Adjoint algorithmic differentiation (AAD)

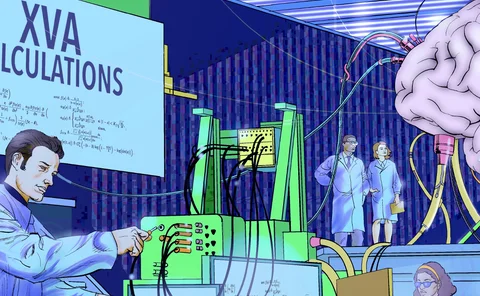

Almost two-thirds of banks now run XVAs on cloud

Risk Benchmarking study finds a majority of big dealers tapping cloud capacity, some exclusively, with others migrating

Banks look back in anger as FRTB revives 1990s risk test

Institutions bemoan need for parallel framework to measure portfolios’ sensitivities to market moves

Bank risk manager of the year: Natixis

Risk Awards 2023: Revised risk management framework and front-office collaboration help bank withstand 2022 volatility surge

Vega decomposition for the LV model: an adjoint differentiation approach

Introducing an algorithm for computing vega sensitivities at all strikes and expiries

Adjoint differentiation for generic matrix functions

The authors develop and apply a formula to derive closed-form expressions in particular quantitative finance cases.

Automatic implicit function theorem

New technique can improve use of adjoint algorithmic differentiation in calibration problems

Chebyshev Greeks: smoothing gamma without bias

A numerical method to obtain stable deltas and gammas for complex payoffs is presented

Podcast: turbo-charging derivatives pricing

Quants achieve more speed by reducing number of dimensions in price calculations

Axes that matter: PCA with a difference

Differential PCA is introduced to reduce the dimensionality in derivative pricing problems

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

A look at future exposures, through a 19th century lens

Can a centenarian maths idea speed up the calculation of forward sensitivities?

Technology innovation of the year: Scotiabank

Risk Awards 2021: New risk engine can run nearly a billion XVA calculations per second

Danske quants discover speedier way to crunch XVAs

Differential machine learning produces results “thousands of times faster and with similar accuracy”

Differential machine learning: the shape of things to come

A derivative pricing approximation method using neural networks and AAD speeds up calculations

Second-order Monte Carlo sensitivities

This paper considers the problem of efficiently computing the full matrix of second-order sensitivities of a Monte Carlo price when the number of inputs is large.

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

Fast stochastic forward sensitivities in Monte Carlo simulations using stochastic automatic differentiation (with applications to initial margin valuation adjustments)

In this paper, the author applies stochastic (backward) automatic differentiation to calculate stochastic forward sensitivities.

Is AD the answer to quicker MVA calculation?

Quants propose faster technique for Simm-MVA based on algorithmic differentiation

Podcast: Antonov on MVA, algorithmic differentiation and model validation

StanChart quant proposes new technique to compute MVA quicker

Efficient Simm-MVA calculations for callable exotics

Algorithmic differentiation are used to simulate sensitivities to calculate MVA

Podcast: Fries on Monte Carlo, Greeks and the future of AAD

Research on AAD is not complete until it becomes easier to implement, says quant