Credit ratings

US Basel equivalence questioned as EU patience wears thin

MEPs say unfaithful US implementation of Basel III could trigger review of third-country capital treatment

Boeing’s descent to junk doesn’t scare investors

Analysts and managers say market can absorb any selling pressure from potential downgrade

Could Trump presidency herald $27bn margin call on World Bank?

Think-tank’s policy plan to pull US out of multilateral threatens AAA rating, ending collateral exemption

An equity-implied rating model for unrated firms

The authors use Merton's distance to default as the basis for new model with which to assign credit ratings to firms which are not traditionally rated.

How do credit rating agencies and bond investors react to credit guarantees? Evidence from China’s municipal corporate bond market

This paper investigates China's municipal corporate bond market, examining the responses of credit rating agencies and bond investors to credit guarantees.

EU banks’ incremental risk charges soared in volatile H2

Charge for traded-bond default and downgrade risk hit 10-year high at BNP Paribas

Brazil readies long-dated FX hedging scheme for green projects

Development bank IDB will lend its credit rating to unlock cheaper USD/BRL hedges out to 25 years

NAIC softens its rating overhaul. Insurers still don’t like it

Insurers worry that the regulatory body could override credit ratings without sufficient explanation

BoE puts American spin on fix for FRTB’s govvies dilemma

Four jurisdictions find four different ways to resolve Basel market risk capital quirk

Esma sounds alarm over conflicts at CLO raters

Investigation points to analysts meeting with managers and notes softening of rating methodologies

Like your CSA dirty? It’ll cost more

Buy-side firms have to pay up if they want to post corporate bonds to their dealers, but prices vary

NAIC proposal sees insurers snub debt rated by smaller agencies

Ability of some corporates to raise capital ‘materially impaired’, bankers say

An NAIC plan to second-guess bond ratings is ‘nonsensical’, insurers say

Proposal to create “quasi rating agency” at regulatory body sparks backlash from industry and US Congress

Norinchukin’s credit RWAs up 31% on early Basel III opt-in

Bank’s standardised charges surge 19-fold following overhaul of models’ scope and parameters

IRC capital charges surge at Deutsche and Intesa

Risk-weighted assets covering default and downgrade of traded bonds all but double at Italian lender

How banks can avoid bad haircuts on hedge fund trades

HSBC quant makes case for looking at collateral and funding rates in concert

Why US bank regulation needs a system upgrade

SVB collapse shows supervisory framework is not fit for a changing industry and new systemic risks

The carbon equivalence principle: methods for project finance

A method to price the environmental impact of financial products is proposed

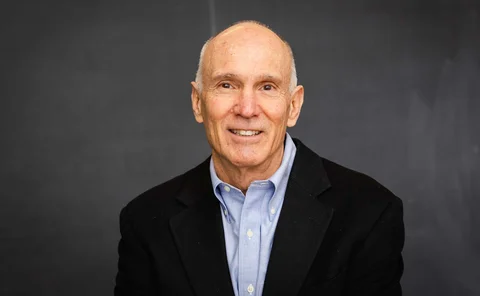

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

Uncleared, unrated CDS notionals boomed in H1 2022

Non-cleared trades up 21% in six months and 14% in twelve, BIS data shows

Fragmented rules muddy Asian FRTB implementation

Banks and vendors warn risk factor data may not be usable across different jurisdictions