Probability of default (PD)

US bank CROs see only ‘modest’ credit risk from tariffs

Risk Live North America: Lower margins are early sign of stress, but Ally, Citizens and Pinnacle confident on loan books

Hong Kong CRE drives rise in HSBC stage 2 loans

Model updates and HK real estate behind $24bn jump in H1

Banks seek EU supervisory green light on external credit data

GCD-developed industry standard to show pooled loss data is representative of banks’ portfolios

Wait in the Q: US banks hold back on tariff-related provisions

Lack of data on supply chain vulnerabilities creates challenges for early CECL adjustments

Amid tariff turmoil, banks warned not to fudge IFRS 9 overlays

Flip-flopping US policies challenge loan loss provisioning models; EU regulators take watching brief

Credit loss database reveals holes in Basel’s IRB formula

Researcher has used two decades of data to propose improved internal model methodology

IRB reliance peaks at over 90% for some lenders ahead of Basel III shift

As reforms loom, IRB usage spans from marginal to near-total among European banks

Stage fright: lenders still struggling with IFRS 9 transitions

Divergence in how banks move loans between stages of impairment prompts regulators to push for more homogenous approach

European regulators turn up the heat on IFRS 9 model overlays

After warnings from EBA and BoE, risk managers urge ‘soul-searching’ on post-model adjustments

Climate capital in the balance as EBA rejects green risk weights

European regulator suggests climate change must be factored into existing risk categories

Can CRE credit risk models cope with hybrid working?

As US office use changes, modellers deploy judgement overlays and alternative data to keep up

Understanding and predicting systemic corporate distress: a machine-learning approach

The authors construct a machine-learning-based early-warning system to predict, one year in advance, risks of systemic distress and demonstrate factors which can predict corporate distress.

Pricing default risk in stochastic time

This paper explores credit derivative pricing through the structural modeling framework and seeks to improve on how accurately such models value derivative securities.

Norinchukin’s credit RWAs up 31% on early Basel III opt-in

Bank’s standardised charges surge 19-fold following overhaul of models’ scope and parameters

Calibration alternatives to logistic regression and their potential for transferring the statistical dispersion of discriminatory power into uncertainties in probabilities of default

This paper compares four calibration approaches to linear logistic regression in credit risk estimation and proposes two new single-parameter families of differentiable functions as candidates for this regression.

US credit risk modellers prepare for life after IRB

Stress tests and economic capital calculations may not carry the same weight as Basel ratio

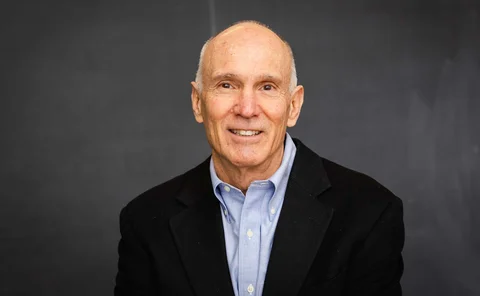

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

Sovereign probabilities of default in the euro area

This paper decomposes credit default swap spreads of euro area members into their risk premium and default risk elements and forecast one year probabilities of default.

Quantification of model risk with an application to probability of default estimation and stress testing for a large corporate portfolio

This paper discusses the building of obligor-level rather than segment-level hazard rate corporate probability of default models for stress testing.

EU eyes fix to FRTB’s capital asymmetry for govvies

Banks say French presidency proposal would see PD floor slashed for sovereign bonds under IMA

Nationwide’s IRB charges up 89% on PRA’s parameter curbs

The building society’s strict focus on mortgages meant impact was all-sweeping