Call options

Neural networks unleashed: joint SPX/VIX calibration has never been faster

SPX and VIX options can be jointly calibrated in real time with deep neural networks

As Fed meets, hedge funds buy ‘lottery’ FX options trades

Options bets reflect cautious pessimism over the dollar ahead of Jackson Hole conference

More than arb: the short signals behind Jane Street’s India troubles

Prop trader ran parallel strategies, source says. That mix may have given rise to manipulation claims

HK warrant issuers optimistic on listing cost cuts

Inclusion of listing reform in second budget speech raises hopes for action on ‘expensive’ fees

Tariffs volatility prompts rush to re-hedge EUR/USD options books

Banks left scrambling to buy vol as spot surged beyond expectations

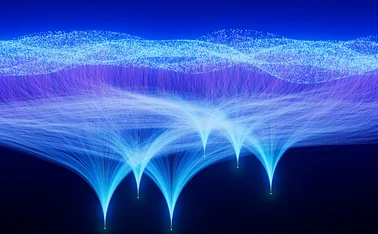

Disappearing dealer gamma spurs wild stock swings

Stock market selloff leaves dealers perilously close to peak short gamma positioning

Podcast: Lyudmil Zyapkov on the relativity of volatility

BofA quant’s new volatility model combines gamma processes and fractional Brownian motion

Long gamma puts brakes on post-election US stock rally

Call selling by ETFs helped fuel largest net gamma positioning among dealers since July

Using option prices to trade the underlying asset

The authors propose strategies with which to trade the underlying assets of options based on large data sets generated by options trading.

Hedge funds pile into short volatility QIS options

New twist on capturing vol premium remains popular despite mixed performance in August vol spike

Pre-market trades blamed for record Vix surge

Traders rushed to cover short vol positions before the market opened on August 5

Credit options notional for top US dealers soars 45.3%

Investor demand for puts and calls drives balances near Q1 2022 record

Gamma jitters from defined outcome funds

Tumbling equity markets could flip dealers’ exposure to gamma from long to short, leading to hedging losses

Taming of the skew sparks new debate over 0DTEs

Some pin lower put premium on short-dated market-maker hedging; others cite fundamentals

BNP Paribas targets hedge funds with equity vol carry options

Bank aims to meet demand for QIS options extending beyond commodities

Lincoln, Global Atlantic push JPM to index options top spot

Counterparty Radar: Among life insurers, options notional grew 7% in Q1

How a machine learning model closed a hidden FX arbitrage gap

MUFG Securities quant uses variational inference to control the mid volatility of options

Modeling the bid and ask prices of options

The authors investigate and partially solve theoretical and empirical problems for the joint modelling of bid and ask prices.

A three-point turn in derivative design

Citibank quant’s triangle method allows information geometry to be applied to hedge structuring

US life insurer index options market hits $1trn mark

Counterparty Radar: Lincoln Financial emerges as top player in Q4 with $43 billion portfolio increase

Mutual funds dump two-thirds of FX options positions in Q4

Counterparty Radar: Morgan Stanley Investment Management leads fall in volumes with big cuts to RMB trades