Risk magazine

Reduced-form capital optimisation

A linear approximation to an allocation technique provides a solution for banks’ capital managment

CFTC’s equivalence plan divides clearing houses and clients

US end-users prefer alternative compliance, but foreign CCPs want exempt status

Looking forward to backward‑looking rates

Interbank offered rates are critical in the world of contracts and derivatives, acting as reference rates in millions of financial contracts and with a total market exposure in the hundreds of trillions of dollars. Bloomberg explores why offering…

Floating start date for 2020 stress test alarms EU banks

Regulator proposal could lead to less reliable market risk data, critics warn

Harnessing AI to achieve Libor transition

Chris Dias, principal at KPMG, explains how the vast increase in accuracy that artificial intelligence (AI) offers when dealing with large volumes of complex agreements is crucial to exploring the market opportunities and mitigating the risks of the…

Libor transition and implementation – Covering all bases

Sponsored Q&A

Ice, CME shore up clearing house recovery planning

Introduction of VMGH and tear-ups comes amid impasse over CCP recovery and resolution rules

Buy side seeks non-cleared margin relief for SMAs

Sifma AMG calls for $50 million IM exchange threshold to be set annually

EU seeks to offer reassurance on Brexit clearing exemption

Commission can act quickly to stave off no-deal market disruption, insists official

Watchdogs ask EC to delay repo haircut floors. Will it?

EBA says hedge funds will skirt the rules, but Basel and FSB want haircut minimums in place

Isda set to launch fallback spread consultation

Lookback and mean/median study to launch this month, with results tipped to move the basis market

CLO investors find silver lining in Libor’s demise

A backward-looking SOFR rate will reduce the asset-liability mismatch that sank CLO equity in 2018

FCA chief calls for EU to extend Brexit clearing exemption

Bailey also urges EU to grant equivalence determinations for UK trading venues

Industry expects US FRTB proposals by year-end

Fed likely to co-ordinate progress with EU, which may also accelerate its timetable

House of the year, Australia: ANZ

Asia Risk Awards 2019

When regulators become nationalists

EU’s new treatment of bank software assets is partly a response to global competitive pressures

People moves: Deutsche hires new treasury unit head; markets role for Barclays’ Pecot; Penney leaves HSBC, and more

Latest job changes across the industry

Enria: no reason for EU to deviate from Basel output floor

ECB supervision chief urges lawmakers to implement contentious Basel III model constraints

An old fight over margin protections rears its head

CFTC rules on margin and loss limits for separate accounts are being torn up for asset managers

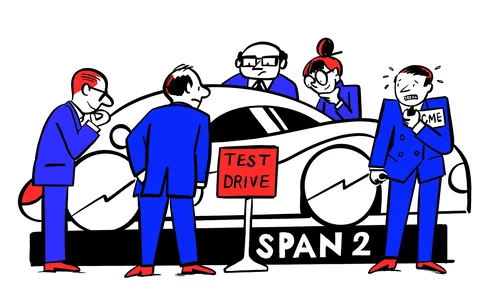

Span 2: a fine balance

Switching margin model means walking a tightrope of competing interests amid regulatory scrutiny

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

A look under the hood of Span 2, CME’s new margin engine

VAR-based framework has new ways of netting contracts and setting volatility floors and more

Revealed: FRTB impact three times higher than expected

Undisclosed Isda study finds capital hike outweighs previous Basel Committee estimate

CME no longer looking back to Lehman

Changes to rates margin model move CCP into line with rivals