Risk magazine - Jul 2021

Articles in this issue

How XVA quants learned to trust the machine

Initial scepticism about using neural networks for derivatives pricing is giving way to enthusiasm

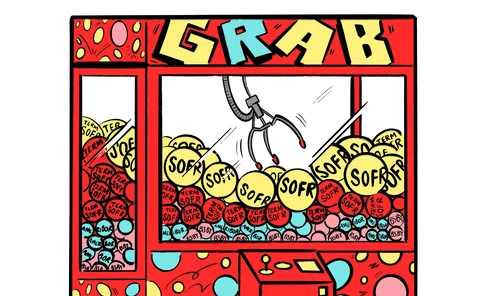

SOFR alternatives remain on track despite regulatory warnings

Pointed criticism from FSOC has done little to dampen interest in credit-sensitive rates

Fed casts doubt on future of Basel internal models in US

Banks warn Fed cannot keep commitment to avoid Basel III capital hike if it forbids models

CFTC rule change sparks dealer-client margin scuffle

FCMs fear “race to the bottom” as funds lobby dealers for lower margin status

Banks fear Fed crackdown on AI models

Dealers say agencies’ request for info could prompt new rules that stifle model innovation

China netting law drives interest in CSAs

Steady growth in contracts with CSAs suggests confidence that clean netting is near

CME, FICC to overhaul Treasury market margining

Clearers eye deal to dramatically improve cross-margin savings, aim to extend offsets to end-users

People moves: BoE’s Roth moves to crypto, UBS bolsters US execution hub, and more

Latest job changes across the industry

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Page 19901: the benchmark that time forgot

CFTC probe into swap price rigging revives the ghosts of Libor manipulation

Sunil Cutinho on CME’s crisis performance

Maverick clearing house boss dismisses the need for anti-procyclicality tools imposed by regulators

Could global regulators miss another Archegos whale?

Spotting systemic risk from OTC swaps requires cross-border access to derivatives data

Confusion reigns as US prepares for Libor’s end

Mixed messages from US regulators make it more difficult to plan for life after Libor

Pick a rate: pitfalls and prizes in the post-Libor world

SOFR set to win big in replacing Libor, but trillions could scatter across alternatives

The Libor replacement stakes: runners and riders

Credit-sensitive rates Ameribor and BSBY nose ahead of Ice, Markit and AXI; regulators keep watchful eye

Euronext’s tech migration sprint alarms electronic traders

Co-location users sound warning on plan to chop two years off data centre move from UK to Italy

Hedging valuation adjustment gets cold shoulder from banks

Dealers back the idea of charging for hedging costs but not as part of a new XVA

Quantum trading and the search for the perfect clock

Government push to overhaul satellite technology could improve time-stamping accuracy for trading firms – and for regulators

Zurich’s Scott: don’t levy climate risk capital charges

Imposing set-asides based on stress tests “does not make any sense”, sustainability chief warns watchdogs

The race to offload the world’s biggest pool of assets

Specialist insurers on both sides of the Atlantic expect a bumper post-Covid second half of 2021

How algos are helping inflation-wary investors

Buy-siders look to machine learning for clues on the effect of rising prices on portfolios

Green figures: EU funds search for sustainable taxonomy data

Fund managers must report compliance with taxonomy before many investee companies

Not so green machine? Questioning commodities’ credentials

As ESG investors eye commodities, issues around measurement and management are unearthed

Shades of green: sustainability guidance may not help EU funds

Talk of high SFDR hurdle for ESG funds stokes fears “sustainable” label will be unobtainable

Hedge funds and the rebound in collateral velocity

Reuse rate of collateral points to growing fragility and interconnectedness in financial markets

G-Sib regime: something’s broken

US banks are taking the Fed for a ride – it’s time to address the issue

NSCC caught $600m short during meme-stock frenzy

Worst-case losses would have wiped out the CCP’s available liquid resources on one day in Q1

Fed stress tests stretch Goldman Sachs, HSBC

US dealers toe binding minimums in latest DFAST exercise

JP Morgan, BofA face higher G-Sib surcharges

Both banks could face an extra 50 basis points of capital add-on without remedial action

JSCC issued $2.8bn VM call on a clearing member in Q1

The call was for a participant in the CCP’s clearing services that cover IRS, CDS and exchange-traded financial products

NSCC hit by $1.06bn margin breach

In total, the DTCC division reported 96 margin breaches at end-March 2021

The case for reinforcement learning in quant finance

The technology behind Google’s AlphaGo has been strangely overlooked by quants

Goal-based wealth management with reinforcement learning

A combination of machine learning techniques provides multi-period portfolio optimisation

An approximate solution for options market-making

An algorithm for the market-making of options on different underlyings is proposed

A Darwinian theory of model risk

An ex ante methodology is proposed to analyse the model risk pattern for a broad class of structures

Mizuho EU CRO reveals his top risks – they may surprise you

Fears over technology dominate Wolfgang Koehler’s list of greatest risks for Mizuho’s EU unit