Risk magazine

Prime services – It’s about what you bring

There are many benefits to integration – particularly when it comes to the provision of prime services. Societe Generale has followed this path, which has allowed it to improve cost efficiency and improve the range of products it can offer. The bank has…

Seamless integration – Drivers of and barriers to cloud adoption

Siarhei Niaborski, executive vice-president of risk at CompatibL, discusses the rate of cloud adoption in the capital markets industry and its possible drivers and barriers, how firms can derive maximum value from cloud usage and the criteria on which…

Successfully moving risk software to the cloud

Cloud technologies offer numerous benefits over traditional on-premise deployments. While the rate of adoption in the financial services industry was initially slow, banks and asset managers are now embracing these technologies and moving their…

FBI sees steep rise in state-sponsored cyber theft

Risk USA: Impact of US sanctions driving theft “to fund coffers”, says special agent

Fed’s repo operations will not fix rate spikes, dealers say

Risk USA: leverage constraints remain, even after massive injections of emergency liquidity

NY Fed CRO urges banks to improve risk controls

Risk USA: Tangled web of controls threatens ability to recover from attacks, says Rosenberg

FRTB costs force banks to weigh IMA desk by desk

Risk USA: Some desks “may not be able to pass these more rigorous standards”, says Morgan Stanley FRTB lead

PRA drops ‘timely’ payouts in credit risk insurance

Plan for expeditious timeframe set aside to delight of banks worried about retaining capital breaks

Goldman’s Granet: repo tumult does not undermine SOFR

Risk USA: Libor transition head says SOFR is more stable than the rate it is set to replace

All clear? Structural shifts add to repo madness

Many things contributed to 10% repo, among them a FICC programme and a surge in overnight funding

LCH won’t back single fix for swaptions switch

Clearing house pledges to “support” multiple solutions to discounting problem

Navigating the impact of climate risk on financial stability

As uncertainty abounds on the impact climate change may have on the industry, financial services firms must best equip themselves for potential regulatory and socioeconomic changes to ensure they maximise the opportunities of embracing new best practices…

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

CFTC set to eliminate post-trade name give-up

Practice has been a mainstay of Sef trading but chairman Tarbert wants it gone

CCPs dismiss bank, buy-side criticisms

CME, Ice bat away suggestions of flaws in clearing house risk management

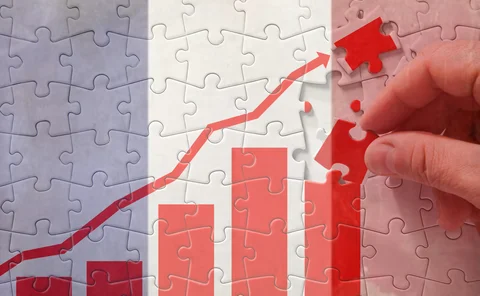

French banks cry foul over EBA’s 2020 stress-test plan

Assumptions about the cost of household sight deposits are “not plausible”, critics say

Banks join forces on model development utility

Crisil is working with HSBC and three other banks on platform to share model-building tools

Stress-testing to improve strategic decision‑making

Banking regulators remain focused on expanding and developing the range of stress-testing regimes across the globe to maintain stability, monitor emerging risks and avoid another financial crisis. Here, a forum of industry leaders discusses the evolution…

Double trouble: don’t blur FRTB deadlines, warns ECB

Ignoring reporting model deadline could muddy capital approval cut-off

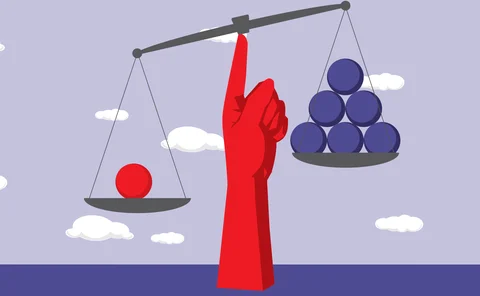

FVA – Time to go asymmetric?

Despite being introduced over six years ago, there is still no market consensus on how to calculate funding valuation adjustments. One point of contention is whether to use the same funding curve for borrowing and lending (symmetric funding) or to use…

A triptych approach for reverse stress testing of complex portfolios

Pascal Traccucci et al present an extended reverse stress test triptych approach with three variables