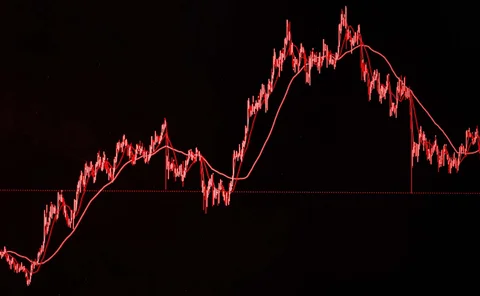

Technical paper/Adjoint algorithmic differentiation (AAD)

Multi-factor Gaussian model calibration: swaptions and constant maturity swap options

A novel closed-form method delivers a new way to calibrate interest rate models

Chebyshev Greeks: smoothing gamma without bias

A numerical method to obtain stable deltas and gammas for complex payoffs is presented

Axes that matter: PCA with a difference

Differential PCA is introduced to reduce the dimensionality in derivative pricing problems

Differential machine learning: the shape of things to come

A derivative pricing approximation method using neural networks and AAD speeds up calculations

Second-order Monte Carlo sensitivities

This paper considers the problem of efficiently computing the full matrix of second-order sensitivities of a Monte Carlo price when the number of inputs is large.

Fast stochastic forward sensitivities in Monte Carlo simulations using stochastic automatic differentiation (with applications to initial margin valuation adjustments)

In this paper, the author applies stochastic (backward) automatic differentiation to calculate stochastic forward sensitivities.

Efficient Simm-MVA calculations for callable exotics

Algorithmic differentiation are used to simulate sensitivities to calculate MVA

Adjoint algorithmic differentiation tool support for typical numerical patterns in computational finance

This paper demonstrates the flexibility and ease in using C++ algorithmic differentiation (AD) tools based on overloading to numerical patterns (kernels) arising in computational finance.

Nonlinear relationships in a logistic model of default for a high-default installment portfolio

This paper uses data on consumer credit along with generalized additive models to analyze nonlinear relationships and their effect on predicting the probability of default in the context of consumer credit scoring.

Pathwise XVA Greeks for early-exercise products

The calculation of XVA Greeks for portfolios with early-exercise products is discussed

Risk optimisation: the noise is the signal

Benedict Burnett, Simon O’Callaghan and Tom Hulme introduce a new method of optimising the accuracy and time taken to calculate risk for an XVA trading book. They show how to make a dynamic choice of the number of paths and time discretisation focusing…

CVA with Greeks and AAD

Reghai, Kettani and Messaoud present new technique to calculate CVA using adjoints

Cutting edge introduction: Adjoints - maintaining the legacy

Quants at UBS show how to speed up the calculation of sensitivities without tearing up legacy code

Greeks with continuous adjoints: fast to code, fast to run

Marzio Sala and Vincent Thiery show the derivation of the continuous adjoint problem for PDEs

Cutting Edge intro: maths versus machine

Banks can use maths - rather than special chips - to boost computing speed

Adjoint credit risk management

Adjoint algorithmic differentiation is one of the principal innovations in risk management in recent times. Luca Capriotti and Jacky Lee show how this technique can be used to compute real-time risk for credit products, even those valued with fast semi…

Fast gammas for Bermudan swaptions

Fast gammas for Bermudan swaptions

Adjoint Greeks made easy

Adjoint Greeks made easy

Cutting Edge introduction: Computation, computation, computation

Computation, computation, computation