Swaps data: anatomy of a wild week in dollar swaps

Chaotic Italian politics jolted rates markets – including US dollar interest rate swaps, writes Amir Khwaja of Clarus FT

The difficulties facing Italy’s new populist coalition dominated the news – and the markets – at the end of May, prompting investors to move money out of euros and into US dollars and US Treasuries. The resulting severe drop in US Treasury yields and swap rates presents an interesting opportunity to look at price and volume data in the dollar swap market.

Tuesday, May 29

Let’s start with Tuesday, the day the market reopened after the US Memorial Day holiday. Dollar swap rates had been drifting down in the prior week with 10-year rates down a cumulative 15 basis points from May 21 to May 25 and daily volumes below or similar to monthly averages on each day in the week. Then, on Tuesday, the market dropped sharply.

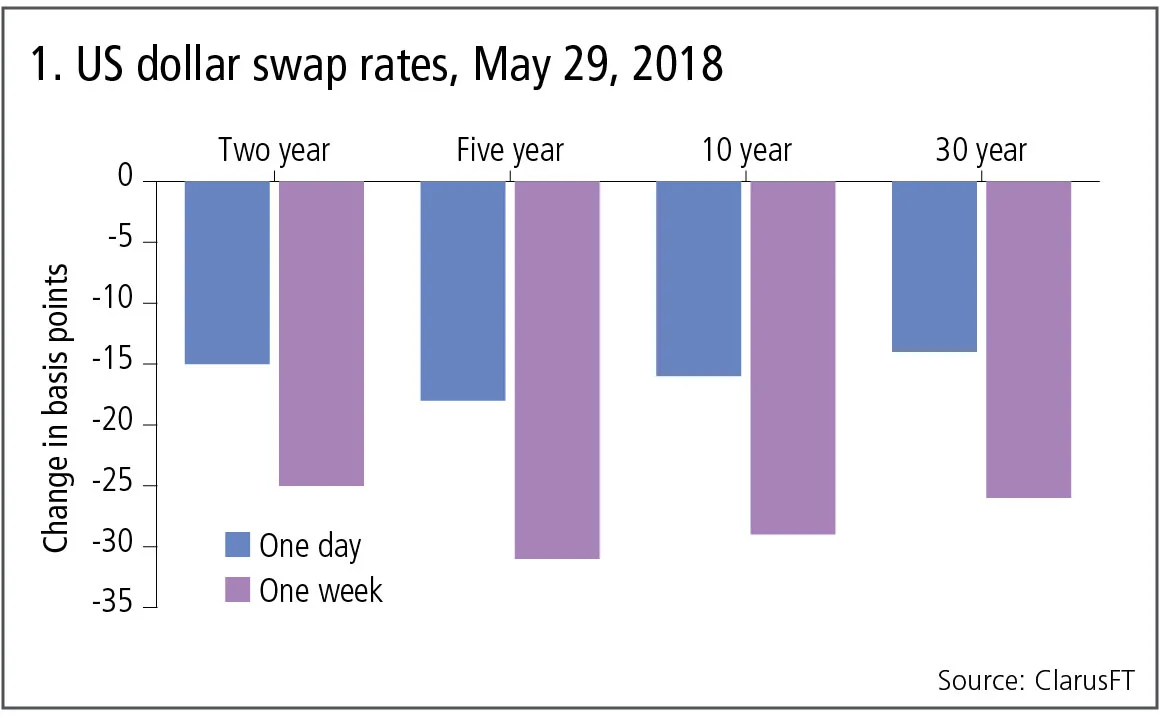

Figure 1 shows:

- Large one-day and one-week falls in swap rates for each major tenor – as a basis for comparison, daily moves are generally less than 2–3bp.

- Five-year swap rates down a massive 18bp at the close on Tuesday from the prior business day and down 31bp over one week.

- Two-year, 10-year and 30-year swap rates with similar drops.

Trade volumes on May 29

Stats from US swap data repositories (SDRs) allows us to build a picture of volume in vanilla spot starting swaps on this volatile day.

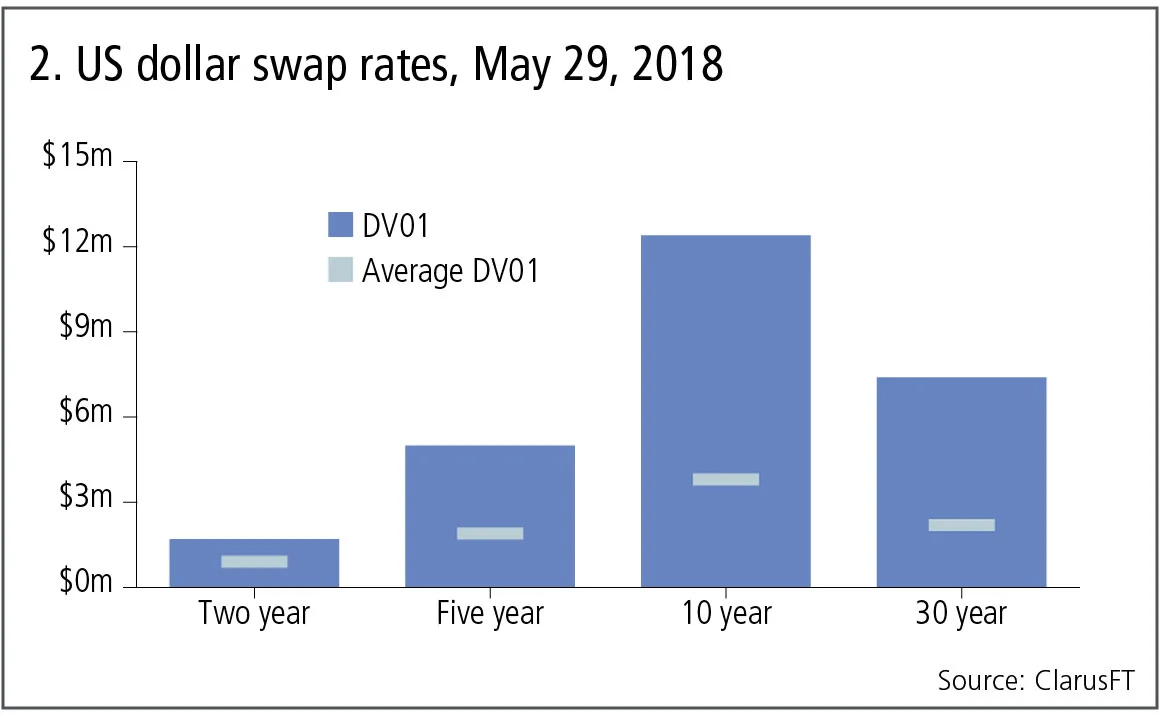

Figure 2 shows:

- Ten-year swap volume was over $12 million DV01 or greater than $14 billion notional, which is over three times the daily average.

- Thirty-year swap volume at $7 million DV01 was also over three times average.

- Two-year and five-year swaps both with elevated volumes.

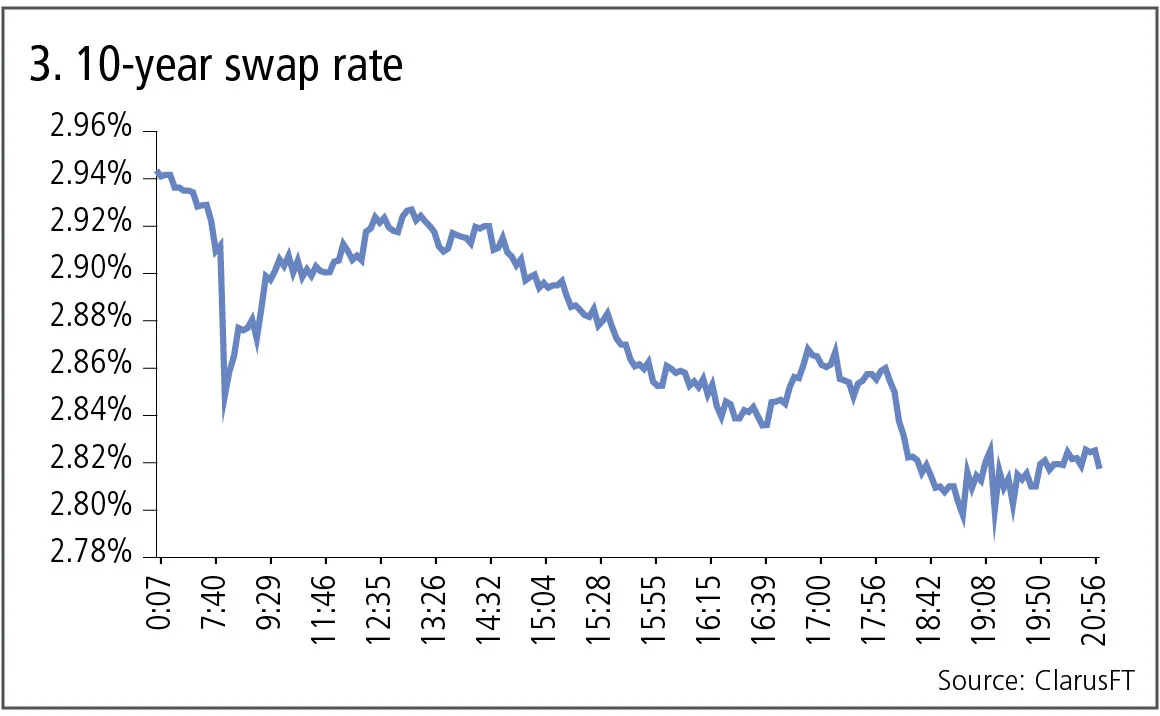

Drilling down into the 10-year tenor, we can see the intra-day prices of the 240 trades reported by US entities that constitute the $12 million DV01.

Figure 3 shows:

- Rates dropping sharply at the London market open to 2.85%.

- Back up to 2.92% for the start of the day in New York.

- Falling steadily in New York morning, back down to 2.85%.

- Rallying 3bp up for a two-hour period.

- Then falling again to just below 2.8%, before drifting up to 2.82%.

From Friday’s close, 10-year swap rates were down 16bp at the end of Tuesday, a tumultuous trading day.

Subsequent days

Frequently, after a shock in any market, prices snap back on subsequent days, as participants digest news and politicians or central bankers make policy statements – and this is what happened on this occasion.

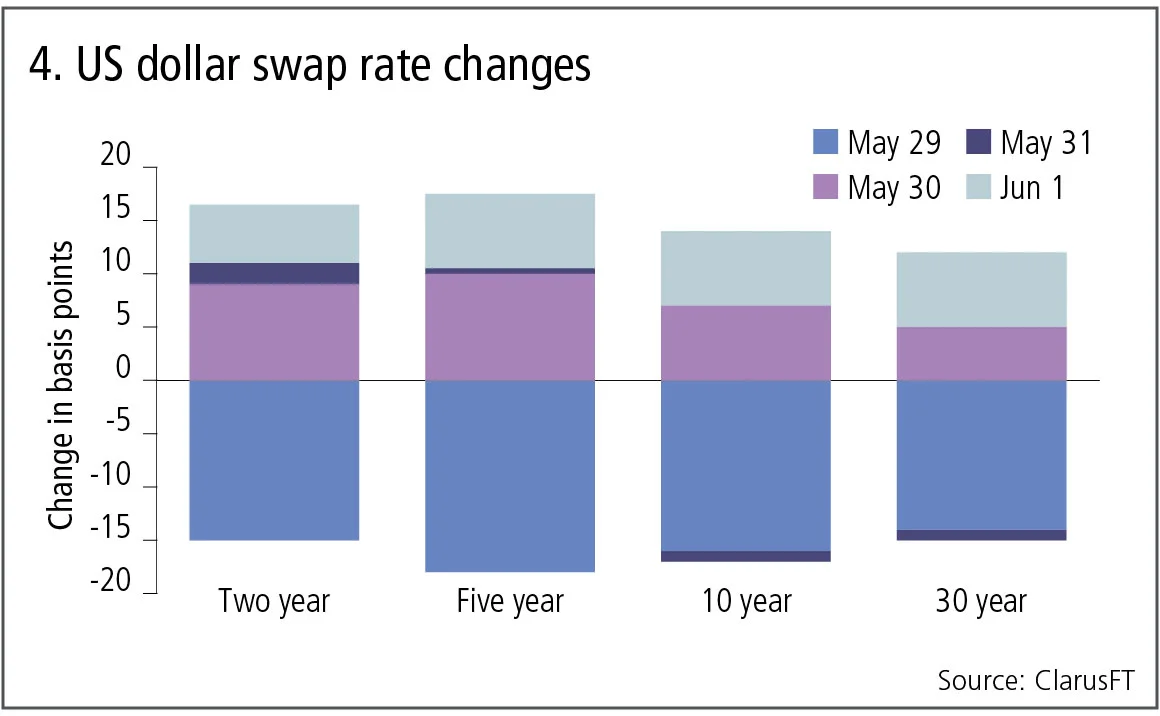

Figure 4 shows:

- After May 29, rates recovered by the end of the week.

- Five-year swap rates – having dropped 18bp – were up 10bp, 0.5bp and 7bp on the three subsequent days to end the week just 0.5bp down.

- A similar pattern for two-year, 10-year and 30-year rates.

In fact, this recovery meant the swap curve was down 5bp in May, compared with a rise of 18bp in April and the 10-year and 30-year benchmarks once again below the significant 3% level.

Let’s also look at volumes on these three days.

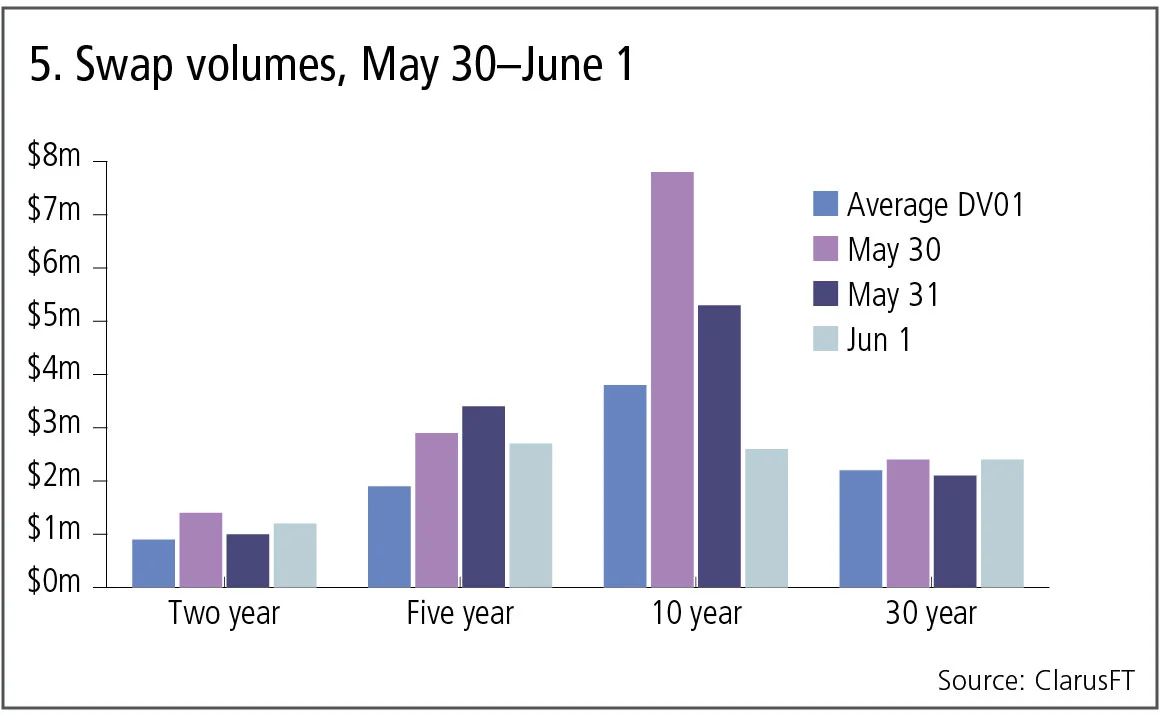

Figure 5 shows:

- Daily average DV01 in millions compared with the actual figure on May 30, May 31 and Jun 1.

- Generally volume was back down to the average for most tenors and days.

- Except for 10-year, which saw twice the average volume on May 30 and almost twice again on May 31, before a lower-than-average day on Jun 1.

Post-trade over-the-counter derivatives data at the transaction level means we can analyse the prices and volume of trades on any tenor and each business day – and can do so, not only the day after it happens, but also during a trading day. Such insight is now part and parcel of trading in swap markets.

Fed rate expectations

The prices of federal funds and overnight index swaps allow us to back out the market’s expectations of rate rises and how these changed over this one-week period. The market assigned a 95% probability on May 21 to a 25bp rate rise at the June 12–13 Federal Open Market Committee meeting, which dropped to a 72% probability on May 29 and then up to 78% probability on June 1. So, a hike is still seen as likely to happen, but it is now less likely than before.

Other markets

We know many other markets saw huge volumes on May 29, with CME reporting a record 39.6 million interest rate contracts traded, almost 50% higher than the previous record on Nov 9, 2016, the day after the US election. Further, CME reports six of its 10 highest-volume days have occurred during 2018.

Market volatility and volume is indeed back with a vengeance in 2018.

Amir Khwaja is chief executive of Clarus Financial Technology.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

市場は決して忘れない:平方根則の持続的な影響

ジャン=フィリップ・ブショー氏はトレードの流れは資産価格に大きく、かつ長期的な影響があると主張する。

ポッドキャスト:ピエトロ・ロッシ氏による信用格付けとボラティリティ・モデルについて

確率論的手法とキャリブレーション速度の向上により、クレジットおよび株式分野における確立されたモデルが改善されます。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。