Credit data: rising tide lifts fund houses – but can it last?

Strong revenue growth masks structural problems in the funds industry, writes David Carruthers of Credit Benchmark

By most accounts, these are tough times for asset managers. Margins have been battered by the double whammy of rising costs and falling fees. Firms of all stripes are cutting headcount and consolidating operations in a frantic bid to build scale and improve efficiency.

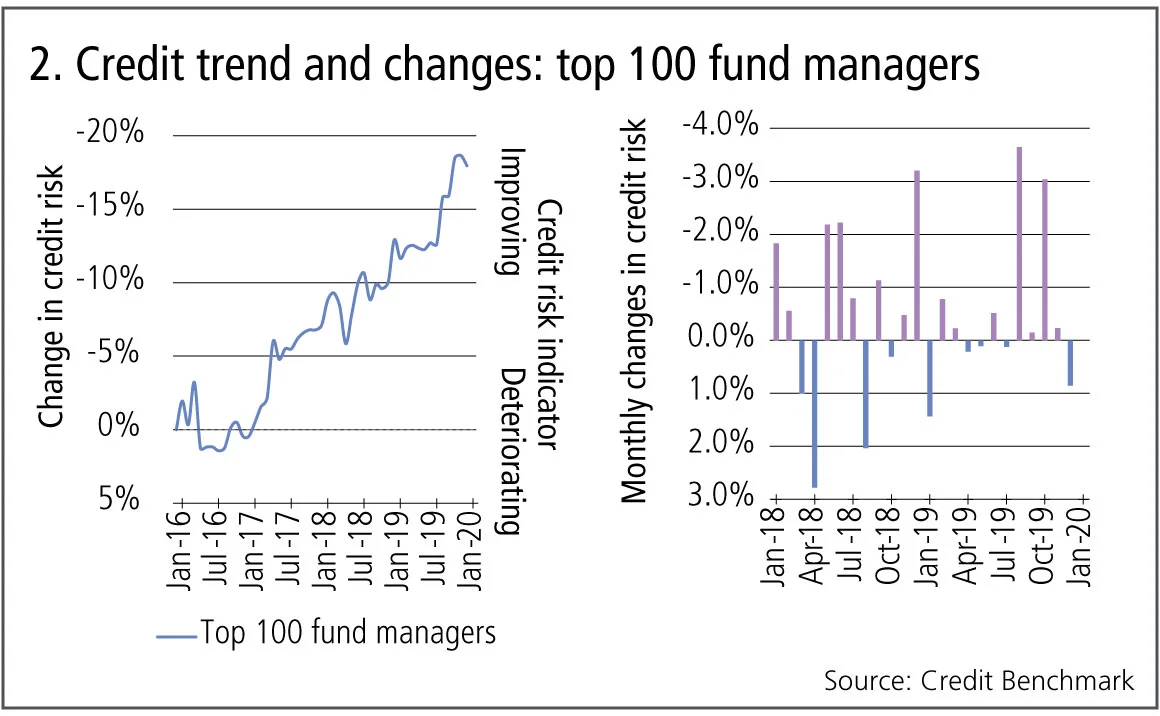

The industry faces real challenges, but you would not know it from the recent trend in credit ratings. The credit risk of the top 100 fund managers has decreased by nearly 20% over the past four years, according to Credit Benchmark data sourced from more than 40 financial institutions.

So, how to explain the optimism of credit risk managers? The multi-year bull run has been a boon for fund houses, whose fees are pegged to the amount of assets under management. The S&P 500 is up around 350% from its financial crisis intraday low of 666 in March 2009 – more than offsetting the steady outflows from active equity funds. Asset managers have effectively been saved by the market.

But bull runs are not meant to last forever. With global markets already in correction territory amid mounting fears of a coronavirus epidemic, a reversal may be on the cards. January saw the first deterioration in consensus credit ratings for assets managers in five months.

This month, we also compare the credit risk of airlines and airports – two sectors that could be hard hit if the coronavirus continues to spread. And we assess the impact of the bushfire crisis on Australian corporates and the outlook for Irish companies in light of Brexit.

Global credit industry trends

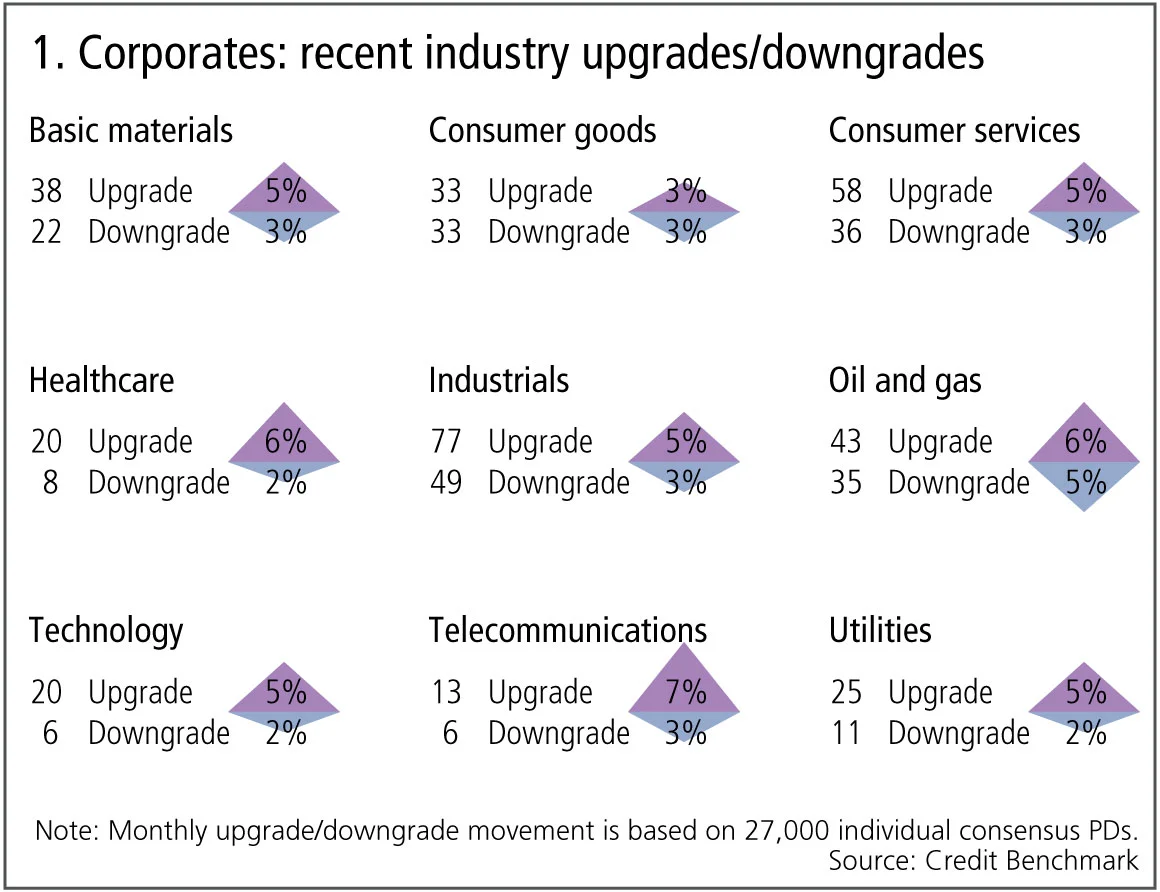

The latest consensus credit data shows that credit activity for corporates and financials has increased, with 6.9% of entities moving by at least one notch, compared with 4.9% last month. Figure 1 shows detailed industry migration trends for the most recent published data, adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, corporate upgrades outweigh downgrades.

- Upgrades outnumber downgrades in eight of the nine industries, and one is in balance.

- Oil and gas and telecommunications see more upgrades than downgrades, after three months of the opposite.

- Utilities return to upgrades dominating after a month of balance.

- Consumer services and industrials have more upgrades.

- Technology has more upgrades than downgrades, after a period of balance.

- Healthcare and basic materials return to upgrades dominating after a month of the opposite.

- Consumer goods show volatility, with this month now showing a balance in upgrades and downgrades.

Top 100 fund managers

The asset management industry faces some major challenges: the impact of the Markets in Financial Instruments Directive has affected the cost and availability of sell-side research, while growing compliance requirements have driven consolidation across the industry in a drive for economies of scale. But although rising costs are an issue, industry income is still mainly a function of assets under management. So as the bull market continues to climb its wall of worry, many asset managers have seen strong growth in their revenues, and this is reflected in their consensus credit ratings.

Figure 2 shows the credit trend and changes for the top 100 fund managers.

Figure 2 shows:

- Credit risk of the top 100 fund managers has decreased by nearly 20% since December 2015.

- The monthly changes chart (right-hand side) shows 16 of the last 24 months have seen an improvement in credit risk.

- The latest data is the first in five months to show a deterioration.

Australia corporates

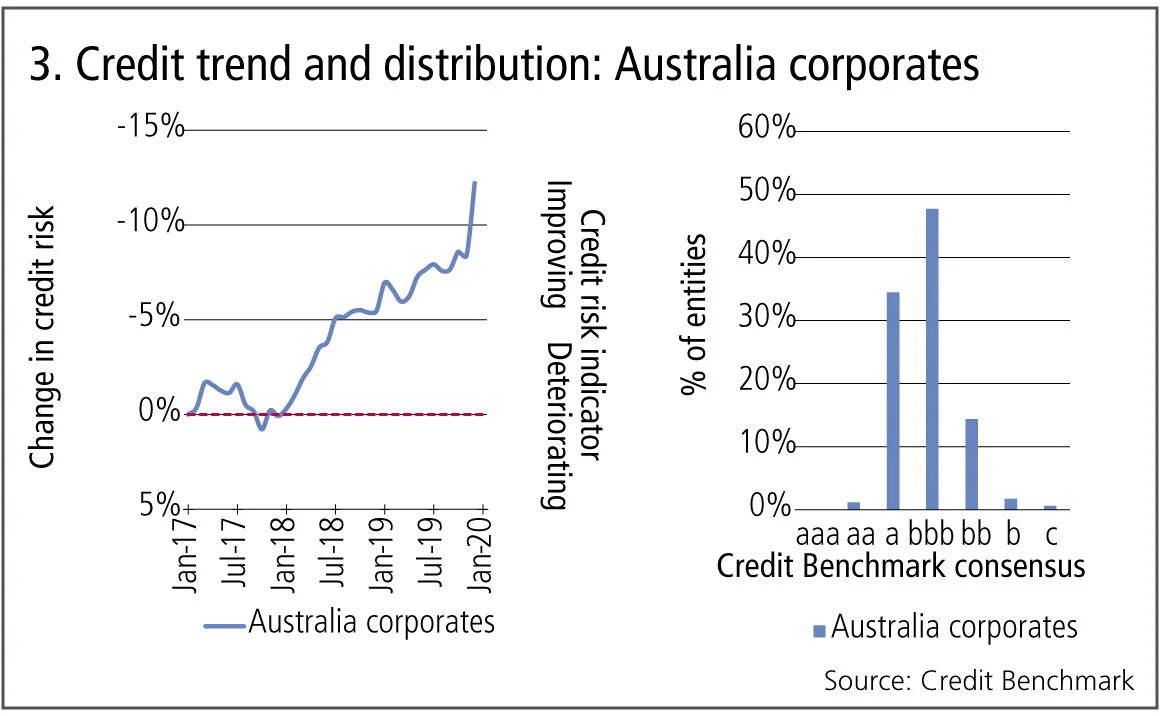

The drought-led fires that have ravaged large swathes of Australian bushland have killed dozens of people, billions of animals, released billions of tonnes of CO2 into the atmosphere and threatened some of Australia’s largest cities. Bouts of long-overdue rainfall may have helped the firefighters, but they have also brought extensive flooding.

Recovery will be difficult and the end of summer will bring only temporary respite. The negative financial impact on the tourist industry is likely to be far-reaching, but the more immediate economic impact will be mixed: there is now a need for replacement infrastructure, investment in irrigation and agricultural redevelopment. Australia’s corporate balance sheet appears to be strong enough to support this.

Figure 3 shows the credit trends and changes for 170 Australian corporates.

Figure 3 shows:

- Australian corporates show a steady improvement from October 2017, with risk dropping by about 13%.

- More than 80% of Australian corporates are investment grade.

- Nearly 50% of Australian corporates have a Credit Benchmark consensus of bbb.

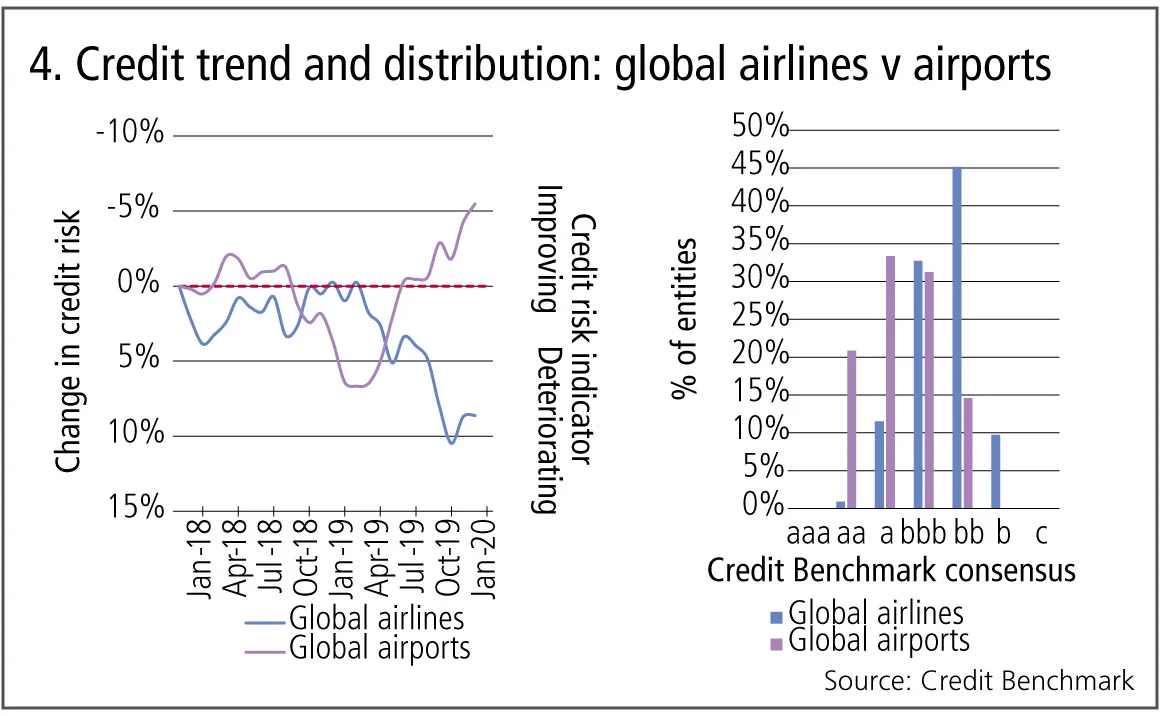

Coronavirus: global airlines v airports

The new, highly contagious strain of the coronavirus has taken the business world by surprise, and the impact will be far reaching. It coincides with growing disruption to supply chains resulting from trade disputes and will add to existing pressure on the airline industry. But while airlines have suffered from competition for some time, airports have become high-quality retail malls that benefit from a large and steadily growing captive customer base. The coronavirus may cause some serious, if temporary, problems for this high credit quality sector.

Figure 4 shows the credit trend and distribution of 110 global airlines and 50 airports.

Figure 4 shows:

- Global airlines credit risk began to deteriorate at the beginning of 2019, with a cumulative move of 8%.

- Global airports credit risk deteriorated about 6 months earlier, with a turning point in February 2019. Airports have improved 11% since then.

- The majority of global airlines have a non-investment-grade Credit Benchmark consensus of bb (45%); but 85% of global airports are currently investment grade.

Ireland corporates and financials

Ireland faces the possibility of dramatic changes over the next few years. Although the Brexit process is still in the transition phase, there will be growing issues with north-south trade as businesses prepare for increased checks, and Brexit is likely to change the Irish economy in a number of other ways. The recent election shows growing support for left-wing policies and an appetite for reopening the debate about Irish unification. Credit estimates for corporates and financials are likely to show some dramatic changes in the next 12 months.

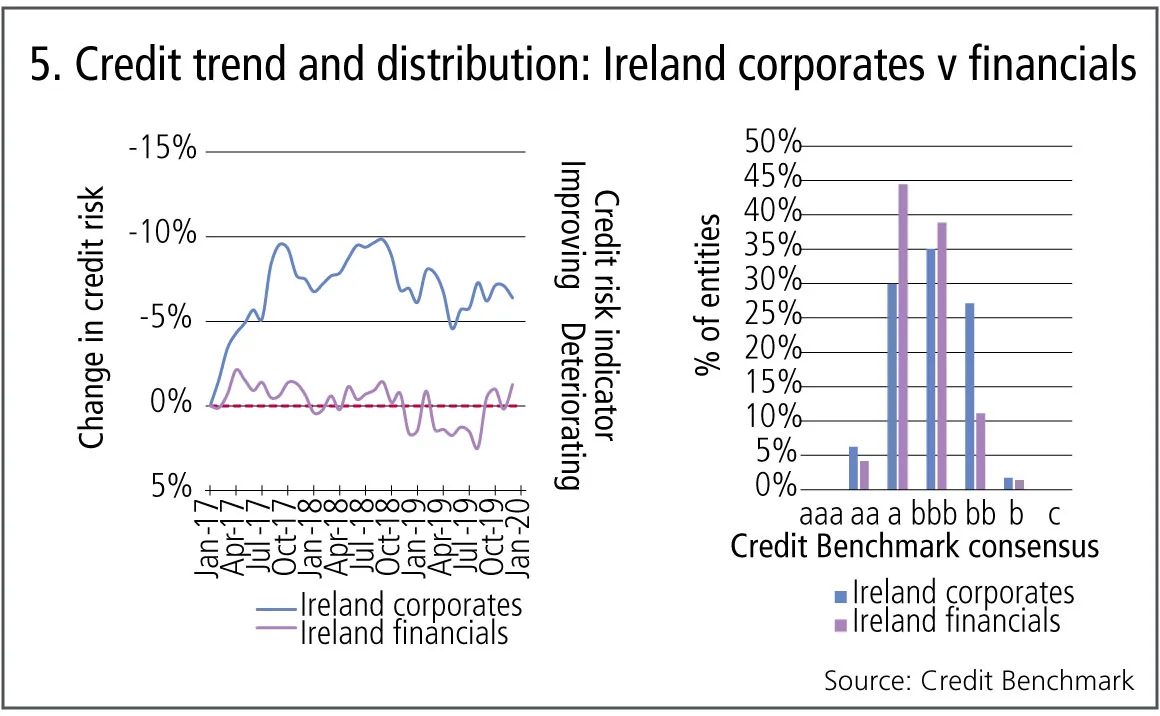

Figure 5 shows the credit trends and distributions for 180 Irish corporates and 70 Irish financials.

Figure 5 shows:

- Irish corporates had an improvement in credit risk of nearly 10% during the first three quarters of 2018. Since then, the trend has oscillated in the 5–10% overall improvement range.

- Irish financials have stayed mostly stable throughout the time period. A very small deteriorating trend of 2% can be seen from May 2017 to July 2019, however this was recovered in the second half of 2019.

- Irish corporates have a largely symmetric distribution around bbb, with 35% of entities in that category. Nearly 45% of Irish financials have a Credit Benchmark consensus of a; 12% of entities are non-investment grade.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance

Allocating financing costs: centralised vs decentralised treasury

Centralisation can boost efficiency when coupled with an effective pricing and attribution framework

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

Does crypto really need T+0 for everything?

Instant settlement brings its own risks but doesn’t need to be the default, writes BridgePort’s Soriano

October’s crash shows crypto has come of age

Ability to absorb $19bn liquidation event marks a turning point in market’s maturity, says LMAX Group's Jenna Wright

Responsible AI is about payoffs as much as principles

How one firm cut loan processing times and improved fraud detection without compromising on governance

Op risk data: Low latency, high cost for NSE

Also: Brahmbhatt fraud hits BlackRock, JP Morgan slow to shop dubious deals. Data by ORX News