Modelling

Quants split on who wins in the alt-data gold rush

Scale helps in handling new data, but alpha may be found in niche strategies

UBS revises credit and counterparty risk estimate

Changes to the bank’s models and methodology expected to add $6bn in second half of the year

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Goldman tackles climate risk controls

Lender joins other banks in translating physical and transition threats into controls framework

Risk managers urge consolidation of climate scenarios

Converging financial and corporate scenarios would provide better data for stress-testing

Loan losses: Banks’ estimates out of sync with Fed’s

Wells Fargo worst performer in latest DFAST exercise

Nomura understated VAR capital charges by 13% in H2 2020

VAR RWAs should have been ¥122 billion higher than originally stated at end-December

How algos are helping inflation-wary investors

Buy-siders look to machine learning for clues on the effect of rising prices on portfolios

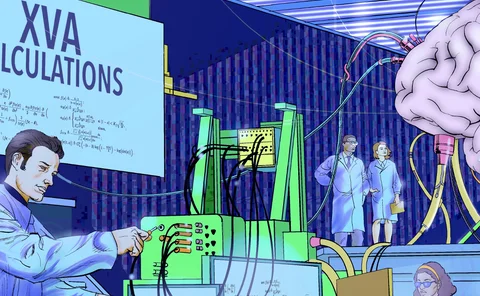

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Market’s mystery jumps might be predictable after all

Endogenous volatility has a tell-tale pattern, quants find

Banks fear Fed crackdown on AI models

Dealers say agencies’ request for info could prompt new rules that stifle model innovation

Pricing services play critical role in securities valuations under SEC rule

Pricing services face scrutiny from investment managers as the US Securities and Exchange Commission's (SEC's) new 2a-5 ‘fair value’ rule takes effect. Here, Refinitiv’s Joseph Hayek explains how pricing services should prepare for the surge in customer…

From one extreme to another: Covid upsets loan models once more

Unusual economic slumps tripped up models in 2020. Now, they are struggling with fast recoveries

Quant fund aims to tame bitcoin, and 39 other digital assets

Ex-Morgan Stanley, Winton vets reimagine institutional risk management for volatile crypto markets

Libor transition nears its end – Five topics you need to know

As the deadline to Libor cessation approaches, Liang Wu, executive director of financial engineering and head of cross-asset product management at Numerix, presents a series of market themes that warrant closer inspection

Fake data can help backtesters, up to a point

Synthetic data made with machine learning will struggle to capture the caprice of financial markets

In fake data, quants see a fix for backtesting

Traditionally quants have learnt to pick data apart. Soon they might spend more time making it up

Quant grad conveyor belt stalls as banks retrench

Jobs market is long quant graduates, short vacancies – but hiring freeze shows signs of thawing

Jarrow and co find a better way to spot stock market bubbles

Quant team’s options-based approach avoids pitfalls of historical data dependence

ECB’s models review heaped €275bn of extra RWAs on banks

Average bank CET1 capital ratio fell 71bp through Trim process

Rough volatility’s steampunk vision of future finance

Some of the trickiest puzzles in finance could be solved by blending old and new technologies

Sign prediction and sign regression

This paper proposes an approach whereby the loss function regularizes the errors in prediction in different ways.

The volatility paradigm that’s stirring up options pricing

‘Rough volatility’ models promise better pricing and hedging of options. But will they catch on?

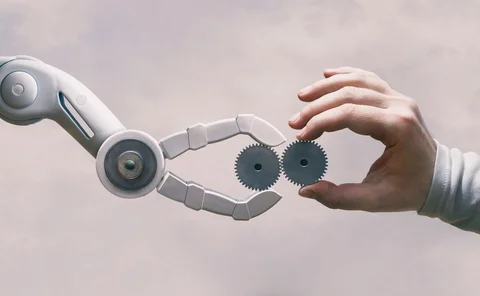

As machines disrupt investing, people still have a role to play

Despite AI’s growth, investing still needs human adaptability and judgement, writes Schroders’ Lim