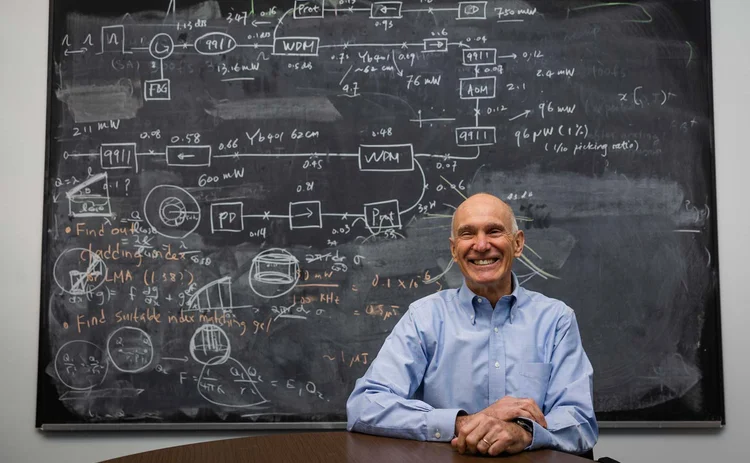

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

The Steve Jobs of credit, or the Forrest Gump of credit? Both epithets have been used to describe Stephen Kealhofer – the first, by a client of the hedge fund Kealhofer founded in 2004. The second, by Kealhofer himself.

The two labels seem wackily mismatched at first. In fact, both are a decent fit.

The Jobs analogy reflects Kealhofer’s entrepreneurial streak, and the uniqueness of his vision. According to Tim Kasta – who has worked with Kealhofer for almost three decades – it was coined by a Swiss investor who had first encountered him at KMV, the pioneering credit risk analytics firm that preceded the hedge fund.

“The client had a dose of Stephen at KMV, and he was just totally enthralled with this whole process, with the decades of research, with the insight,” says Kasta, now a senior managing director at Blackstone, which acquired Kealhofer’s hedge fund in 2020.

I sometimes feel like the Forrest Gump of corporate credit, because I’ve managed to be a close witness to a lot of fascinating action

Stephen Kealhofer

The Jobs analogy isn’t officially sanctioned, Kasta notes: “I thought it was great. I told Stephen about it. He gets embarrassed.”

Kealhofer’s preferred comparison is more of a puzzler. The character played by Tom Hanks in the 1994 movie is born with a crooked spine, a low IQ, and has a walk-on role in a series of historical events – from the Vietnam War to the Watergate scandal. This latter element is what Kealhofer has in mind.

“I sometimes feel like the Forrest Gump of corporate credit, because I’ve managed to be a close witness to a lot of fascinating action,” he says.

Where the label misses the mark is in underplaying Kealhofer’s contribution. He wasn’t just a witness – glimpsed, Gump-like, in the backdrop of a changing world. Kealhofer helped catalyse those changes.

He didn’t do it alone, of course, but Oldrich Vasicek – the ‘V’ in KMV, to Kealhofer’s ‘K’ and Mac McQuown’s ‘M’ – credits his former colleague with getting that venture rolling.

Kealhofer was originally hired by Vasicek and McQuown in 1986 as a consultant to a previous business, which allowed banks to pool their corporate loans and receive a slice of diversified exposure in return. He came in, kicked the tyres of the credit model that was used to price the loans, built the database that proved the model worked, and then – when the pooling idea failed to take off – recognised the model was the thing that might have some value.

“Stephen actually was the one who came up with the idea for KMV,” says Vasicek. “He’s a great entrepreneur, but also a fantastic researcher, and communicator. Somebody who can do all these different things to such a high standard is very rare, in my opinion. He’s an exceptional person.”

KMV would ultimately help to transform the banking industry’s approach to credit risk – showing lenders how to use market data to measure default risk for the first time, and advising them on how to apply those new insights to portfolios. The concepts are commonplace now, but were edgy and new in the 1990s, tearing up historic practices not just in lending, but also providing some of the underpinning for credit trading and the adoption of credit default swaps (CDSs).

Other firms – and other people – played a part in this revolution, of course, but Kealhofer didn’t stop there. After KMV was sold to Moody’s Investors Service for $210 million in 2002, Kealhofer moved from loan origination to bond investing. KMV’s market-implied default probabilities became the foundation for two decades of further research, and the rules-based credit strategies at his fund, Diversified Credit Investments.

By the time DCI was acquired by Blackstone in 2020, it had $7.5 billion in assets and a roster of clients who – like the unnamed Swiss investor – had been bowled over by Kealhofer and DCI’s unique understanding of credit risk. At Blackstone, the DCI team, with Kealhofer as head of research, now manages roughly $27 billion.

David Modest joined Columbia University as a finance professor in 1981 – at the same time as Kealhofer, who he has counted as a friend ever since – before embarking on a long career in the hedge fund world. At one point, he was a partner at Long-Term Capital Management, where Nobel winner Robert Merton was among the principals.

“I’ve heard Merton talk a number of times about how finance is uniquely able to bring theory and practice together, with those two aspects of the discipline forming a virtuous circle. Stephen is the epitome of that,” says Modest. “For most people, KMV would have been enough, but he went on, founded DCI, transitioned it to Blackstone. And what he’s been trying to do all along is take credit theory and apply it to credit practice.”

Catching a wave

All along? Well, almost.

Growing up in South California, the young Stephen Kealhofer had what he now calls an “uneven” education. In fact, he never finished high school, preferring to surf, and only found his way to finance by way of a spell working in construction in Iran, and a late-blossoming interest in economics. He was exposed to – and rejected – development economics (“it was full of various elites, a lot of talk, and not much roll-up-your-sleeves”), then spent six years as an economics professor at Columbia and Berkeley, without really settling.

Then – at the suggestion of his brother’s ex-girlfriend – Kealhofer interviewed for the consulting gig with McQuown and Vasicek’s loan-pooling venture. The model he was asked to vet and validate was Vasicek’s work, drawing on the seminal 1974 paper by Merton, which applied options pricing theory to the world of corporate credit, as well as a 1976 extension by Fischer Black and John Cox.

Merton’s original paper imagined a company with a single class of outstanding debt. If the value of the company’s assets was greater than the value of that debt at maturity, then creditors would be paid back and shareholders would own the rest of the company, but if the value of the bond was greater than that of the company’s assets, then the company would default and shareholders would get nothing. Those possible outcomes – for shareholders – look like the payoff of a call option on the company’s assets, with the face value of the debt as the strike price. When the value of the assets is below the strike, the equity is extinguished; when above, the holder gets to stay in the game.

As a result, Vasicek and others were able to use options pricing theory – and market data – to measure bond default risk, the key inputs being the value of the company’s assets, and the volatility of that value, as well as the value of its liabilities. In Vasicek’s version of the model, other key concepts were introduced or expanded upon, allowing it to calculate not just a default probability, but also a specified point of default, and – thus – how far the company was from defaulting.

What was missing from the model – and from other famous efforts to measure default risk, such as Ed Altman’s Z-score – was an empirical foundation.

“I started looking at the validation work Oldrich had done, the validation work Altman had done on his accounting-based models, and what became clear right away was they just didn’t have very much default data. They were trying to evaluate models predicting very rare events, and you need a big sample to do that reliably. I think Altman’s original paper had a sample of around 40 defaulted companies – and this was what people were working with at the time,” says Kealhofer.

So began months of painstaking labour. Commercial databases were focused on equity markets, says Kealhofer, with defaulting firms often being deemed irrelevant and removed. Legal databases included payment defaults, but many other kinds of default as well. At one point, he recalls, frustrated with the available data, the firm tried going direct to the source – phoning companies up and asking them if they had ever defaulted on a bond payment.

“That didn’t work very well,” he says, drily. “There were some interesting phone calls. Mostly, we learned you have to be very suspicious of firms with the word ‘Phoenix’ in their names – there was almost always a default in their past.”

Eventually, Kealhofer amassed data on around 500 corporate defaults. With it, he was able to shed light on something that had stymied widespread use of Merton’s model in the 13 years since its publication. Other researchers – Yale’s Jon Ingersoll, and a trio of Harvard professors including Eric Rosenfeld – had explored the empirical basis for the model and came back with as many questions as answers. Although recognising Merton’s theoretical breakthrough, they found the model didn’t seem to work in practice, particularly for investment-grade bonds.

“That was really the dominant view, and when we saw the default data, it was immediately clear to us what was going on, because most of the investment-grade population was six or more standard deviations from the default point. So, if you use the normal distribution, it basically said they had zero risk of default, and that’s what people were getting out of these studies – it didn’t appear to work at all. But what the data showed was that the normal distribution wasn’t right. There were, in fact, economically significant amounts of defaults occurring in the four-to-ten standard deviation range,” says Kealhofer.

We learned you have to be very suspicious of firms with the word ‘Phoenix’ in their names – there was almost always a default in their past

A further breakthrough occurred when Kealhofer tried to understand why a bond rating predictor – also developed by Vasicek, but using a statistical approach with Altman-style accounting variables – was outperforming the Merton approach in some cases. Increasingly confident that the Merton approach was conceptually sound, Kealhofer guessed the accounting model was improving in some way on one of the key inputs to its Merton-based rival.

“I was testing both models, and I realised there had to be something in the rating prediction models’ inputs – mostly accounting variables – that was improving one or more of the key inputs to the Merton model: equity value, equity volatility or liability structure. When I tested the rating inputs as predictors of those variables, it turned out it was the volatility estimate that was being improved. I went on to develop a combined approach that ended up dominating the accounting-based predictors,” says Kealhofer.

“By early 1988, it was quite clear to me that we were able to measure credit risk in a way people had not been able to before.”

As the loan-pooling idea foundered, Kealhofer went to McQuown and Vasicek to suggest a new direction – commercialising their credit risk model. The three of them believed they were on the verge of something special. Now, they just had to get the banks to agree.

Really big beans

That wasn’t always easy. At one point in 1994, Kealhofer found himself shrouded in smoke at JP Morgan’s then-headquarters on 60 Wall Street – the projector he was using had just gone pop, and a make-or-break meeting was threatening to go the same way.

KMV’s work had advocates at the bank, but they were primarily among the team that was trying to get the CDS market off the ground. Peter Hancock, Blythe Masters and others realised it would be helpful to their project if lenders saw default risk as a dynamic, shifting thing, which could be derived from the markets. What better way to manage this risk than with a traded instrument? But others were not convinced by the KMV story, and it took some time to bring together the necessary bigwigs from around the bank.

“It was a room full of the most senior people – the guys that led syndication, the chief credit officer, the risk guys, the CDS team – but the meeting began unpropitiously,” says Kealhofer.

After a new – more stable – projector had been found, Kealhofer showed off some of KMV’s work, from the theoretical underpinnings of the model to a tour of market-implied default probabilities and credit ratings for a range of companies.

“The chief credit officer there was very sceptical of the whole thing. He wanted to see this company, he wanted to see that company – and he chose IBM,” Kealhofer says.

The years leading up to that meeting had not been kind to IBM. In particular, during 1991, its stock slid almost 40% from a February high to a December low. Because the KMV model measured default risk in part by looking at the value of an enterprise, and its volatility, as implied by equity markets, IBM’s default risk had surged and its implied rating nose-dived. Kealhofer told JP Morgan’s credit bigwigs that the tech titan had joined the ranks of high-yield issuers.

“This guy was so derisive,” Kealhofer recalls. “You know: ‘You expect us to believe IBM was junk?’ So I was standing in front of the group, trying to figure out how to answer, but before I could say anything, the guy that was head of syndication said: ‘Well, you know, we led a syndication for IBM in 1991 – and we thought it was high-yield.’”

Kealhofer and KMV got used to objections of the kind they’d faced at 60 Wall Street. At the time, many credit officers simply didn’t think about default risk as something fluid (some prospective clients told KMV they would only need to see the firm’s default probabilities once a year, when they ran their annual portfolio review) and they used time-honoured, inky-fingered, fundamental methods to measure it. Even if they were open-minded enough to consider another approach, they might not have been willing to have it fed to them by a bunch of San Francisco-based academics.

“It was threatening for some of these guys, because we were telling them there was a better way. When you visited their offices, the desk would just be piled high with credit files, and they were poring through pages and pages of documentation. And they weren’t prepared to have a couple of nerdy guys waltz in from the West coast and tell them how to do their jobs,” says Kealhofer.

KMV needed a way to overcome those objections, and the breakthrough came after a visit to a St Louis-based brokerage, where the analysts relied heavily on charts and graphs to do their jobs. Kealhofer realised KMV needed to be able to show its insights to people, as well as describe them. The result was the fledgling firm’s first real product – dubbed CreditMonitor – which made visible a radical conceptual change. In KMV’s world, credit risk was no longer some rusty, mechanical monster that briefly lurched into life with every ratings decision or quarterly earnings statement, and whose next move could only be divined by crusty old credit officers – it was constantly in motion, and its movements could be observed by anyone.

“It blew people away. They had never seen anything like it before,” says Kealhofer. “Instead of telling some abstract, analytic story about this derivatives-based model, we could just go straight to the data and say: ‘Here’s Company X, here’s what they look like from a liability/accounting framework and here’s what their volatility is. And here’s what that implies in terms of their default probability.’ People found it fascinating. It was like a video game for bankers – they’d just sit there and say: ‘Show me this company, show me that company.’ It was pretty simple, but it really got us moving.”

It also helped convince sceptical chief credit officers. Lonely figures at many banks, their working lives were a constant fight with loan originators who were trying to get their latest deal across the line. KMV may have looked like a threat; it became an ally.

Most people had what I call a bean-counting approach to diversification: if we have enough beans then it’s diversified. But the problem was that there were some really big beans in there

“What they discovered was that we were on the side of the angels,” says Kealhofer. “Often, our results lined up with their intuition, and our numbers gave them an argument to turn down deals they didn’t like.”

Another way to deal with objections from the banks’ credit gatekeepers was to bypass them.

After the loan-pooling venture wound down, KMV – and particularly McQuown – spent time with senior bankers, trying to work out how and where the fledgling firm’s credit risk model might be useful. At the time, bank bosses were waking up to the idea that loans should be managed on a portfolio basis, creating a potential demand for KMV’s analysis.

One of the things KMV’s modelling revealed was the huge variation in risk from one issuer to the next. Among a big sample of companies, some issuers would be as much as 15 times riskier than those at the other end of the spectrum. Kealhofer contrasts this with equities, where a three-to-one range covers much of the universe.

“Most people had what I call a bean-counting approach to diversification: if we have enough beans then it’s diversified. But the problem was that there were some really big beans in there. People just hadn’t recognised the range of risk, and as a consequence, they hadn’t really recognised the concentration risk,” he says.

So, KMV focused on helping the banks understand how concentrated their portfolios were, and what kind of pricing they needed for riskier positions. For many bankers, particularly more senior ones, this was catnip. Bank of Montreal was one of the first to see the potential.

“Jeff Chisholm, vice-chairman of the bank at the time, had heard what we were up to,” Kealhofer recalls. “He grabbed a colleague, got in the corporate jet, flew down to San Francisco, and said ‘Show me’. And we showed him, and he said: ‘We want to do it.’”

Another early convert – in fact, the first to pay KMV anything – was Lew Coleman, who at the time was on his way to becoming chief financial officer at Bank of America. But it still took some time for KMV to stand on its own two feet.

Initially, the firm’s principals needed their own side-ventures to pay the bills. Then, Coleman agreed to a pilot project, and gradually the clients started piling up. By the time the sale was being mooted, KMV had around 250 employees, and was working with most of the world’s big banks.

Mac, and I think particularly Steve, did not want to sell. We refused S&P a few times, and Barra

Oldrich Vasicek

That success inevitably caught the attention of a number of would-be acquirers. KMV had conversations with Standard & Poor’s and Barra, as well as MSCI – still part of Morgan Stanley – before a deal was struck with Moody’s.

Although the transaction made him rich, Kealhofer says he would have turned it down at the time: “I felt we were being under-valued. My partners didn’t all see it the same way. I won’t name anybody.”

McQuown also says he would have been happy to remain independent.

Vasicek outs himself: “Mac, and I think particularly Steve, did not want to sell. We refused S&P a few times, and Barra. We did initially refuse Moody’s. But in the end I felt it was too good to turn down. I wanted to retire and do some academic research and things like that.”

Despite that difference of opinion at the end, all three of the founders are still in touch – Vasicek and Kealhofer are near-neighbours in the same, well-heeled Californian town – and they all look back on their KMV years with pride.

It may be the case for many successful start-ups, but each of KMV’s co-founders brought something special and distinct to the firm. Put very crudely, Vasicek was the maths guy, McQuown the commercial guy and Kealhofer the product guy – the practical bridge between the two. But in any young, fast-growing venture, the lines are never that distinct.

Kealhofer points to Vasicek’s conviction that the Merton approach could work in the real world – he “went out on a limb that he could produce a practical version that was commercial. KMV would never have happened without him taking that step”. McQuown was key in “believing the message, supporting the work, and carrying the message to the banks. It wouldn’t have happened without him either”.

This kind of alchemy wasn’t enough, of course.

“It took patience and persistence, and some belief from guys like Lew Coleman,” says McQuown. “One day you have two clients, then you have 10 and then – well, it just became huge. It was a rare, humbling experience of going into the unknown and finding a jackpot.”

“Mac was fond of saying we should have fun, make money, and change the world – but not necessarily in that order,” says Vasicek.

KMV did all three of those things – changing one specific part of the world, at least – but Kealhofer wasn’t finished. In 2004 – two years after the Moody’s acquisition – he launched DCI, where he was joined by Kasta.

All credit, only credit

Superficially, the switch from KMV to DCI looks dramatic: from software vendor to asset manager; from bank clients to investors; from adviser to principal; from loan portfolios to bonds.

Kealhofer sees a thread connecting it all – a thread that started at the loan-pooling venture, then led to KMV, and which DCI enabled him to pursue for a further two decades. He’s still following it now at Blackstone – the private equity titan that has become one of the world’s biggest non-bank originators and distributors of credit risk.

“The common theme is intermediation of corporate risk,” he says. “If you step back and look at the economy at large, you’ve got corporations that are investing – and making decisions about where and how to do that on a daily basis. And you’ve got investors who are largely funding that process. So, the question is how best to price and transfer the risk. There’s a bunch of big issues there.”

Addressing those big issues required Kealhofer – again – to confront a host of smaller ones first. The plan was for DCI to use a Merton-type approach to systematically identify names that were rich or cheap, relative to their modelled risk, and then to make a lot of relatively small, relatively short-term credit bets. And only credit bets. In theory, the resulting portfolios would systematically harvest the healthy risk premium that emerges at times in specific names, and would be well-diversified, allowing returns to accrete steadily over time.

Making that approach work requires a lot of data. Merton models need a detailed picture of the liabilities for any target firm, so DCI had to consume information from multiple vendors, then restructure it all to make it comparable. Merton-style default risk analysis also requires an understanding of the volatility of each enterprise, much of which comes from equity option markets and the return on cash equities. Kealhofer and co eventually built a process that would enable them to run the rule over bonds and CDSs belonging to 30,000 entities.

The next step – deciding which of the credits are rich or cheap – rests on an assessment of their default risk, but these comparisons are not straightforward. DCI also needed to be able to compare bonds of varying maturities, which in turn means stripping out the component of each bond’s yield that reflects the time value of money, rather than credit risk. In other words, DCI needed a sound grasp of the term structure for credit. This stopped being easily observable in the years after the global financial crisis, as the single-name CDS market shrivelled up, covering fewer names and concentrating on the 5-year contract almost exclusively.

DCI had to cook up its own model, deriving it from bonds for each issuer – to create a term slope – and then using the slope differential as the basis for a term structure model, which Kealhofer sees as part of the firm’s secret sauce.

Once the default risk had been calculated for each firm, and the firm’s bonds and CDSs had been compared to the model, DCI also had to consider whether the credit was actually investable – a liquidity scoring system was required.

That – briefly – is how individual investments are identified. Putting it all together at the portfolio level required further work on credit market factors. This has become a buzzy topic in recent years among quant investors, but Kealhofer claims DCI was the first firm to have a working factor model for credit. Ironically, that wasn’t because DCI wanted to invest heavily in those factors, but because it wanted to avoid them – in line with the firm’s focus on amassing portfolios of idiosyncratic, diversifying risks, rather than shared, systematic ones.

An unsolved problem

This whistle-stop tour of DCI’s approach doesn’t give much sense of the difficulties involved in applying it – scouring thousands of credits for mispricings on a daily basis is easy enough to describe, but far harder to do. Kealhofer believes few – if any – other credit managers have been able to.

“Most of the technology we built at DCI other people don’t have, to our knowledge. So we understand a lot about how credits price, what credit term structures look like, how they operate, what drives them, what are the liquidity components of credit, what are the credit components of credit, how recovery is getting priced, how to calculate credit sensitivities correctly. And what we’ve done with all that is, we’ve used it to go out and explain our portfolios to investors,” he says.

Kealhofer believes the firm’s capabilities are unusual because its clients say so. Invited to comment for this article, 10 investors responded, between them using the word “unique” eight times.

“The focus on rigorous academic insights – under what circumstances would a credit move towards default – as well as a pragmatic implementation, makes for a unique investment product,” says Gerben Wanningen, head of external fixed income at the Abu Dhabi Investment Authority.

UBS Pension Fund praises the “highly liquid investment strategy built upon the groundbreaking and proven structural KMV model”. The KMV lineage was also important for Mussie Kidane, chief investment officer at Pictet North America Advisors, who has been a DCI client for more than a decade: “I didn’t know Stephen as a person before DCI, but I knew about KMV – our initial conversations were about that background, which was important. Over the years, we’ve had many subsequent discussions. He is clearly the source of the firm’s intellectual framework – his contribution has been very significant.”

Most of the technology we built at DCI other people don’t have, to our knowledge

For the head of investments at one Swiss insurer, the implementation of that intellectual framework is what makes DCI stand out: “Their fundamental, systematic approach to corporate credit, in terms of how they search for anomalies and credit mispricings.” Niclas Hiller, chief investment officer at Nordic wealth manager Formue, calls this kind of approach “the future of systematic credit management”.

It helps that the performance has been good as well, of course: since inception in 2008, the firm’s original flagship fund has delivered annualised returns of 6.07%, beating its benchmark by two percentage points. Its six-year old high-yield-focused fund has an annualised return of 5.31%, versus 3.89% for the best-performing of three benchmarks.

All of this helps explain why DCI was attractive to Blackstone, a private equity firm that has built a significant credit business. But why was Blackstone attractive to DCI?

For Kealhofer, it comes back to his long interest in credit intermediation, and the particular challenge of getting financing from investors to medium-sized companies – ones that are too small to attract investment on their own. He calls it “the biggest unsolved problem in credit”, and argues Blackstone has a shot at solving it.

“It doesn’t make sense to intermediate on an individual basis, so you’ve got to pool them in some fashion, and you’ve got to get it off bank balance sheets – because bank balance sheets are not transparent, and capital rules have also made it expensive. What you want is to find a cheap, transparent, efficient way of getting financing from investors to those firms,” says Kealhofer.

He adds: “To my mind, that’s the opportunity, because Blackstone is probably the biggest non-bank originator of that type of credit right now, and is working on different ways of packaging and getting it to investors.”

Wandering star

One final, and obvious, question that arises from the DCI and Blackstone years is how an investor can reliably earn a return after identifying a mispricing – it’s one thing to believe a bond is too rich or too cheap, but how do you make money out of that?

Kealhofer says his research shows bond prices are mostly determined by default risk, and that while those prices might occasionally forget that fact, they will always be dragged back into line eventually.

“The opportunity to earn an active return in credit is that spreads tend to wander away from their actual values. And ‘wander’ seems to be the right description of the process. That is, it seems to accrete over time and many of them reverse and go back, but some of them go out a fair way,” says Kealhofer.

“And if they go far enough, then they become good candidates to buy because they revert back. They don’t revert back to where they started, they don’t revert back to the level implied by their credit rating – they revert to where we think they should be, based on their true credit risk. And that reversion process is what we’ve been exploiting now for about 20 years.”

There’s an irony here. Kealhofer may be able to tell you pretty much anything about the risk profile of any particular bond. He understands the pattern bond prices follow as they wander away from their true risk – and he knows they’ll wander back again in the end. But he can’t tell you why.

“That’s a great question,” he laughs. “We don’t know.”

DCI has looked at a lot of different hypotheses, expecting to find – perhaps – some kind of technical factor that would explain these periods of repulsion and attraction. The firm has come up empty handed. One thing Kealhofer can say is that the divergence, when it occurs, is explained primarily by changes on the credit side, rather than by changes in the equity markets that drive the default risk model.

Beyond that, though, the bonds seem to be dancing to a tune played by an invisible piper.

“If you start with a group of names that are correctly priced and just follow them over time, with the ones that get most mispriced, it looks more or less like it’s happening by accident,” he says.

“In other words, every period they wander. Sometimes they wander back and sometimes they wander out – and some fraction of them are going to wander far out. And the further out they wander, the higher the propensity for them to revert in the next period – and that likelihood steadily goes up as the absolute difference grows – so when you get stuff that’s wandered pretty far away, it has a pretty high reversion probability.”

It must seem like weird, alien behaviour to Kealhofer. While his bonds wander here and there – over hills, down dales, with no apparent guide – he has plumbed a straight line, trying to understand their behaviour, for more than three decades.

His friend, David Modest, says Kealhofer “has amazing focus, he has his own north star, his own compass – it tells him what’s important, and that’s the path he follows. It’s been a long path, but he’s kept to it”.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Awards

Best user interface innovation: J.P. Morgan

J.P. Morgan wins Best user interface innovation thanks to its Beta One portfolio solution

Market liquidity risk product of the year: Bloomberg

Bringing clarity and defensibility to liquidity risk in a fragmented fixed income market

FRTB (SA) product of the year: Bloomberg

A globally consistent and reliable regulatory standardised approach for FRTB

Best use of cloud: ActiveViam

Redefining high-performance risk analytics in the cloud

Best use of machine learning/AI: ActiveViam

Bringing machine intelligence to real-time risk analytics

Collateral management and optimisation product of the year: CloudMargin

Delivering the modern blueprint for enterprise collateral resilience

Flow market-maker of the year: Citadel Securities

Risk Awards 2026: No financing; no long-dated swaps? “No distractions,” says Esposito

Pricing and analytics: fixed income – Quantifi

Quantifi delivers high-performance, transparent and adaptable pricing and risk analytics for fixed income and credit markets