Asset management

Realism or deregulation? Fed sidelined in oversight of insurers

Proposed activities-based approach to non-bank systemic risk will make Sifi designations less likely

Weiss scraps bond strategy amid liquidity qualms

Buy-Side Risk USA: $1.6 billion manager says thinned-out markets make generating alpha hard

UBS Asset Management cools on alternative data

Buy-Side Risk USA: Firm checked several datasets and found little alpha

Funds ring alarm on EU guidelines for liquidity stress-testing

Managers could be forced to use multiple methods to stress-test large number of funds every quarter

Robo traders not so different from us, says Man AHL risk chief

Watching over machine learning algorithms is similar to monitoring human portfolio managers

As China bonds go global, dealers size up demand for swaps

China’s onshore derivatives market must grow quickly to meet the hedging needs of foreign investors

Asia ETF Forum 2018 special report

Since the launch of the first exchange-traded fund (ETF) on the Hong Kong Exchanges and Clearing (HKEX) in 1999, exchange-traded products (ETPs) have gained popularity as they become one of the fastest-growing investment products in the world. Hong Kong…

Some trend followers are less than ‘pure’ – study

Sick of waiting for a crisis, some commodity trading advisers move from ‘pure trend’ to ‘trend-plus’

Buy-side quant says Brexit a ‘test’ of new AI

Natural language processing can give “more insight” into possible market shudders, says Simonian

Banks concoct fixed income alternative premia 2.0

Fixed income was a rare winner in a terrible 2018 for alternative risk premia. More complex iterations are on the way

Capturing alpha in Asia’s ETF market – Trends to watch in 2019

As the inclusion of China A-shares into major indexes could potentially lead to record inflows into China, 2019 is set to be an exceptional year for the Asian exchange-traded funds (ETFs) market. Meanwhile, investors in the region are increasingly eyeing…

Relationship banking isn’t dead, just different

Some asset managers are pumping banks for liquidity leads. But what can they offer in return?

A blueprint for alternative data in asset management

UBS Asset Management’s data chief describes how alternative data can aid the investment process

Funds use artificial intelligence to weigh ethical investing

Quants explore links between ESG investment and outperformance

Stability heightens flash crash risks – research

Liquidity breaks down when latent orders are revealed too slowly, quant firm says

Irrational exuberance? One gauge gives BlackRock pause

One measure of investor euphoria is registering its most extreme readings since the 2000 tech crash

CSOP to tap Chinese interest in quant with momentum index

Hong Kong asset manager plans to spin off products from recently launched cross-asset index

BlackRock’s psych team (yes) hunts for bias in trades

Portfolio managers asked to keep ‘trade diaries’ of the thinking that led up to poor investments

Quants clash: machine learning or linear models?

Some studies say the algorithms beat the common models; other studies say the opposite

Can nowcasting unlock factor timing?

Fulcrum Asset Management is running tests to see if fresher data can help improve factor allocations

Factors’ tails are fatter than you think

Investors should beware extreme losses from factor investing strategies

Asset managers brave patchy data to nowcast China’s GDP

Techniques include using many datasets, relying on proxies and continually reviewing models

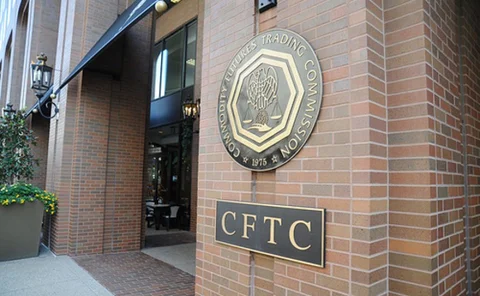

DE Shaw rebukes Giancarlo’s big idea on Sefs

Hedge fund endorses electronic trading, as CFTC pushes for a return to old phone-based business

Rokos hires new risk chief

Gianluca Squassi is replacing Nick Howard as the $8 billion hedge fund’s CRO