Credit data: falling default risk for China’s banks

Economic data may be relatively gloomy, but default probabilities for lenders fell sharply last year

On London’s Shaftesbury Avenue, a chain of red lanterns hangs outside a branch of the Bank of China, marking the transition to the Year of the Pig – a symbol of fortune and wealth. But growing economic clouds suggest this will be a nervy year for China’s banks.

After growing 6.8% in 2017, China’s economy slowed to 6.6% in 2018, according to GDP data released on January 21, with fourth-quarter growth of 6.4% the lowest quarterly rate since 2009. The data stoked fears that a wave of defaults could capsize the country’s lenders and sink the global economy at the same time.

Crowd-sourced default probabilities, in contrast, tell a story of growing confidence in China’s banks. After a 4% deterioration during 2016 and 2017, credit risk for the 62 banks in our sample actually rebounded 6% during 2018. Across the course of the year, a number of bb-rated banks were effectively upgraded to bbb – where roughly half the group now sits. The proportion of a-rated lenders remained steady.

The improvement may reflect a belief that China’s government has the tools and the capacity to support growth for the immediate future, at least – reserve requirements for banks have been cut five times in the past year, part of broader stimulus efforts.

Elsewhere this month, we look at recent data on German financials versus corporates, the global tobacco industry, as well as credit trends among US electrical utilities.

Global credit industry trends

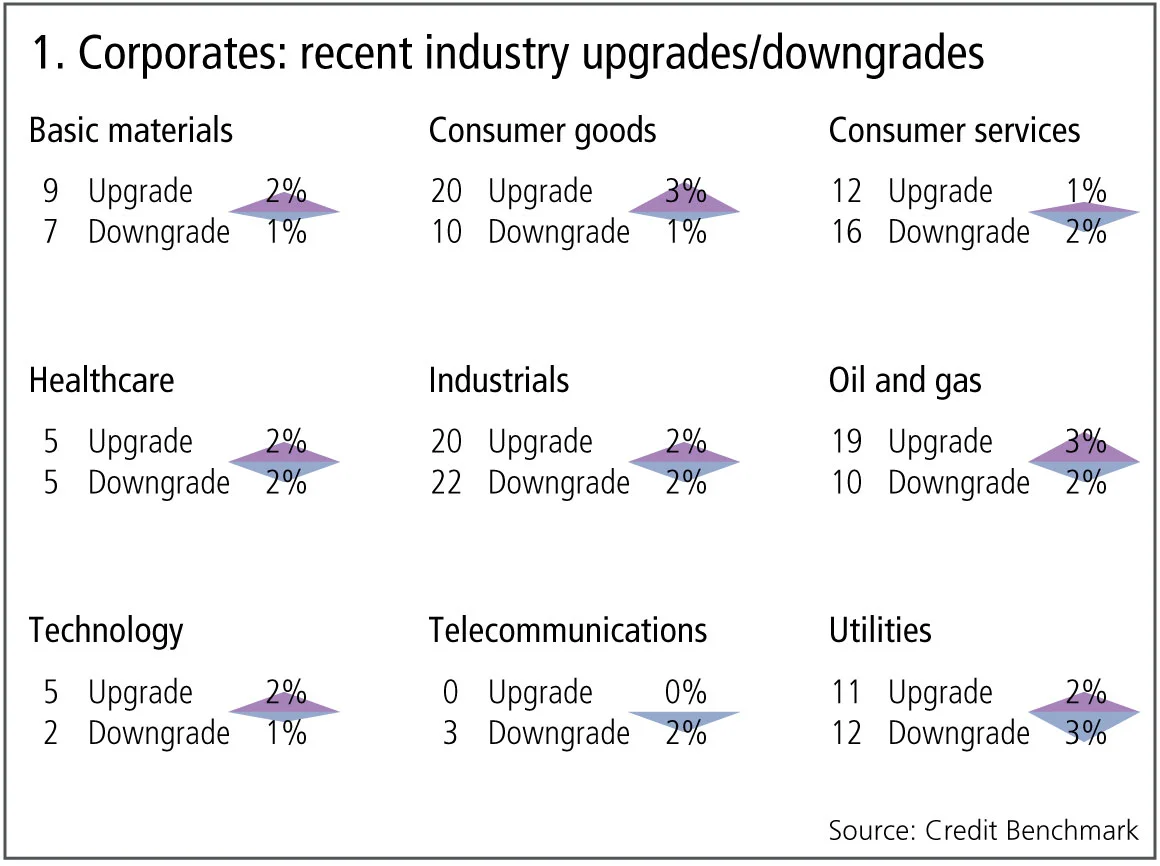

The latest bank-sourced credit data, based on 29 contributor banks, shows upgrade and downgrade activity has decreased, with 26 companies moving more than one notch, compared with 62 companies the previous month. Figure 1 shows detailed industry migration trends for the most recent published data, based on data adjusted for changes in contributor mix.

Figure 1 shows:

- Across global corporates, the number of upgrades and downgrades are in balance.

- Upgrades dominate downgrades in four of the nine industries, three industries are biased towards downgrades and two industries are in balance.

- Basic materials sees upgrades continue to outweigh downgrades, a trend that has lasted for more than six months.

- Oil and gas returns to upgrades outweighing downgrades after a period of the reverse.

- Consumer goods sees double the number of upgrades as downgrades, after four months of downgrades dominating.

- Technology continues to see upgrades outweigh downgrades for the second month.

- Telecommunications show downgrades dominating for the second month.

- Utilities see downgrades outnumbering upgrades, after a two-month trend of favouring upgrades.

- Consumer services still remain volatile, with downgrades now dominating upgrades.

- Healthcare and industrials are in balance after a period of upgrades dominating.

German corporates v financials

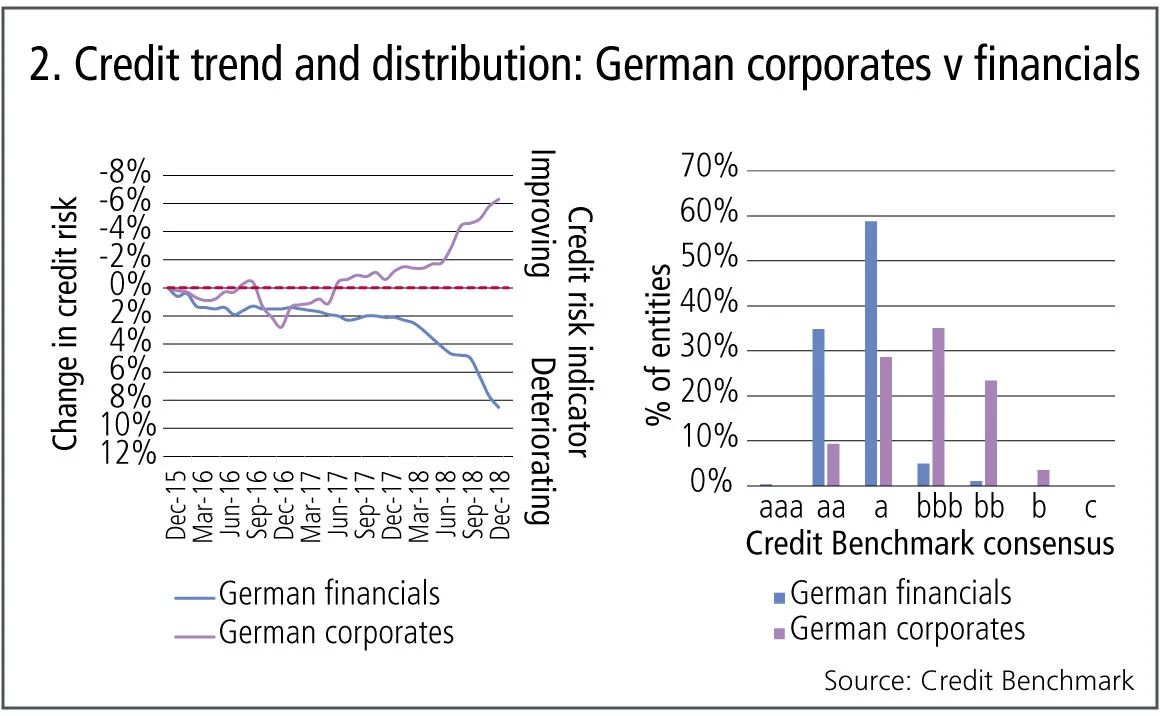

The German economy is slowing as its traditional export-led growth falters due to trade wars, Brexit uncertainty and global flux in auto technology, which has led many potential buyers to defer their purchases. German financials have languished in the aftermath of the financial crisis, although Brexit may be a modest positive for the sector.

Figure 2 compares recent credit data for 195 German corporates and 970 financials.

Figure 2 shows:

- German corporate credit has slowly but steadily improved over the past two years. Despite profit warnings from the auto sector, this suggests that banks remain optimistic about the broader set of German corporates.

- German financials are almost a mirror image – they showed a modest decline in 2017 and a steeper fall in 2018. 2019 is likely to be dominated by a possible Brexit-related increase in market share as well as persistent rumours about mergers and acquisitions.

- Despite the recent declines, German financials are nearly all investment grade, with the majority in the a category. German corporates are broadly based across the a, bbb, and bb categories. The tails of the distribution show a slight skew towards the aa category.

China banks

Recent poor export data suggests US tariffs have intensified the challenges already facing the Chinese economy. The Chinese current account surplus has dwindled in recent years and private – local currency – debt has been a drag on growth. But the central bank has cut monetary reserve requirements and the government has announced a major fiscal stimulus; with government debt of less than 50% of GDP, there is scope to take up any short-term slack.

Figure 3 shows credit data for 62 Chinese banks.

Figure 3 shows:

- Chinese bank credit has been volatile but showed a modest overall deterioration until the end of 2017.

- Credit improved consistently and rapidly during 2018.

- The proportion of Chinese banks classed as investment grade has increased by a few percentage points in the past 12 months.

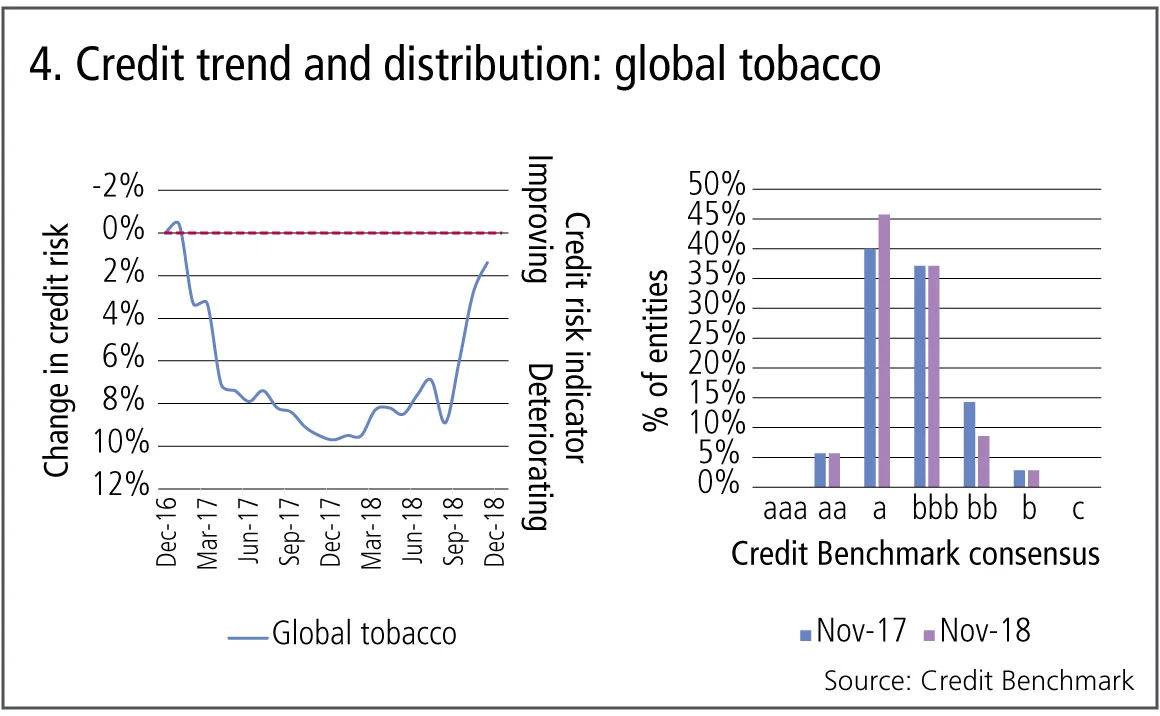

Tobacco

Philip Morris International recently announced plans to replace traditional cigarettes with smokeless heated tobacco, although for cost reasons this is only currently realistic in developed economies. Heated tobacco is likely to be healthier than smoking, but does not yet have the same level of medical backing as vaping. Big tobacco is also eyeing up cannabis company acquisitions as a potential diversifier, especially in the US and Canada where the market is thought to be worth more than $25 billion – although this is tiny compared with global tobacco revenues of $500 billion.

Figure 4 shows the credit trends and credit distribution for 34 global tobacco companies.

Figure 4 shows:

- Average credit risk deteriorated by 10% during 2017.

- Credit recovered modestly in the first half of 2018 and the rate of improvement accelerated in the second half.

- The credit distribution shows a small increase in the proportion of companies in the a category, and an equivalent reduction in the proportion in the bb category – an overall shift towards investment grade.

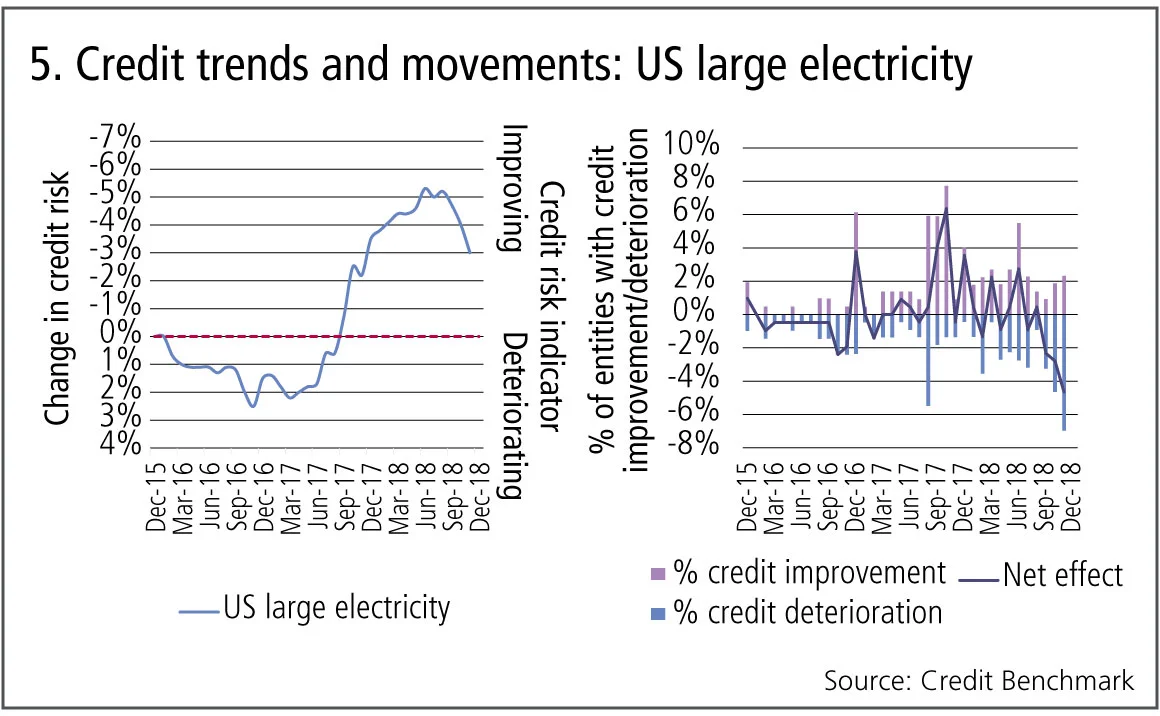

US large electrical utilities

The devastating wildfires in California and the PG&E bankruptcy filing have highlighted some broader issues in US electrical utilities. It was one of the best-performing equity sectors in the S&P in 2018, but rising interest rates and tax changes have clouded the outlook and Moody’s downgraded the sector in mid-2018.

Figure 5 shows credit risk trends for 215 US large electrical utilities over the past two years.

Figure 5 shows:

- The sector showed a modest credit improvement from early 2017, peaking in mid-2018.

- The balance of improvements v deteriorations began to decline in late 2017 and accelerated in the second half of 2018.

- Average credit risk shows a modest but consistent decline from mid-2018.

About this data

The Credit Benchmark dataset is based on internally modelled credit ratings from a pool of contributor banks. These are mapped into a standardised 21-bucket ratings scale, so downgrades and upgrades can be tracked on a monthly basis. Obligors are only included where ratings have been contributed by at least three different banks, yielding a total dataset of about 25,000 names.

David Carruthers is head of research at Credit Benchmark.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

市場は決して忘れない:平方根則の持続的な影響

ジャン=フィリップ・ブショー氏はトレードの流れは資産価格に大きく、かつ長期的な影響があると主張する。

ポッドキャスト:ピエトロ・ロッシ氏による信用格付けとボラティリティ・モデルについて

確率論的手法とキャリブレーション速度の向上により、クレジットおよび株式分野における確立されたモデルが改善されます。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。