Risk magazine

Bond managers relaxed ahead of bumper index rebalance

Fed’s credit facilities boost confidence as downgrades hit corporate bond indexes

TMX backs down on blanket margin hike after members revolt

Canadian CCP will review methodology and apply margin multipliers at the product level

Money funds turn to Fed facility amid record inflows

MMFs are accepting 0% returns and waiving management fees to avoid ‘breaking the buck’

RBS exits listed derivatives trading and clearing

Clients served eviction notices last week as bank moves to downsize NatWest Markets unit

Climate risk – Special report 2020

As governments worldwide focus on the coronavirus (Covid‑19) pandemic amid plummeting demand for fossil fuels, it may seem climate change has dropped down the global agenda. Firms that don’t assess the climate risk in their portfolios, or hedge or divest…

Uncleared margin – The changing needs of buy-side firms

Raf Pritchard, head of triResolve, discusses the initial margin calculation and collateralisation challenges for firms coming into scope under phases five and six of the uncleared margin rules

Eurostoxx dividend futures see trading frenzy

December 20 contracts drop 39% in March

Libor Risk – Quarterly report Q1 2020

Regulators may have to accept Libor transition will be slower than they hoped. But the final framework may yet be more robust as a result. Knowing how rates perform in times of stress will be crucial to the success of benchmarks intended for real economy…

Pre-cessation Ibor picture gets clearer

As the derivatives market has accepted the impending transition away from interbank offered rates, attention has turned to how best to manage it. Philip Whitehurst, head of service development, rates at LCH, explores how the clearing house is working…

Global investing under water? – Climate change could leave equities exposed

As impending global changes brought about by climate change loom, one issue in particular threatens to cause massive losses to institutional investors – rising sea levels. David Lunsford and Boris Prahl, of MSCI, explore where, despite the efforts of…

A sea change – Driving awareness to confront climate risk

Amid a global push towards green policies, the reality of overhauling how industries worth trillions of dollars operate is causing concern. A forum of market participants and sponsors of this report discuss the levels of awareness of climate risk and its…

Operational uncertainty – An unavoidable challenge

The transition from Libor to a new risk-free rate has revealed a number of challenges for all financial markets participants – the nature and scope of what lies ahead is vast, impacting businesses, operations and support functions. KPMG‘s global Libor…

Managing the cost of transition and the risk of delay

A forum of industry leaders, which includes sponsors of this report, discusses key industry concerns around the transition away from Libor, including the risks investors will face once the rate is discontinued and how to manage them, whether forward…

The impact of climate change on banks

Over the past few years, concern and public discussion around environmental damage and climate change – and their social impacts – have increased dramatically. Peter Plochan, principal risk management advisor at SAS, discusses some key ideas to allow…

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

Climate risk management – A self-assessment of progress

Due to a combination of increasing social pressure, demands for better disclosure from investors and emerging regulation, companies are increasingly questioning the extent to which they are incorporating climate change into their global risk management…

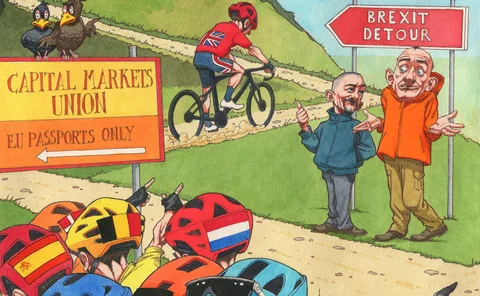

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

Adapting to technological change in op risk management

Baker McKenzie‘s Jonathan Peddie explains how the role of operational risk manager has evolved in recent years, how financial firms are managing increasing demand for data privacy and transparency, and how technological advancements over the coming…

BNY Mellon nabs Hallinan for enterprise risk role

Hiring of former Credit Suisse op risk head follows last year’s appointment of Senthil Kumar as CRO