Economics

Deep water waves: accelerating, broadening, consequential

Factors that will impact investment returns over the next decades, the interplay between them and their likely impact on investment outcomes

Trading robots and financial markets trading solutions: the role of experimental economics

The authors investigate and summarize experimental studies on automated trading strategies in financial markets.

In a downturn, mitigation beats litigation every time

Economic shocks increase op risks for banks, but institutions can take steps to limit the danger

An experimental study of capacity remuneration mechanisms in the electricity industry

The authors investigate the efficiency properties of energy market designs with regard new investments, reductions in unserved energy frequency and energy prices of a generic capacity remuneration mechanism impervious to the forward capacity market.

Inflationary forces (and microbial soups)

The hold of central banks over inflation may be weaker than we thought

New investor solutions for inflationary markets

Geopolitical risks, price volatility, clashing cycles, higher interest rates – these are tough times for economies and investors. Ahead of the 2022 Societe Generale/Risk.net Derivatives and Quant Conference, Risk.net spoke to the bank’s team about some…

Banks struggle to assess climate impact on op risk

Supervisors have provided less stress-testing guidance for op risk than for credit risk

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with buffer hike while forecasting recession

AI models point to recession, but quants won’t trade on them

Predicting the odds of a recession, and how markets will respond, is still a step too far for machines

Turbulent markets put focus on evaluated pricing

Jayme Fagas, global head of valuations and transparency services at Refinitiv, explores why, in such an environment, firms need to have the right evaluated pricing to ensure they are pricing their portfolios at fair value levels and complying with…

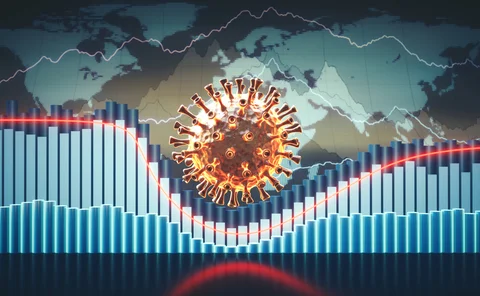

The wild world of credit models

The Covid-19 pandemic has induced a kind of schizophrenia in loan-loss models. When the pandemic hit, banks overprovisioned for credit losses on the assumption that the economy would head south. But when government stimulus packages put wads of cash in…

Decomposing supply shocks in the US electricity industry: evidence from a time-varying Bayesian panel vector autoregression model

This paper investigates spillovers between electricity supply shocks and US growth, using monthly data from forty-eight US states from January 2001 to September 2016, and employs a novel strategy for electricity supply shocks based on a time-varying…

Covid scenarios, pt II: apocalypse how?

Second crowdsourced scenario exercise reveals polarised views in equities and FX

NYU’s Epstein on fear and complacency in the age of Covid

Pioneer of agent-based models warns of virus resurgence akin to 1918 Spanish flu

The unintended impact of swap stays on financial stability

As swaps leverage shrinks, bankruptcy stay rules are not guaranteed to reduce systemic risk, says economist

Doyne Farmer’s next big adventure: capturing the universe

Quant fund pioneer plans to build an economic super-simulator on a global scale

Covid scenarios: finding the worst worst-case

As pandemic trashes historical data, a Risk.net tie-up with Ron Dembo’s new outfit tests promise of polling

ICAAP/ILAAP – Unlocking business value from capital and liquidity assessment

Regulators consider banks’ internal capital adequacy and assessment process (ICAAP) and internal liquidity adequacy assessment process (ILAAP) important tools in managing risk. The European Central Bank’s (ECB’s) updated guidance – which came into effect…

Will uncleared margin rules change the FX landscape?

As the next phases of uncleared margin rules come into force, there will be an economic driver for more clearing of FX. By Phil Hermon, Executive Director of FX Products at CME Group

Navigating the impact of climate risk on financial stability

As uncertainty abounds on the impact climate change may have on the industry, financial services firms must best equip themselves for potential regulatory and socioeconomic changes to ensure they maximise the opportunities of embracing new best practices…

Libor transition and implementation – Covering all bases

Sponsored Q&A