Bonds

CGB repo clearing is coming to Hong Kong … but not yet

Market wants at least five years to build infrastructure before regulators consider mandate

Banks hope new axe platform will cut bond trading costs

Dealer-backed TP Icap venture aims to disrupt dominant trio of Bloomberg, MarketAxess and Tradeweb

Credit spread risk approach differs among EU banks, survey finds

KPMG survey of more than 90 banks reveals disagreement on how to treat liabilities and loans

Winds of change 2026: managing opportunities

Shifts in monetary and fiscal policy are reshaping fixed income markets

JPM stands alone as substitutability cap reins in G-Sib score

Bank of America crosses 500bp threshold for first time, as Basel continues review

Hong Kong regulator exploring Southbound Swap Connect

Discussions on Southbound route for swaps trading follows surge in Northbound activity

Bessent’s Treasury buy-back ‘success’ draws expansion warnings

BMO Treasury trading head warns of “overarching presence” as Treasury scales up programme

Ardagh CDS spreads reel amid payout confusion

Dispute over company’s recapitalisation plan leaves credit default swap holders with uncertain future

ECB finds holes in banks’ credit spread risk nets

Banks censured for insufficient evidence to support exclusion of products from CSRBB perimeter

Talking Heads 2025: Who will buy Trump’s big, beautiful bonds?

Treasury issuance and hedge fund risks vex macro heavyweights

EU banks’ incremental risk charges up 20% in H1 2025

Heightened trading flows and worsening credit outlooks leave dealers with more risk-heavy books

Market awaits GMRA green light after China repo relaxation

ICMA reviewing new PBoC rules and “potential implications” for GMRA eligibility onshore

Goldman’s credit reporting proposal sparks criticism

Shift to end-of-day and next-day reporting on large portfolio trades seen as step back for transparency

JPM and MS offer US Treasury algos on Tradeweb

Dealer algos form part of broader execution strategy following acquisition of r8fin

It takes two: bilateral price streaming takes hold in govvies

Large dealers offer direct API access to government bonds as alternative to request-for-quote trading

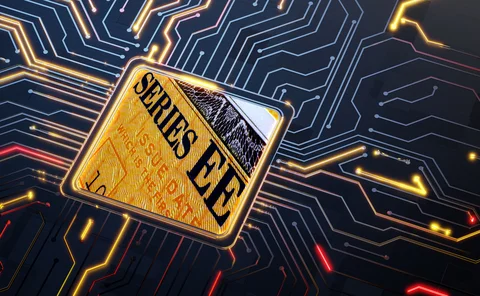

The ‘get-out-of-debt’ card that may worry bond investors

A new paper analyses the controversial tool that governments may be forced to deploy to control borrowing costs

Some European banks still failing net interest income test

Swedbank joins seven other outliers after it updates methodology assumptions

The investors who aren’t fretting over Trump’s stat sulk

Some see dismissal of statistics agency chief as an assault on US institutional integrity; for others it offers a chance to throw off outdated methods

JPM piles into Treasuries with record $72bn AFS surge

Portfolio reshaped with shift to medium-term maturities as Q2 glut boosts holdings to all-time high

ICE’s approach to pricing global fixed income assets

Accurate and transparent bond pricing is critical for managing risk, meeting regulatory requirements and making informed investment decisions

Fed’s new leverage ratio: the horse that never left the gate

Most of the biggest dealers aren’t leverage constrained now, and experts are sceptical that banks will use the extra capacity for Treasuries