Distributed ledger technology (DLT)

Wall Street vets vie to be BlackRock of crypto

Fund launch uses fundamental analysis to identify value propositions in high-risk industry

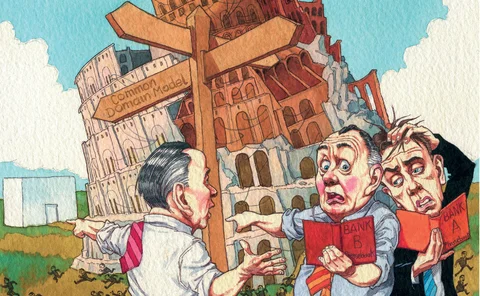

Blazing new analytical paths: Tackling data aggregation for new risk insights

As the risk function’s influence continues to grow within financial services firms, demand for quality integrated risk data to support a wider range of business-critical decisions is stretching the capabilities of existing technology to breaking point. A…

Blockchain won’t help the UK to go P2P

Legal and practical problems mean blockchain is unlikely to change the UK’s grid, writes energy expert

Cryptocurrencies: king’s ransom or fool’s gold?

Extreme volatility makes products an unreliable store of value – for now

Hackathon finds pre-trade gold in Isda’s post-trade project

Dealers’ derivatives trade processing costs could be cut by at least $3 billion per year

Financial risks don’t go on holiday

Better mapping of financial system would help avoid seasonal surprises, argues Andrew Lo

Risktech start-ups: survival of the fittest?

A new breed of vendors could change the face of risk management, if they can hang around long enough

Risktech start-ups struggle to clinch big-bank contracts

Light on cash, risk management fintechs face an extended gauntlet most won’t survive

Power market set for 2019 blockchain boom

Blockchain could cut costs and bring in microgenerators, industry believes

Planned sale prompts hard look at post-trade firms

Plans to sell MarkitServ fuel warnings about middleware vendors’ future

The changing face of European power trading

Webinar: FIS

Trade data initiatives aim to unify regulatory reporting

Standardised data would improve systemic risk monitoring and save firms billions, say data engineers

From prophets to ‘parasites’

How post-trade vendors went from problem-solvers to ‘rent-seekers’

The battle for the back office

Post-trade incumbents at risk as Isda and others search for standards

How fintech could reboot Libor

Polsinelli’s Rutenberg says blockchain technology and ‘Libor currency’ could boost submission incentives and make process more secure

DLT offers new possibilities for securities settlement, say ECB and BoJ

Second phase of ‘Project Stella’ looks at delivery versus payment on three DLT platforms

Distributed ledger technology in payments, clearing and settlement

This paper examines how DLT can be used in the area of PCS, and identifies both the opportunities and challenges associated with its long-term implementation and adoption.

FMIC 2 special issue introduction: a policy view on developments in the field of financial market infrastructures

This introductory article positions these papers and speeches within the context of the wider conference proceedings of the Financial Market Infrastructure Conference II: New Thinking in a New Era, including insights from the panel sessions and…

Forecasting crypto crashes with bubble analysis

Analysis finds bubble signals in bitcoin and ether, write trio of quant risk managers

Swift’s CRO on Bangladesh Bank heist, cyber risk and DLT

Quraishi lays out Swift’s approach to members’ security, and technological risks and opportunities

Russian crypto-currency will threaten AML efforts

Targeting individuals and companies could be impossible with digital currency, write academics

DTCC’s Bodson on blockchain, SDRs and repo clearing

Risk30: swap data reporting will move to a distributed ledger platform in early 2018

Nex’s Spencer on tech, Brexit and the UK’s identity crisis

Risk30: Icap founder fears return of exchange controls under a Labour government

Chicago exchanges embrace crypto-currency

Exchanges' interest piqued, but regulators and some market participants hesitant