Risk magazine - Mar 2020

In this issue: the UK’s long road to equivalence; Morgan Stanley’s butterflies; the black box of AI, opened; and much more

Articles in this issue

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

Cross-border trading could suffer under IM rules

Conflicting US and EU cash reinvestment rules may force buy side to post bonds

Ion’s Broadway deal leaves banks in a bind

Barclays and Nomura among banks that had moved from Ion to rival it now controls

Goldman, JPM kick off SOFR swaptions

US dealers spearhead non-linear trading but patchy liquidity weighs on vol market ambitions

First SOFR versus CORRA cross-currency swap hits market

JP Morgan and National Bank of Canada extend SOFR cross-currency trading into Canadian market

Chinese banks set for mass loan repricing

Options launch slated for February to help industry switch to new benchmark by August

BoE to publish ‘golden source’ compounded Sonia index in July

UK to align with US in effort eliminate interest calculation mismatches and turbo-charge adoption

Dealers prefer repo for new risk-free rate in Korea

Unsecured rate undercut by dwindling transactions in local call market

EU banks rue SA-CCR mismatch with US

European clearers are stuck with CEM until 2021, but some US banks are reluctant to switch early

Singapore banks tighten ML governance amid regulatory scrutiny

DBS, StanChart and Deutsche build model inventories and draw up standards around use cases

FX options see record volumes as yen goes off-script

Coronavirus outbreak and recession fears trigger frenzied trading in USD/JPY options

People moves: Morgan Stanley names FX co-heads, Dray expands BNPP role, Singh switches post at Bank of America, and more

Latest job changes across the industry

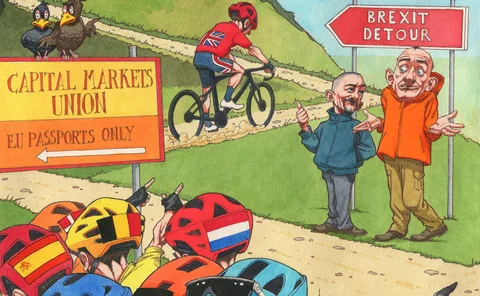

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Morgan Stanley FX loss leaves ill-feeling, questions in wake

Options traders saw odd quotes by US bank months before losses were publicised

Prising open the black box of AI

Shapley values, Lime and other tools can help decipher machine learning’s output. It’s a start…

Top 10 operational risks for 2020

The biggest op risks for 2020, as chosen by industry practitioners

Adapting to technological change in op risk management

Baker McKenzie‘s Jonathan Peddie explains how the role of operational risk manager has evolved in recent years, how financial firms are managing increasing demand for data privacy and transparency, and how technological advancements over the coming…

A growing focus on op risk

Operational risk and resilience have taken centre stage over the past year. While op risk concerns all systems and controls that deliver effective solutions against the risks financial services businesses regularly face, Jonathan Peddie, partner at Baker…

Clearing members in cash clash with Apac CCPs

Banks and clearing houses wrangle over who should pay for losses on invested collateral

Margin exchange threshold relief: get out of jail free?

‘Game-changing’ IM exchange threshold relief may not be the phase five free pass it first appears

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Splits emerge over EBA’s stress test 2.0

Experts question utility of separate bank leg that won’t feed into capital requirements

Fund securitisation makes capital vanish – and watchdog growl

Probe into possible “abuses” of CFO structure could hit wider investments, experts say

False start for foreign banks under Fed’s tailoring rule

Delayed reporting form means requirements for Barclays and Credit Suisse could change twice in 2020

The age of ethical investing, but can quants cope?

Systematic managers grapple with ESG demands of clients

Fuzzy data stalls ESG alpha hunt

Quants searching for ESG signals have reached very different conclusions. Mostly they blame the data

How diversifying too far weakened alt risk premia’s rebound

Strategies that hurt ARP funds in 2018 did better but some cancelled out last year

All aboard for LNG freight derivatives?

Tools to manage LNG freight risk were developed last year, but how is the market responding?

The open data revolution in banking falls short

Lax Pillar 3 rules are leading to inconsistent data being collected

Dollar OIS volumes hit $3.3trn high

Short-dated swaps dominated trading in last week of February

VAR models at odds on forex, commodities, credit risks – EBA

Interquartile distribution of VAR outputs highest for small banks, watchdog finds

Rates trading revenues up 154% at top US banks

Net gains on interest rates-related exposures top $21 billion

Systemic US banks shed $70bn of repo exposure in Q4

Goldman Sachs lowered repo exposures 13% quarter-on-quarter

‘Fallen angels’ pose little threat to EU funds

Passive fund outflows in a credit crisis would put pressure on high-yield bond prices

Goldman hits the Collins floor

Changes to loss-given-default models caused advanced approaches credit RWAs to plummet

Op risk data: Citi fined $18m for failing to buy flood insurance

Also: VTB takes $535m hit from Mozambique loan fraud; Citadel Securities fined in China. Data by ORX News

Credit data: rising tide lifts fund houses – but can it last?

Strong revenue growth masks structural problems in the funds industry

Swaps data: cleared volumes drop for all markets – except FX

Smaller CCPs make market share gains in a quarter of double-digit declines for rates and credit

Outsmarting counterparty risk with smart contracts

A digital transaction system developed by quants at DZ Bank could slash margin costs for derivatives

Smart derivative contracts: detaching transactions from counterparty credit risk

Introducing deterministic termination rules to eliminate counterparty risk in smart derivatives

Quantifying systemic risk using Bayesian networks

Creditworthiness of individual entities may offer an insight into systemic risk of financial markets

‘Quantamental’ approach convinces Morgan Creek CEO

Proponent of big-picture investing sees growing role for machines, but with caveats