Equity derivatives

French transaction tax loophole could prompt tougher European regimes

A twist in the tale for artful dodgers

Credit Suisse loses Korea head of equity derivatives

Charlie Shin has left the Swiss bank

Italian budget vote brings equity derivatives tax closer

Watered down proposals include equity derivatives to avoid creating loophole, experts say

France warns on use of derivatives to evade new transaction tax

Tax adviser to the French finance minister tells Risk the country's authorities will act on "tax evasion through synthetic instruments" if necessary, as cash equity volumes fall

Equity derivatives house of the year

Equity derivatives house of the year

White paper: How Using The Right Index Can Expand Opportunities In European Markets

Prior to 2012 there was a gap in investable products covering the European small-cap, midcap, and SMID-cap market segments. Anecdotally, hedges against these segments were often created with products based upon liquid large cap indexes. Given the mega…

Equity Derivatives House of the Year – JP Morgan

Asia Risk Awards 2012 winner: JP Morgan – Equity Derivatives House of the Year

SG's head of cross-asset private banking sales exits

Departure of Janice Yu from the French bank is latest example of consolidation in the Asian derivatives sector

Houari leaves Barclays to head equity structuring group at Deutsche Bank

Hassan Houari has ended a 12-year career at Barclays to take up a role as global head of structuring at Deutsche Bank in London

UBS poaches Edwards from RBS and Naylor from Deutsche to bolster equity derivatives

Shane Edwards is joining the UBS equity derivatives team in London. His appointment follows that of Roger Naylor, who was named global head of equity derivatives at the Swiss bank earlier this month

An easy-to-hedge covariance swap

An easy-to-hedge covariance swap

Sponsored statement: Ito33

Which model for equity derivatives?

OCC: equity derivatives to get a cross-margin service

OCC: equity derivatives to get a cross-margin service

RBS retains structured products in restructure

Trimming the fat

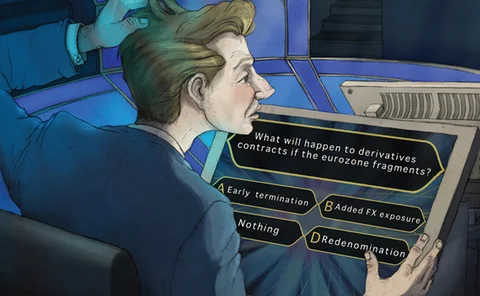

Dealers tackle euro redenomination risks

Back to the drachma?

CIBC hires Citadel's Siddique

Nadim Siddique joins CIBC World Markets as head of equity derivatives trading

RBS cash equities exit could hike hedging costs

RBS will have to pay more to hedge vega from its equity derivatives business after losing offsets provided by cash, rivals say

People: Luc Francois leaves Morgan Stanley

People: Luc Francois leaves Morgan Stanley

Derivatives house of the year: JP Morgan

Risk awards 2012

Equity derivatives house of the year: JP Morgan

Risk awards 2012

Low rates to favour equity-linked securities in South Korea this year

The popularity of equity-linked securities is set to remain strong in South Korea as investors seek yield enhancement to combat low interest and deposit rates

EDHEC and SocGen release rationale for structured products in Asia

EDHEC and SocGen reveal all on Asian volatility