Model risk

US units of BBVA, BNPP, TD Bank post VAR breaches in Q1

TD Bank losses on one day exceeded VAR estimate by 195%

EU’s model study finds problems with bank VAR methods

Banks surveyed by the ECB had an average of 32 issues with their market risk models

ECB model review continues to eat at ABN Amro’s capital

Trim effects add €1.3 billion of RWAs in Q1

Not random, and not a forest: black-box ML turns white

Bayesian analysis can replace forest with a single, powerful tree, writes UBS’s Giuseppe Nuti

Models need longer datasets to handle economic cycles – research

Decades, not years, of credit losses required for accurate risk modelling, argues expert

A new approach to the quantification of model risk for practitioners

This paper's aim is twofold: to introduce a mathematical framework that is sufficiently general and sound to cover the main areas of model risk, and to illustrate how a practitioner can identify the relevant abstract concepts and put them to work.

Converging on sound model risk management practices

Although most banks are progressing rapidly towards a certain standard in MRM practices, the rate of progress is uneven and so are the ambition levels. Management Solutions provides a summarised overview of the state of MRM evolution and how banks are…

Common validation techniques for risk proxies found wanting

Research finds two out of three methods for checking index prices as proxies don’t properly gauge tail risk

Quantification of model risk in stress testing and scenario analysis

In this paper, the author's aim is to empirically analyze the numerical quantification of model risk, yielding exact buffers in currency amounts (for a given model uncertainty).

At US G-Sibs, 11 VAR breaches in 2018

The final quarter of 2018 saw a record number of VAR breaches at the biggest US banks

Honesty is key to machine learning’s future – Roberts

Oxford-Man Institute director on why tomorrow’s models will gracefully admit defeat

Model risk chiefs warn on machine learning bias

ML model outputs open to “potential bias sitting in your datasets”, says RBS model risk head

Teach history to avoid mistakes of yesterday’s quants

Quant grads should be taught follies of LTCM, Gaussian copula and London Whale, writes UBS’s Gordon Lee

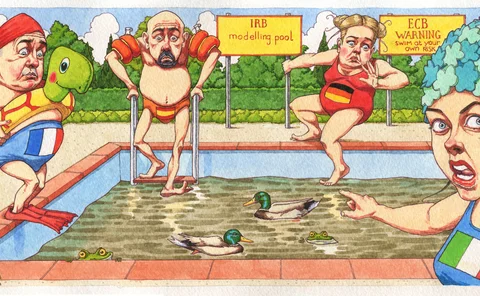

EU banks punished over lowball credit risk estimates

Two of 17 firms facing follow-up inspections will be hit by capital add-ons

Valuation model risk on the rise at EU banks

Over two-thirds of fair value assets priced using banks' models

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

HSBC hires new head of model validation

Bank appoints Credit Suisse veteran to key role

BNPP, Credit Suisse, State Street incur VAR breaches

BNP Paribas capital multiplier increases on seventh breach in nine months

The disputed terrain of model risk scoring

There is no concord on how banks should police their model risk. But two Fed economists have an idea

Fed’s Brainard wary of black box AI models in consumer credit

Speech raises explainability issue; says existing model risk guidelines are “a good place to start” in regulating AI

Machine learning hits explainability barrier

Banks hire AI industry experts in face of growing regulatory scrutiny

National supervisors put pressure on global risk models

Varied supervisory and external audit demands stretch cross-border risk management

Compliance preparations amid uncertain rules

A forum of industry leaders discusses how banks will define individual trading desks under FRTB, whether BCBS 239 compliance projects can help banks meet FRTB risk data challenges, which model validation obstacles banks still face and other key topics