Machine learning

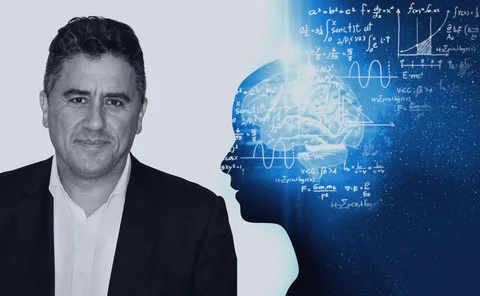

Buy-side quant of the year: Gordon Ritter

Risk Awards 2019: Quant uses new tech to tackle old problem of optimal execution

Global perspectives on operational risk management and practice: a survey by the Institute of Operational Risk (IOR) and the Center for Financial Professionals (CeFPro)

This paper presents survey results which represent comprehensive perspectives on operational risk practice, obtained from practitioners in a wide range of countries and sectors.

The machine shines in Hong Kong A-share fund

Strategy run by ChinaAMC (HK) combines machine learning with human judgement to outdo rivals

Basel’s archaic op risk taxonomy gets a makeover

Industry moves to revise out-of-date categories that feature risks such as cheque fraud

Quant of the year: Alexei Kondratyev

Risk Awards 2019: A glimpse of the future? Quant uses ML to model term structure and crunch margin costs

Asset manager of the year: Goldman Sachs Asset Management

Risk Awards 2019: Firm’s algos pick through earnings call transcripts to figure out what analysts really think

Fed’s Brainard wary of black box AI models in consumer credit

Speech raises explainability issue; says existing model risk guidelines are “a good place to start” in regulating AI

AI data could be tainted even as it’s being cleaned

Risk USA: Expert says even touching raw data could lead to loss of context

Man embraces open source in push to lure tech talent

Risk USA: Forget Silicon Valley – come work in finance, hedge fund CRO tells technologists

BlackRock shelves unexplainable AI liquidity models

Risk USA: Neural nets beat other models in tests, but results could not be explained

Banks split on human oversight of AI models

Risk USA: Most firms supervise their models, but one expert says they can be trusted to make decisions

Humans struggle to keep pace with machine learning

Banks and regulators grapple with ‘XAI’ challenge

Machine learning hits explainability barrier

Banks hire AI industry experts in face of growing regulatory scrutiny

Why Dario Villani trusts machine learning

Duality Group CEO says people should abandon ‘top-down, godlike model’ and their need to understand

At BlackRock’s West Coast AI lab

The firm is handing its ‘most vexing problems’ to artificial intelligence

Predictive fraud analytics: B-tests

In this paper, the authors look at B-tests: methods by which it is possible to identify internal fraud among employees and partners of the bank at an early stage.

Big funds muzzle their AI machines

Fears over interpretability, crowding and overfitting have put a damper on efforts to unleash AI for asset management

Do or die – asset managers take up data science

Firms are scanning an ocean of text and images, as well as big number sets, to grab an edge

A call to arms – How machine intelligence can help banks beat financial crime

The revolution in artificial intelligence promises new leads in banks’ fight against dirty money. Alexander Campbell of Risk.net hosted a live online forum, in association with NICE Actimize, to investigate the applications of this emergent technology

Banks discreetly seek personnel to mine alt data riches

Citi, Credit Suisse, HSBC and Morgan Stanley are hiring data scientists for a plethora of new initiatives

Disruptive change in US power markets: Identifying risks and embracing opportunities in the new world of digital

Power markets worldwide are experiencing disruptive changes on a bigger scale and with greater speed than many had anticipated. Now, more than ever, it is essential to understand opportunities and risks associated with these changes

From AI to cheese: funds seek fixes for trend following

Firms turn to machine learning, hybrid products and new markets to boost returns