Modelling

UniCredit cuts market RWAs by 9%

Removal of capital requirements for FX risk sheds standardised RWAs by 68% in three months

US unit of Barclays close to a VAR breach in Q4

Largest loss-to-VAR ratio at the firm was highest among 10 US intermediate holding companies

HSBC’s SA market RWAs double on new structural FX rules

Move from Pillar 2 to Pillar 1 for unhedged FX risk adds $6.8bn of RWAs

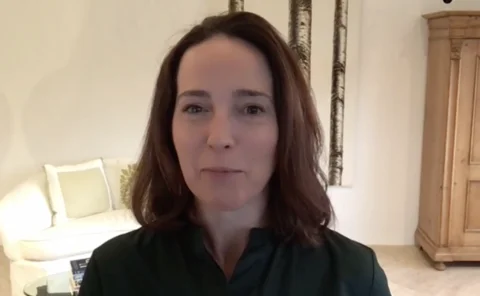

Interview with Sarah Friar, chief executive at Nextdoor: part 2 of 2

Sarah Friar, chief executive at Nextdoor, says enterprise risk assessments are vital because, when done well, they are great mental models and helpful for playing out scenarios

Barclays’ modelled RWAs jump 71%

SVAR pinned to Covid-19 panic drives latest quarterly increase

Smaller EU nations stare down giants in capital floor standoff

EU member states clash over severity of internally modelled output floors for cross-border bank groups

US banks see highest number of loss-making days in six years

Wells Fargo, Citi and JP Morgan the worst performers in record-breaking Q4

Benhart: banks should start revising for OCC’s climate exams

US agency’s climate chief says firms will need more data from clients if they’re to make the grade

Top US banks record 14 VAR breaches

JPM, Morgan Stanley, BofA, Citi, Goldman and State Street wrong-footed in volatile end to 2021

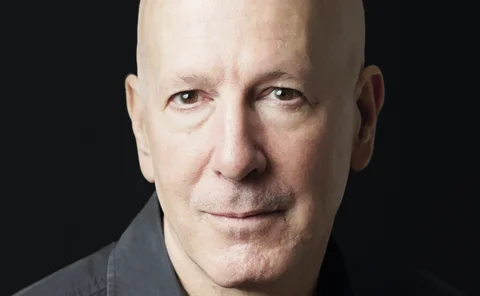

Bookstaber: past performance is no guide to future risks

Veteran risk chief says trading gains in wake of LTCM’s demise forged love of agent-based modelling

Prime broker of the year: Barclays

Risk Awards 2022: Focus on risk management helps UK bank win client trust – and balances – in wake of Archegos collapse

Clearing house of the year: OCC

Risk Awards 2022: Risk management reforms help clearing house weather meme stock volatility

JP Morgan incurs eight VAR breaches, triggering capital hike

Largest trading loss in Q4 reached 207% of the bank’s VAR limit

SocGen cut trading VAR by a third in Q4

Trading risk gauge shrinks to lowest in 17 years

The Collins flaw: backstop turned binding constraint

US legislative tweak was meant to prevent banks from using their own capital models too liberally. It’s now something different

Apra’s overlay pushes CBA’s market RWAs up 30%

Market risk is at the highest level since Q4 2020

Nordea’s trading VAR keeps climbing amid rate hike jitters

Trading risk gauge surged 17% through Q4

ING’s interest rate VAR spiked in Q4

Potential-loss indicator for rates trading peaked at €20 million

UBS incurred a VAR breach in Q4

The latest larger-than-expected loss – the fourth in 2021 – leaves the bank one step closer to higher capital requirements

Deutsche’s op RWAs down 10% in 2021

‘Bad bank’ unwinding pushed op risk at multi-year low

All top US banks below Collins floor

None of the eight systemic banks in the country above the threshold for the first time since 2015

Top US banks released $18.5bn of credit reserves in 2021

JP Morgan reversed over $6bn of PCLs, the most of the group

Bank of America’s VAR drops 19% in Q4

Average one-day trading VAR falls to lowest point since Q1 2020

Wells Fargo RWAs drift apart

Standardised RWAs have increased for three consecutive quarters, putting pressure on the bank’s CET1 capital ratio