Risk magazine - Jun 2018

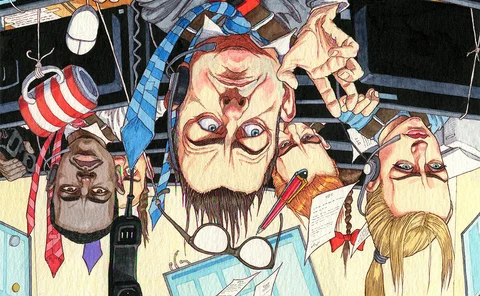

In this month’s issue: how stock-bond correlations are turning traders’ worlds upside down; a downward surge for corporate swaps; dealers weigh up what to do with swaps portfolios in a Brexit world; a possible return of the ‘big bank’; and much more

Articles in this issue

Modelling correlation: from zig-zag to zig-zig

Research is starting to show the stock-bond link in a new light

Esma clampdown puts pressure on Mifid data services

Guidance insists data be free and machine-readable, attacking current practices

Euro swaps market faces loss of key basis hedge

New Eonia/Euribor swaps will be barred from 2020 if Eonia fails to comply with EU benchmark rules

Euribor can stay if reforms succeed – ECB’s Holthausen

Regulator also sees no clear favourite in array of Ibor fallback approaches

Compression firms vie to ease Libor switch

Quantile and TriOptima launching services to tear up Libor swaps and replace with new rates

Swaps users to get three choices for synthetic Libor

Consultation due next month as industry tries to avoid big losses on benchmark’s death

Isda faces member backlash on margin lobbying

Working groups were not consulted over Isda-funded paper that could threaten industry’s Simm

Planned sale prompts hard look at post-trade firms

Plans to sell MarkitServ fuel warnings about middleware vendors’ future

Foreign banks in US wary after funding costs rise

Following jump in Libor/OIS spread, many US entities continue borrowing from parents

No safety net for no-deal Brexit, warns BdE’s Alonso

UK banks should not rely on temporary rule waivers being granted in the event of a disorderly Brexit

People moves: Societe Generale makes senior changes, Mattatia moves to BNP Paribas, and more

Latest job changes across the industry

Buy-side modellers seek ‘Holy Grail’ of investing

When stocks and bonds fell in tandem this year, it sparked a debate about whether a lasting regime shift could be predicted

Swap spreads halve as dealers fight for corporate market share

US bank push, rate movements and evolving market practice driving spreads to “suicidal” levels

Actionable data breach insights from op risk modelling

Thomas Lee, chief executive at VivoSecurity, and Martin Liljeblad, operational risk manager at MUFG Americas, examine how a data breach cost model can replace an advanced measurement approach in a structured scenario

Brexit: banks consider four ways to move swaps en masse

Statutory business transfers in frame as bilateral novation may take too long

Lenders reveal struggles over IFRS 9 roll-out

Size of task caught some banks unawares, leading to botched home-grown systems or data problems

Citi CRO: stress tests now vital part of bank strategy

Bank has leveraged CCAR to build culture of constant internal stress testing, says Brad Hu

ECB’s Angeloni: bullish on Brexit, wary on regulatory reform

Relocations from UK will boost EU capital markets; but CRR needs to remove national barriers

Replacing too big to fail with too small to survive

Subordinated debt requirement will hit smaller banks hardest

Funding in the dark: EU banks wait on bail-in bond rules

Issuance strategies clouded by uncertainty over MREL subordination and pre-positioning

Banks explore new data techniques to tackle money laundering

Artificial intelligence in tandem with human analysis seen as effective for know-your-customer

Asia-Pacific banks grapple with conduct risk rules

Australia, Hong Kong regimes lead in developing conduct risk guidelines; Singapore lags behind

Op risk standard will hike capital by 11% – latest data

Rises in capital under SMA will vary depending on regulator treatment, writes op risk expert

Duelling repack platforms find common ground

Standard documentation initiative mulls shared SPV model as founders seek to join rival

NDF nightmare: banks seek fix for benchmark ‘mess’

European firms face bar from using three Asian fixings from 2020, raising concerns about legacy trades

Trade data initiatives aim to unify regulatory reporting

Standardised data would improve systemic risk monitoring and save firms billions, say data engineers

Risk-return dominance of US ‘big five’ a myth, data shows

US stock markets less exposed to a ‘Gafam factor’ than assumed, says La Française Investment Solutions

Chinese oil future could be first of many in Asia

Traders optimistic over long-term prospects for INE RMB crude future

Model risk in the transition to risk-free rates

Transition is an opportunity to reduce multi-rate complexities, say Bakkar and Brigo

XVA swings boost US bank trading revenues

DVA change pares down dealers' derivative liabilities

G-Sib swap portfolios reveal transatlantic divide

EU banks record 16% fall in non-cleared swaps, while US dealers see 9% growth

Goldman, JP Morgan get riskier in Q1

Each bank could face an extra 50 basis points of capital add-on without remedial action

EU banks’ CVA capital to triple if exemptions axed

Seven banks would incur 200bp-plus hit to capital if long-standing waivers were repealed, says EBA

Liquidity resources vary across CCPs

Eurex, Ice Clear Credit, LCH SA most dependent on cash deposited at central banks

Five US banks below Collins floor

Morgan Stanley, JP Morgan, Citigroup, State Street and Wells Fargo had higher standardised RWAs than modelled RWAs

European investment fund growth slows

Bond fund growth rate falls from 10.6% to 8.2% quarter-on-quarter

Monthly op risk losses: banks count the cost of IT failures

Also: top five loss breakdown led by Wells Fargo’s $1bn fine. Data by ORX News

Credit data: ‘dirty diesel’ woes weigh on autoparts firms

Auto supplier default risks have jumped, as environmental concerns hit prospects for diesel vehicles, says David Carruthers of Credit Benchmark

Swaps data: anatomy of a wild week in dollar swaps

Chaotic Italian politics jolted rates markets – including US dollar interest rate swaps, writes Amir Khwaja of Clarus FT

How machine learning could aid interest rate modelling

Standard Chartered quant proposes machine-learning technique to better capture rate dynamics

Curve dynamics with artificial neural networks

Artificial neural networks can replace PCA for yield curves analysis

Mark Yallop on conflicts in fixed income

Banks and their clients need protocol on information sharing, says FMSB chair