Financial Conduct Authority (FCA)

AMA, RCSAs and dealing with Libor at Rabobank

Dutch bank Rabobank has shaken off its Libor label pretty quickly, leaving it to focus on its co-operative roots, the AMA and its RCSA roll-out. Anne Snel-Simmons, head of operational risk management at Rabobank, talks to OpRisk about the challenges of…

Benchmark survey and Lloyds/Bank of Scotland fine underline need for bonus scrutiny

£28 million penalty for poor incentives – but op risk still largely excluded from pay policies, survey finds

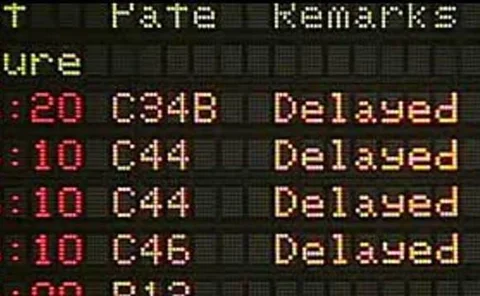

Schedule slips and costs rise on rate hedge payouts

UK regulator reveals that banks will miss deadline for compensating interest rate hedge mis-selling victims

RBS review heralds tighter focus on small business lending

The news of a regulator-ordered review of RBS's lending shows that the FCA plans to tighten up oversight of treatment of small businesses as well as retail customers

Sants quits Barclays after just 10 months in compliance role

Ex-regulator and head of compliance quits UK bank citing stress

Energy trading firms must be whiter than white

Allegations of manipulation are particularly bad for energy trading firms, which should respond by holding themselves to higher standards

Top 10 op risks: internal control failures

The fifth in our series of top 10 op risks for 2014 looks at internal control failures. Banks in 2014 face the task of improving governance to prevent another year of embarrassing losses

Top 10 operational risks for 2014

Internal failures will prove as dangerous as external threats for the financial industry in 2014

FCA skilled persons reviews 'a distraction from compliance', experts warn

Stronger FCA focus may be diverting resources from day-to-day compliance tasks

Rabobank fined $1 billion for Libor failings

Dutch bank the latest to pay for benchmark manipulation

The value of stress-testing structured products

Trade of the month

Whistleblowing: the case for financial incentives

UK authorities are edging closer to offering bounties to encourage whistleblowers

UK banks improving on sales incentives, says FCA's Wheatley

Three out of four major UK banks now link incentives to more than just sales, regulator says

AIFMD continues to cause concern among hedge fund managers

Sponsored forum: AIFMD

Big European companies reject third-party reporting for derivatives

Corporates fear they will still pay the penalty if mistakes are made by delegated reporting services

Energy trading firms unprepared for Emir and Remit, poll finds

Many energy market participants are worryingly unprepared for Emir and Remit, according to a recent poll by Energy Risk

Cross-border stricter-rule-applies approach causing confusion

Global regulators have agreed to cooperate when implementing new derivatives rules on a cross-border basis, but market participants are unsure as to how this will work in practice

Icap fined $87.4m for Libor manipulation as brokers charged

CFTC and FCA impose fines of $65 million and £14 million

JP Morgan fined $920m over 'woefully deficient' London Whale controls

UK and US authorities fine bank over $6.2 billion trading losses in July 2012

First substituted compliance determinations by year-end, says Gensler

CFTC chairman confident that first entity-level determinations will be complete by December 21, but is less certain about transaction-level requirements

Gensler not ruling out targeted Sef relief

CFTC chairman recognises difficulty in meeting October 2 Sef deadline, but says platforms need to be targeted in requests

FCA: insurers are 'undermining' RDR rules

Regulator finds that "more than half" of UK insurers are still offering banned inducements

PPI-related complaints show signs of levelling off

Modest increase in complaints related to payment protection insurance