This article was paid for by a contributing third party.More Information.

Navigating the impact of climate risk on financial stability

As uncertainty abounds on the impact climate change may have on the industry, financial services firms must best equip themselves for potential regulatory and socioeconomic changes to ensure they maximise the opportunities of embracing new best practices. Here, Aviva explores potential future scenarios that could arise as a result of action or inaction to minimise climate change, and what these scenarios could mean for the industry

Aviva anticipates unmitigated climate-related risks presenting a systemic threat to financial stability over the coming decades. As a result, it is taking action today to identify, measure, manage, monitor and report climate-related risks and opportunities. The insurer has already invested £4.4 billion in green assets since 2015 and is committed to supporting a Just transition to a low-carbon economy in line with the 2015 Paris Agreement on climate change. Aviva also welcomes the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD).

In particular, Aviva has been developing a climate value-at-risk (VAR) measure in conjunction with the UN Environment Programme Finance Initiative (UNEP FI) Investor pilot project and environmental financial technology firm Carbon Delta, an MSCI company. This enables investors to measure the potential business impacts of future climate-related risks and opportunities on their equity and corporate bond investments. Aviva has extended this measure with Elseware, a risk management and quantification expert consultancy, to cover other asset classes, and life and general insurance to assess the potential business impacts of each of the Intergovernmental Panel on Climate Change (IPCC) scenarios, as well as in aggregate.

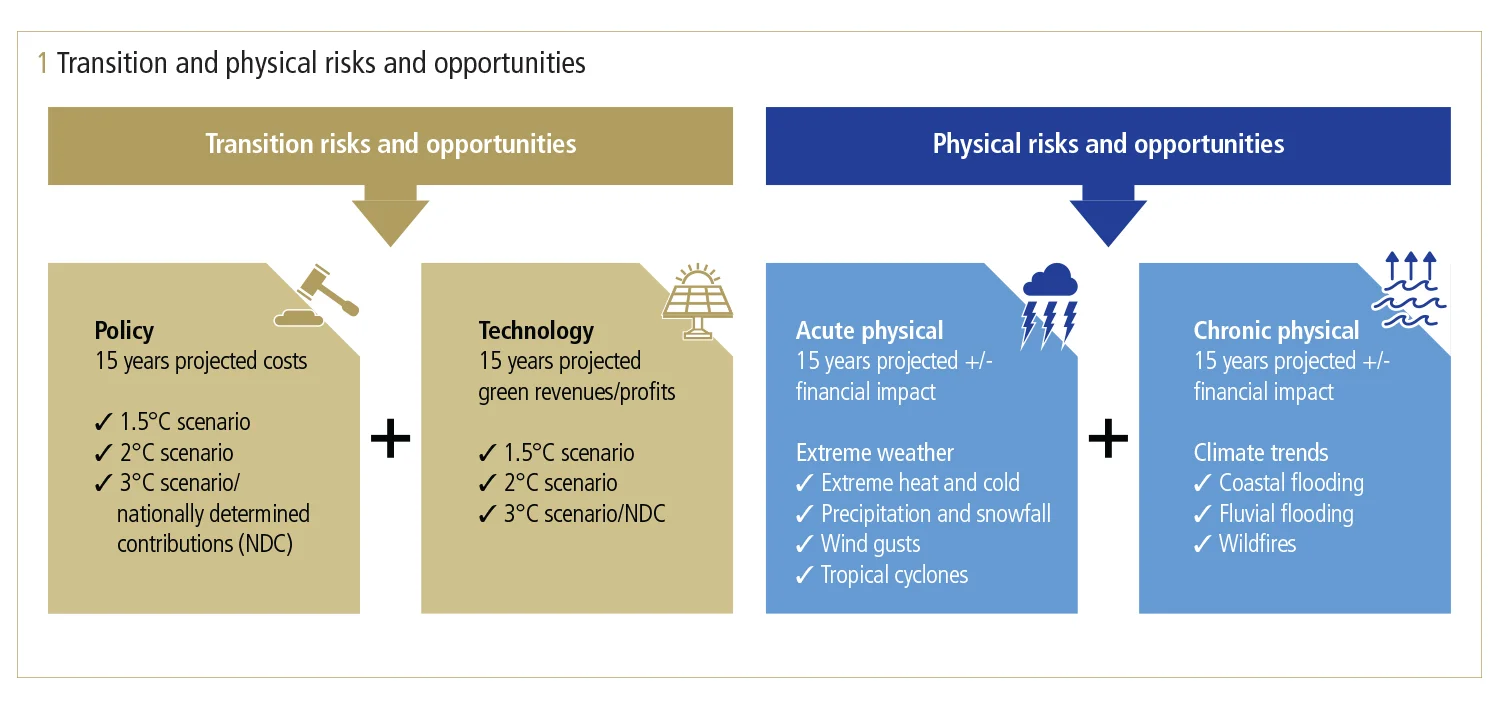

This climate VAR measure provides a holistic, forward-looking view of the climate-related transition and physical risks and opportunities to Aviva’s business (see figure 1). Transition risks and opportunities include the projected costs of policy action that aims to limit greenhouse gas emissions, and projected profits from green revenues arising from developing new technologies and patents. Physical risks cover the financial impact of climate change through extreme weather as well as the impact of rising sea levels and mean temperatures.

To support this initiative, an internal interdisciplinary team was created with representation from across the business to

manage the project day to day, and an expert panel was established to review and challenge the main assumptions made in the selection, development and modelling of the scenarios.

The panel included internal experts, as well as three from the Grantham Research Institute on Climate Change and the Environment at the London School of Economics – Simon Dietz, Nick Robins and Swenja Surminski.

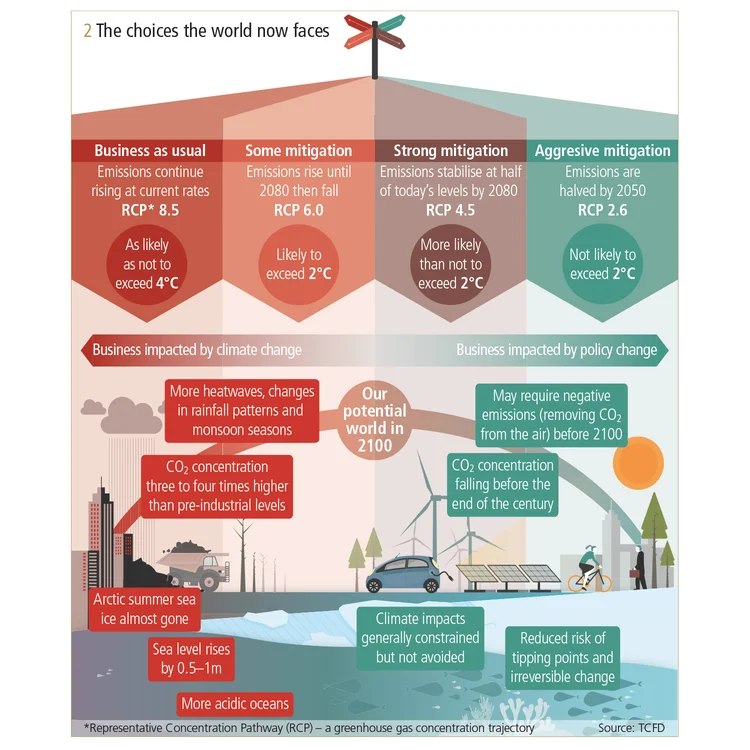

The IPCC has identified four potential future scenarios with respect to climate change (see figure 2). Each scenario describes a potential trajectory for future levels of greenhouse gases and other air pollutants, and can be mapped to potential temperature rises and the levels of mitigation required: 1.5°, 2°, 3° and 4° Celsius.

It is important to note that the four scenarios all assume a gradual path, in which temperatures rise slowly but climate policy is ramped up at varying speeds with a fairly high degree of global co‑ordination. They do not consider the transition risk in a more chaotic policy environment where there is a lack of global co-ordination and policy action is taken too suddenly and too late. This may result in an understatement of transition risk. Carbon Delta’s model and scenario analysis tools also allow consideration of the five Shared socioeconomic pathways. These consider socioeconomic characteristics, including population, economic growth, education, urbanisation and the rate of technological development.

The IPCC’s October 2018 special report, Global warming of 1.5°C, indicates the need to take dramatic action now to keep warming below this temperature, and the potential severe consequences if this is not achieved. The scale of change required to meet the 1.5°C target is unprecedented – industry will have to slash its CO2 emissions by 65–90% by 2050, and investments in low-carbon energy technology and energy efficiency will need to increase fivefold by 2050 versus 2015 levels. Buildings and transport will also need to shift heavily towards green electricity and tools to remove CO2 emissions from the atmosphere, such as carbon capture and storage (unproven at scale), will be needed to store between 100 and 1,000 gigatons of CO2 over the century.

In the IPCC’s 4°C scenario – which corresponds to emissions continuing to rise at current rates – the transition risk is clearly more limited but the potential physical risks are significant and the likelihood of tipping points being reached is much higher. In particular, increased precipitation, coastal and river flooding, periods of extreme heat and cold, wildfires and droughts can be expected. In addition, sea levels could rise significantly, resulting in major displacement of populations as well as the spread of diseases currently endemic in tropical areas into more temperate areas.

Finally – particularly in more extreme warming scenarios – it is important to consider whether climate might trigger changes in social attitudes, which result in increased litigation against companies for failing to reduce emissions or to disclose climate risks transparently.

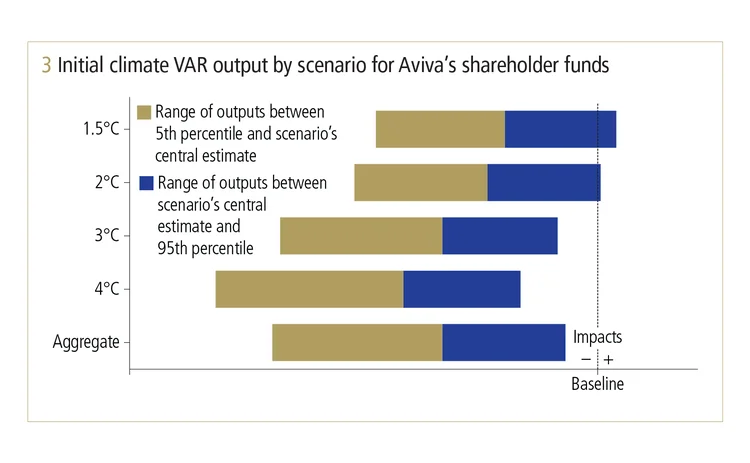

The initial results of Aviva’s climate VAR analysis compares a plausible range of outcomes (5th–95th percentile) from the different scenarios considered. As can be seen from this analysis, Aviva is most exposed to the ‘business as usual’ 4°C scenario, in which physical risk dominates, negatively impacting long-term investment returns on equities, corporate bonds, real estate, real estate loans and sovereign exposures.

The aggressive mitigation 1.5°C scenario is the only scenario with a potential upside. Physical risk impacts are much more limited but there is still downside risk on long-term investment returns from carbon-intensive sectors, such as utilities, as a result of transition policy actions. This is offset partially by revenues on new technologies from some sectors – automotives, for example.

When aggregated to determine an overall impact of climate-related risks and opportunities across all scenarios, the plausible range is dominated by the results of the 3°C and 4°C scenarios, reflecting that neither existing nor planned policy actions are sufficiently ambitious to meet the goal set by the Paris Agreement.

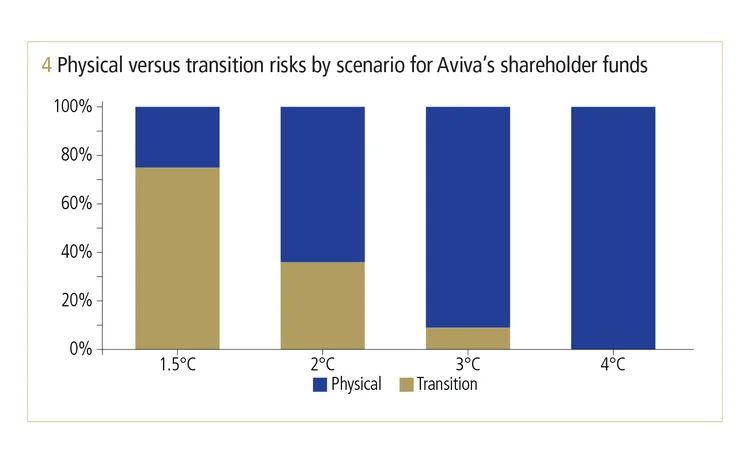

The 1.5°C scenario is dominated by transition risk, even after taking into account mitigating technology opportunities. In the 2°C scenario, transition and physical risks are more evenly balanced, whereas in the 3°C and 4°C scenarios physical risk dominates.

In all scenarios, the impact on insurance liabilities is more limited than on investment returns. However, there is potential for some impact on life and pensions business as a result of changes in mortality rates in different scenarios, either from physical effects such as more extreme hot and cold days or transition effects related to changes in pollution levels. The impact on general insurance liabilities is relatively limited because of the short-term nature of the business and the ability to reprice annually and mitigation provided by Aviva’s reinsurance programme. However, the physical effects of climate change will result in more risks and perils becoming either uninsurable or unaffordable over the longer term.

This analysis is just the beginning of Aviva’s journey to further develop metrics and targets to support decision-making and understanding of the impact of climate-related risks and opportunities on its business. Aviva will continue to develop and incorporate climate VAR into its overall strategy, risk management and reporting frameworks, with particular focus on the impact of climate-related risks and opportunities on specific insurance products, geographies and investments.

Aviva fully anticipates that this approach will evolve and improve in light of new research and data becoming available, as well as emerging best practices over the coming years.

To learn more

For more details on Aviva’s climate VAR methodology, see the firm’s 2018 Climate-related financial disclosure

Climate risk – Special report 2019

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net