Model risk

Maximising effectiveness with tech

Winners' Circle Q&A: Risk Market Technology Awards 2018 | Murex

A Darwinian view on internal models

In this paper, Paul Embrechts reviews discussions on regulation within banking (Basel III and IV) and insurance (Solvency II and Swiss Solvency Test (SST)) from a historical, personal and academic point of view.

Model validators squeezed by stress test deadlines

CCAR cycle frustrates compliance with Fed model risk guidance

OCC regulator warns on interest rate risk build-up

Fed policy, liquidity requirements and model herding all raise concerns

Fed’s outgoing CCAR chief defends stress tests

Timothy Clark rebuffs US Treasury recommendations; supports more transparency

Banks tout machine learning amid regulatory concerns

Machine learning being used to build challenger models for model validation

CCAR feedback prompts banks to improve governance

Dual reviews of stress testing models and scenarios becoming the norm

A practical maturity assessment method for model risk management in banks

This paper proposes a qualitative method to assess the maturity of model risk management practices within banks.

This tangled web: banks seek to contain systemic model risk

Network studies are being used to identify model dependencies and concentrations

Asset price bubbles and the quantification of credit risk capital with sensitivity analysis, empirical implementation and an application to stress testing

This paper presents an analysis of the impact of asset price bubbles on standard credit risk measures.

Banks warned off machine learning for model risk

Banks acknowledge they “cannot hide behind a complex tool” to assess interconnectedness

Cyber insurers accused of lax underwriting standards

Loss data becoming more granular and diverse, but critics highlight pricing inconsistencies among underwriters

HSBC’s model risk chief departs

Exit follows February reshuffle of UK lender’s global risk analytics unit

Model risk managers grapple with interconnectedness

US regulators ask banks to assess cross-dependencies of models – prompting some to employ network theory

Falling margins force energy firms to expand data use

Verification and model challenges arise as volatility and margins dry up

Model management frameworks: what lies ahead?

Sponsored by KPMG

US Treasury stance on CCAR a return to ‘bad old days’

Overhaul would kill test failed by eight banks in past three years

Don’t let the SMA kill op risk modelling

The SMA is not a good response to the AMA’s failings – but don’t throw the baby out with the bathwater

Model risk falls under the CCAR microscope

Fed using qualitative reviews to test compliance with SR 11-7

Incorporating model risk management as a core discipline

Content provided by IBM and Risk.net

Data woes force dividend swaps out of Simm update

Dealers have different approaches to pricing dividend risk factors

Model risk managers eye benefits of machine learning

Ramp-up in regulatory scrutiny of model validation sees banks turn to black boxes

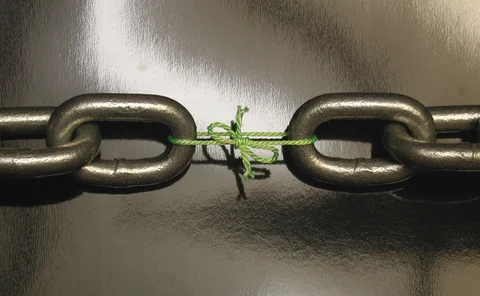

Regulatory blitz weakening model risk management, say banks

Smaller banks’ modelling practices under growing scrutiny, but ability to comply is stretched

Broaden your reach on model risk, quants told

Three banks say their model inventories are “a work in progress”