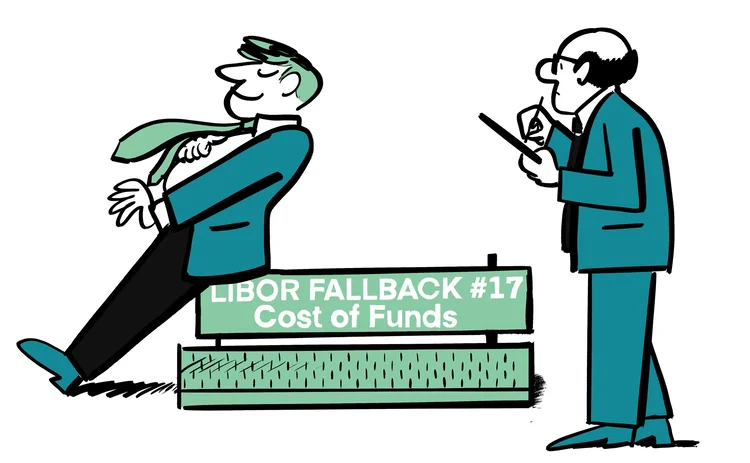

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

For lenders across Europe, the Middle East and Africa, the loss of Libor reference rates could have punishing consequences.

In standard Loan Market Association (LMA) loan documents, the cost of funds – the rate at which banks fund themselves – is the rate to which contracts default: the fallback rate. Envisaged as a stopgap contingency, not a longer-term transition, the cost-of-funds fallback

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Eurex mulls ‘integrated’ prediction market

Dividend derivatives seen as template for event contract expansion

After market whipsaws, banks put new twist on QIS options

Variable strike options aim to catch recoveries after volatility spikes

Broker quoting gap keeps Eurex-LCH basis alive

Lack of differentiated prices helps retain CCP basis

QIS futures debut – but only simple ones for now

Goldman and Societe Generale kick-start Eurex market with equity baskets

Hedge funds trim US swap spreads on tariff decision

Investors cut back asset swap positions as Supreme Court ruling reignites deficit concerns

Opinions split on EU bond balance sheet squeeze

Some say QT and issuance wave will hamper intermediation; others say dealers nimble enough to respond

Eurex looks to shine ‘more light’ on off-book liquidity

Block order book initiative to aid price discovery slated for later this year

CME outage sparks FX soul search

How November’s halt exposed fragile wiring of new futures-led market structure