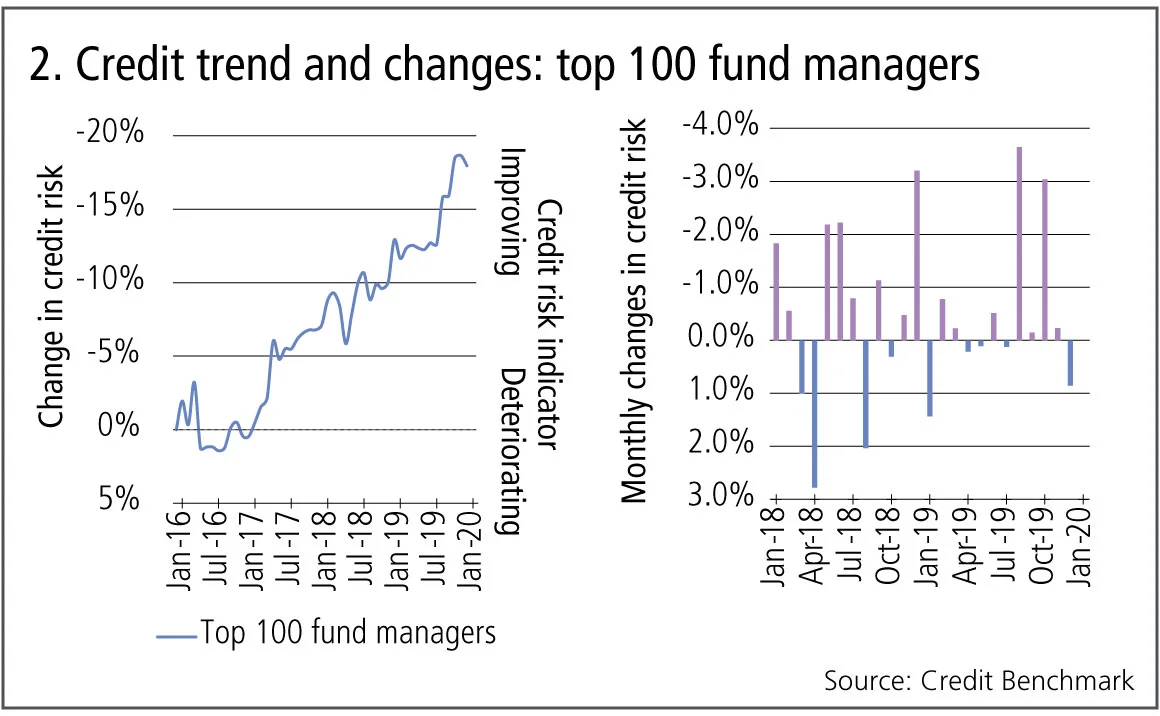

The industry faces real challenges, but you would not know it from the recent trend in credit ratings. The credit risk of the top 100 fund managers has decreased by nearly 20% over the past four years, according to Credit Benchmark data sourced from more than 40 financial institutions.

So, how to explain the optimism of credit risk managers? The multi-year bull run has been a boon for fund houses, whose fees are pegged to the amount of assets under management. The S&P 500 is up around 350% from its financial crisis intraday low of 666 in March 2009 – more than offsetting the steady outflows from active equity funds. Asset managers have effectively been saved by the market.

But bull runs are not meant to last forever. With global markets already in correction territory amid mounting fears of a coronavirus epidemic, a reversal may be on the cards. January saw the first deterioration in consensus credit ratings for assets managers in five months.

This month, we also compare the credit risk of airlines and airports – two sectors that could be hard hit if the coronavirus continues to spread. And we assess the impact of the bushfire crisis on Australian corporates and the outlook for Irish companies in light of Brexit.

Global credit industry trends

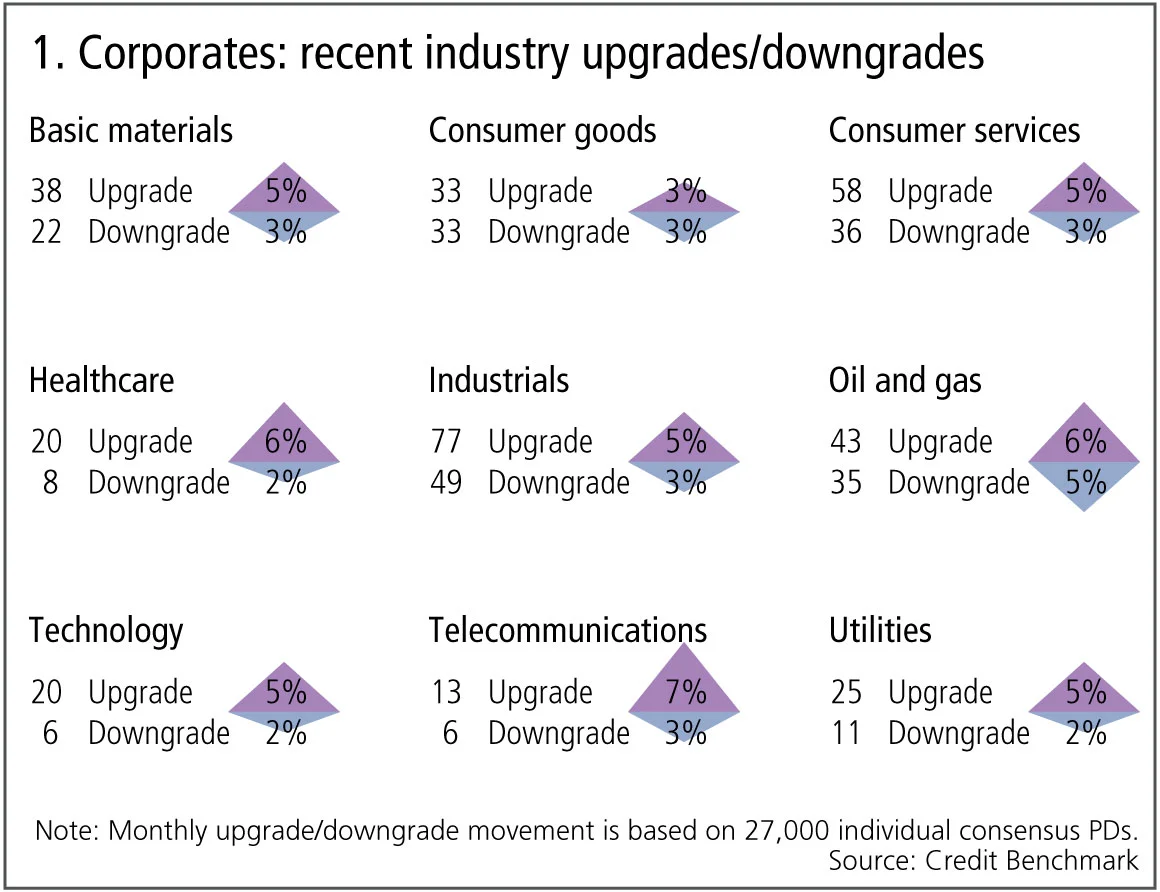

The latest consensus credit data shows that credit activity for corporates and financials has increased, with 6.9% of entities moving by at least one notch, compared with 4.9% last month. Figure 1 shows detailed industry migration trends for the most recent published data, adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, corporate upgrades outweigh downgrades.

- Upgrades outnumber downgrades in eight of the nine industries, and one is in balance.

- Oil and gas and telecommunications see more upgrades than downgrades, after three months of the opposite.

- Utilities return to upgrades dominating after a month of balance.

- Consumer services and industrials have more upgrades.

- Technology has more upgrades than downgrades, after a period of balance.

- Healthcare and basic materials return to upgrades dominating after a month of the opposite.

- Consumer goods show volatility, with this month now showing a balance in upgrades and downgrades.

Top 100 fund managers

The asset management industry faces some major challenges: the impact of the Markets in Financial Instruments Directive has affected the cost and availability of sell-side research, while growing compliance requirements have driven consolidation across the industry in a drive for economies of scale. But although rising costs are an issue, industry income is still mainly a function of assets under management. So as the bull market continues to climb its wall of worry, many asset managers have seen strong growth in their revenues, and this is reflected in their consensus credit ratings.

Figure 2 shows the credit trend and changes for the top 100 fund managers.

Figure 2 shows:

- Credit risk of the top 100 fund managers has decreased by nearly 20% since December 2015.

- The monthly changes chart (right-hand side) shows 16 of the last 24 months have seen an improvement in credit risk.

- The latest data is the first in five months to show a deterioration.

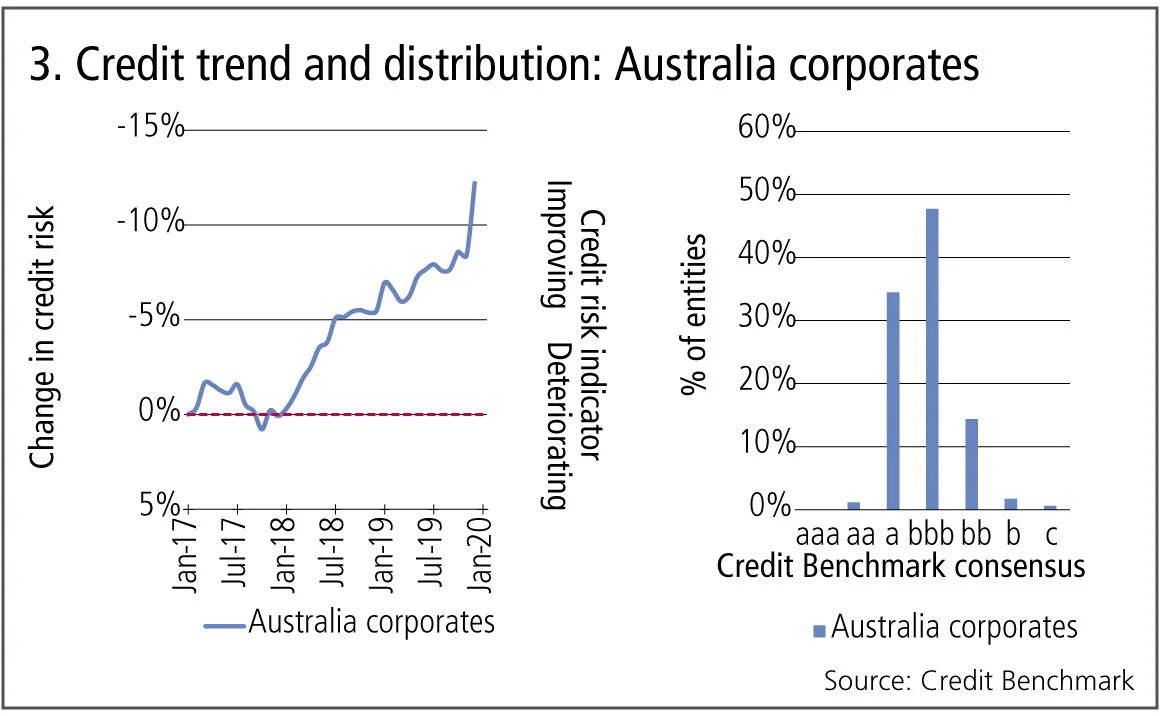

Australia corporates

The drought-led fires that have ravaged large swathes of Australian bushland have killed dozens of people, billions of animals, released billions of tonnes of CO2 into the atmosphere and threatened some of Australia’s largest cities. Bouts of long-overdue rainfall may have helped the firefighters, but they have also brought extensive flooding.

Recovery will be difficult and the end of summer will bring only temporary respite. The negative financial impact on the tourist industry is likely to be far-reaching, but the more immediate economic impact will be mixed: there is now a need for replacement infrastructure, investment in irrigation and agricultural redevelopment. Australia’s corporate balance sheet appears to be strong enough to support this.

Figure 3 shows the credit trends and changes for 170 Australian corporates.

Figure 3 shows:

- Australian corporates show a steady improvement from October 2017, with risk dropping by about 13%.

- More than 80% of Australian corporates are investment grade.

- Nearly 50% of Australian corporates have a Credit Benchmark consensus of bbb.

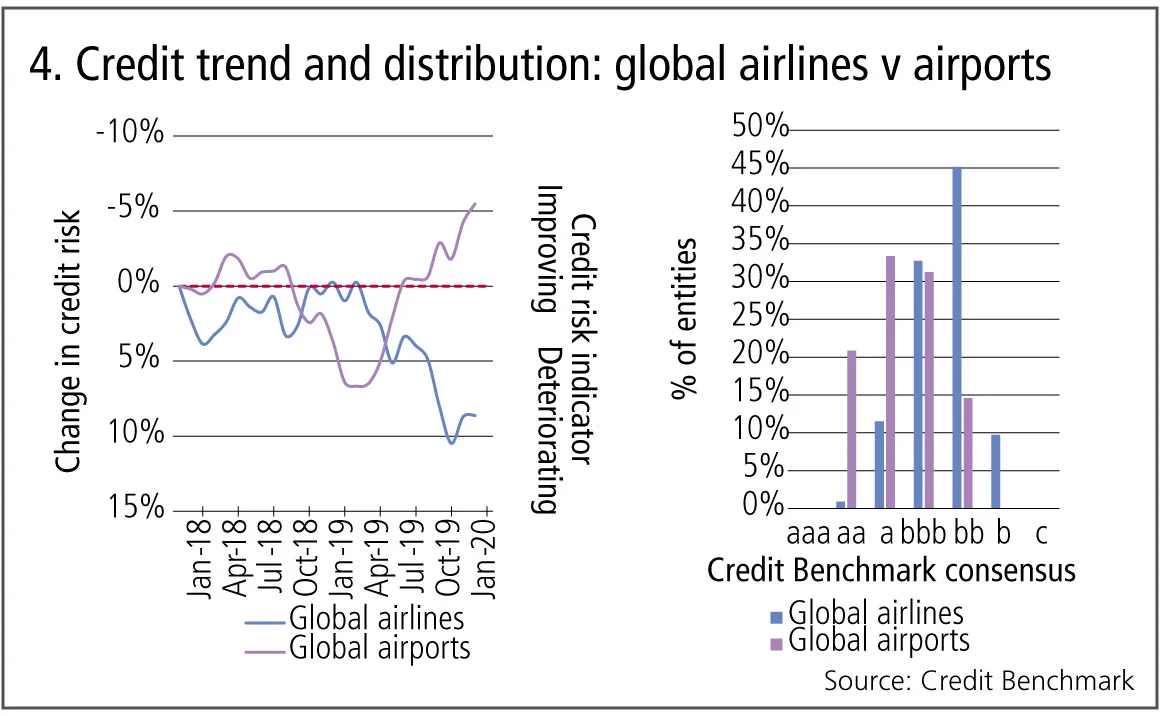

Coronavirus: global airlines v airports

The new, highly contagious strain of the coronavirus has taken the business world by surprise, and the impact will be far reaching. It coincides with growing disruption to supply chains resulting from trade disputes and will add to existing pressure on the airline industry. But while airlines have suffered from competition for some time, airports have become high-quality retail malls that benefit from a large and steadily growing captive customer base. The coronavirus may cause some serious, if temporary, problems for this high credit quality sector.

Figure 4 shows the credit trend and distribution of 110 global airlines and 50 airports.

Figure 4 shows:

- Global airlines credit risk began to deteriorate at the beginning of 2019, with a cumulative move of 8%.

- Global airports credit risk deteriorated about 6 months earlier, with a turning point in February 2019. Airports have improved 11% since then.

- The majority of global airlines have a non-investment-grade Credit Benchmark consensus of bb (45%); but 85% of global airports are currently investment grade.

Ireland corporates and financials

Ireland faces the possibility of dramatic changes over the next few years. Although the Brexit process is still in the transition phase, there will be growing issues with north-south trade as businesses prepare for increased checks, and Brexit is likely to change the Irish economy in a number of other ways. The recent election shows growing support for left-wing policies and an appetite for reopening the debate about Irish unification. Credit estimates for corporates and financials are likely to show some dramatic changes in the next 12 months.

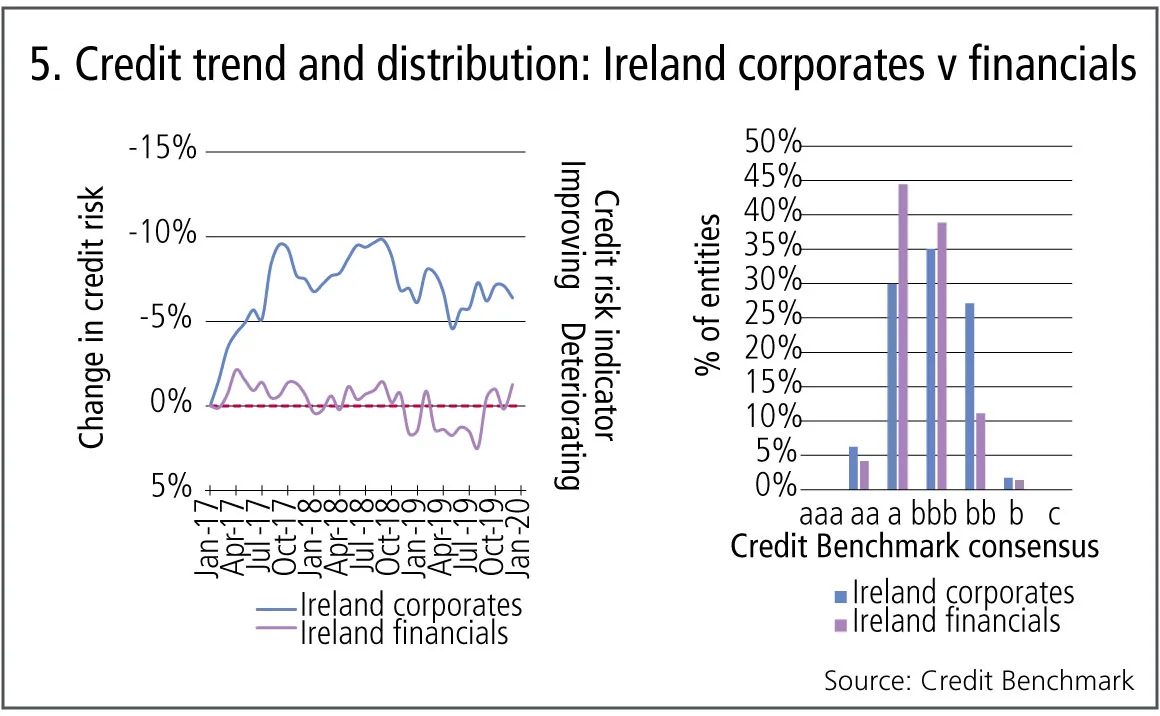

Figure 5 shows the credit trends and distributions for 180 Irish corporates and 70 Irish financials.

Figure 5 shows:

- Irish corporates had an improvement in credit risk of nearly 10% during the first three quarters of 2018. Since then, the trend has oscillated in the 5–10% overall improvement range.

- Irish financials have stayed mostly stable throughout the time period. A very small deteriorating trend of 2% can be seen from May 2017 to July 2019, however this was recovered in the second half of 2019.

- Irish corporates have a largely symmetric distribution around bbb, with 35% of entities in that category. Nearly 45% of Irish financials have a Credit Benchmark consensus of a; 12% of entities are non-investment grade.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

市場は決して忘れない:平方根則の持続的な影響

ジャン=フィリップ・ブショー氏はトレードの流れは資産価格に大きく、かつ長期的な影響があると主張する。

ポッドキャスト:ピエトロ・ロッシ氏による信用格付けとボラティリティ・モデルについて

確率論的手法とキャリブレーション速度の向上により、クレジットおよび株式分野における確立されたモデルが改善されます。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。