Risk magazine - Feb 2020

In this month’s issue: how Netflix model is influencing corporate bonds; BNP Paribas leads European clearers comeback; a special in-depth section on Libor; and much more

Articles in this issue

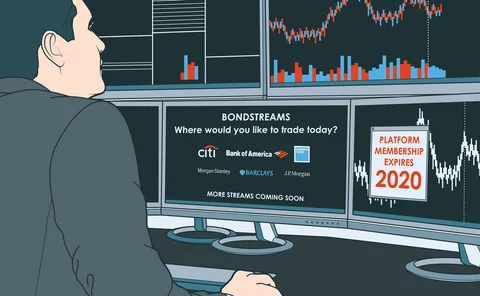

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

Libor replacement jumble may hike hedging costs

Use of term rates and credit adjustments will create new basis risks that could be costly to hedge

JSCC caps member cash calls, revamps futures margin model

Clearing house set to end unlimited default fund top-ups for futures clearing

EU council dials back on margin haircuts for CCP resolution

Lawmakers close avenues for regulators to dip into non-defaulting members’ initial margin

Non-EU hedge funds stage surprise escape from SFTR

European Commission clarifies scope of reporting obligation that confused many in the industry

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Isda plans February rerun of Libor pre-death trigger poll

Lack of consensus would add pre-cessation option to post-cessation protocol for bilateral swaps

People moves: De Roeck quits Standard, BofA adds risk exec, and more

Latest job changes across the industry

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

Secrets and Libor fallbacks

Lenders may be forced to reveal sensitive funding data when Libor disappears

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

Frustrated authorities resort to BCBS 239 ‘fire drills’

ECB and Finma lob impromptu data requests at banks, as BCBS 239 quietly permeates everyday supervision

Why the numbers don’t add up for post-Libor hedge accounting

Experts raise concerns over IASB’s Phase II plans to move on from Libor

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

Show don’t tell: BoE’s climate stress test dilemma

Making the test easier to run could come at the expense of building risk management capacity

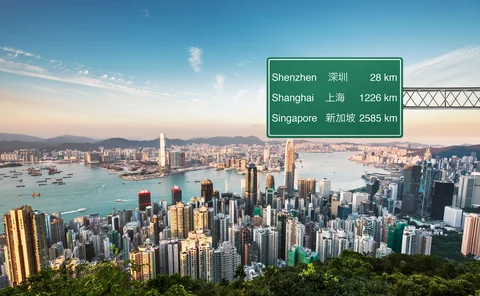

Fund managers look beyond Hong Kong as instability bites

Contingency planning for Hong Kong protests could turn into structural shift for asset management industry

Ex-Credit Suisse quants embrace machine learning

Founders of XAI Asset Management grapple with unsupervised learning and the problems of explainability

How Onyx came from nowhere to conquer oil swaps

In just four years, market-maker has become the largest provider of liquidity in energy derivatives

Grand designs? Time to rein in the Pillar 2 project

Pillar 2 capital add-ons are becoming increasingly elaborate

EU banks failing on op risk and governance – ECB

Central bank raises concerns on board management, risk controls and data aggregation

Growth of shadow banks slowed in 2018 – FSB

Funds susceptible to run risk make up 72% of narrowly-defined non-bank universe

Giant £174bn Sonia swaps trading day may be biggest ever

Mammoth swaps focus on upcoming announcements from the Bank of England’s Monetary Policy Committee

Top five clearing members dominate CCPs

Thirteen of 25 clearing services surveyed have 50% or more open positions in hands of top five members

Liquidity risks acute for popular retail funds – Esma

Eight per cent of real estate fund NAV may be withdrawn over a one-day period

JP Morgan takes $2.7bn capital hit from CECL

Credit card portfolios see allowances for loan losses spike the most

Op risk data: Regulator fines tumble by $5bn in 2019

Also: Julius Baer hit with $150m Cold War-era claim, Barclays pays $87m for bond rigging. Data by ORX News

Credit data: a sharp turning point in CCP credit risk

The credit risk of CCPs is worsening, even as margin requirements rise, writes David Carruthers

No silver bullet for AI explainability

No single approach to interpreting a neural network’s outputs is perfect, so it’s better to use them all

Interpretability of neural networks: a credit card default model example

Recently developed techniques aimed at answering interpretability issues in neural networks are tested and applied to a retail banking case

The market generator

A generative neural network is proposed to create synthetic datasets that mantain the statistical properties of the original dataset

Neuberger Berman gets its Sherlock on

Asset manager deploys quant-cum-sleuth to sniff out portfolio risk