Swaps data: SOFR swaps slip, futures flip

After a banner month for the young OTC instrument in January, volumes then halved

With Libor rates on borrowed time, the adoption of new risk-free rates (RFRs) is being closely watched. Last month’s data revealed increased activity in derivatives linked to the secured overnight funding rate (SOFR), with both SOFR futures and swaps volume hitting new highs.

This month brings mixed tidings. On the one hand, open interest in SOFR futures traded at CME almost doubled. On the other, SOFR swaps volume is half what it was a month ago.

Meanwhile, RFRs for other major currencies, including sterling and the Australian dollar, are seeing more activity.

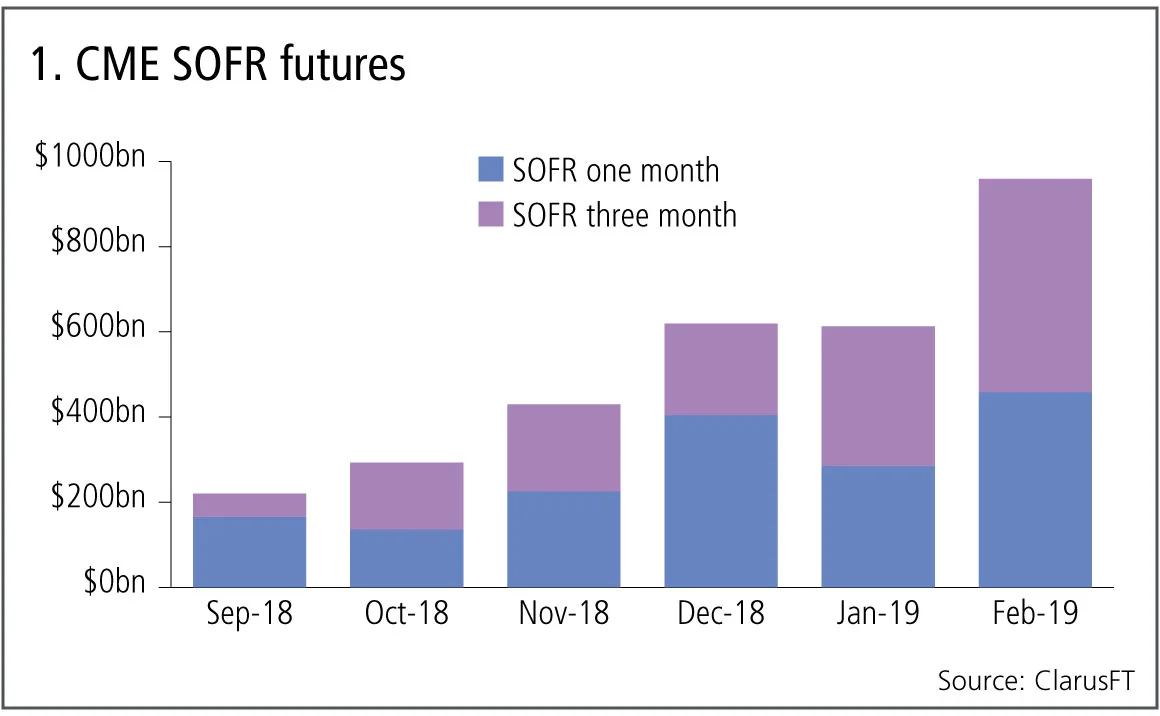

CME SOFR futures

February saw a big jump in volume and open interest.

Figure 1 shows:

- A record month, with volume touching $1 trillion, compared with $600 billion a month before.

- Both one-month and three-month contracts saw higher volumes.

- A clear trend of month-on-month increases.

Just as importantly, open interest almost doubled from $216 billion at the end of January to $400 billion at the end of February.

Futures volumes are coming along very well and it will be interesting to see if the trend holds over the course of this year.

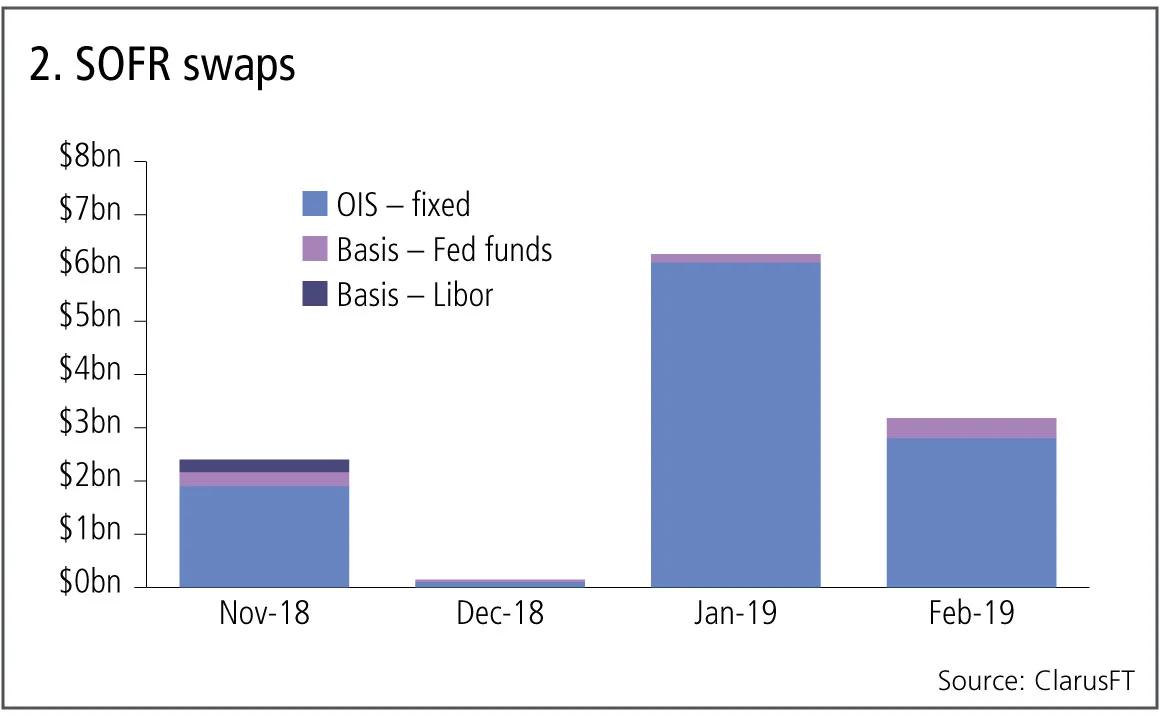

SOFR swaps

What about swap volumes? Using US trade repository data, we can isolate swaps that reference the SOFR index. In this case, the data is disappointing.

Figure 2 shows:

- Volumes are down, with only $3.2 billion gross notional.

- Only 24 trades were reported by US persons.

- Of these, 16 were SOFR versus fixed overnight indexed swaps, and six were SOFR versus Fed funds basis swaps.

SOFR swaps still have a long way to go. But it is early days for the Alternative Reference Rate Committee’s paced transition plan and, as 2019 progresses, we expect to see a sharp pick-up in volume.

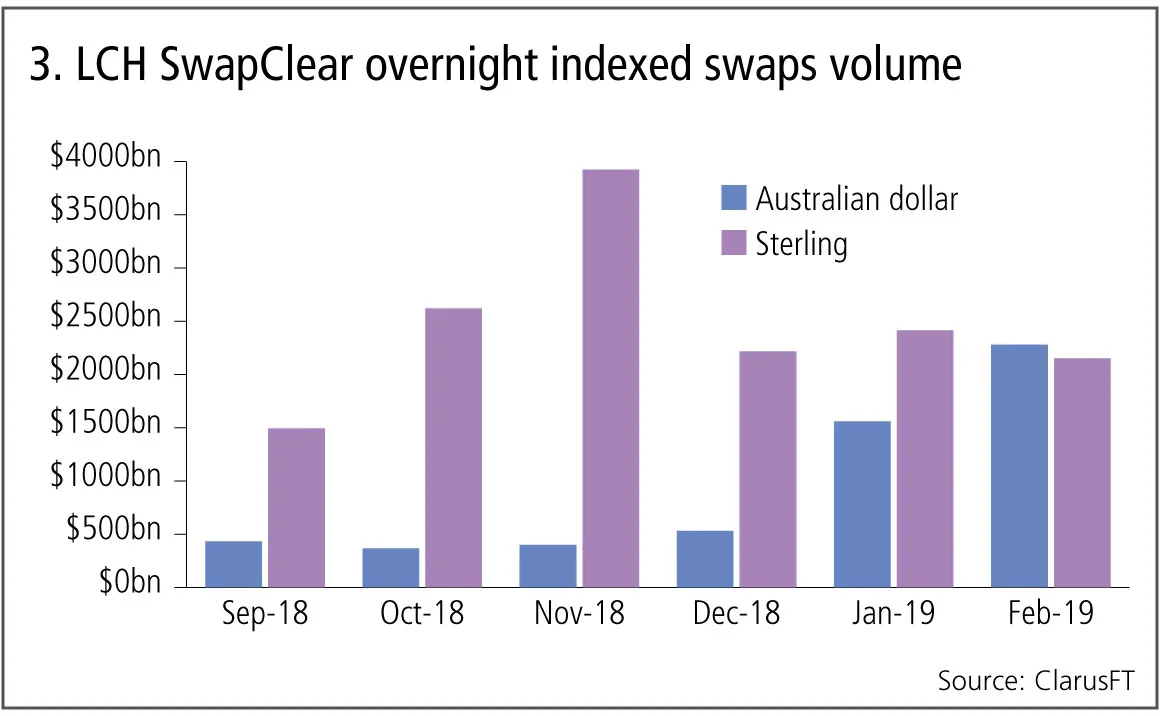

Aonia and Sonia swaps

For comparison, we can look at the RFR replacements for two major currencies: the sterling overnight interbank average (Sonia) and the Reserve Bank of Australia cash rate, also known as Aonia.

Figure 3 shows:

- The chart shows monthly volumes of Australian dollar and sterling OIS swaps at LCH SwapClear.

- For the first time, Australian dollar volume exceeded sterling, a result of recent uncertainty in the direction of the RBA cash rate.

- Sterling Sonia reached an all-time high of $3.9 trillion in single-sided gross notional in November 2018.

While Sonia is only cleared in material amounts at LCH SwapClear, Aonia also sees significant volume at ASX, which had record months in January and February, with A$250 billion and A$414 billion, respectively, of single-sided gross notional.

Aonia and Sonia are healthy markets. While sterling generally sees more gross notional trades in OIS than interest rate swaps, this was also true for Australian dollars in the months of January and February.

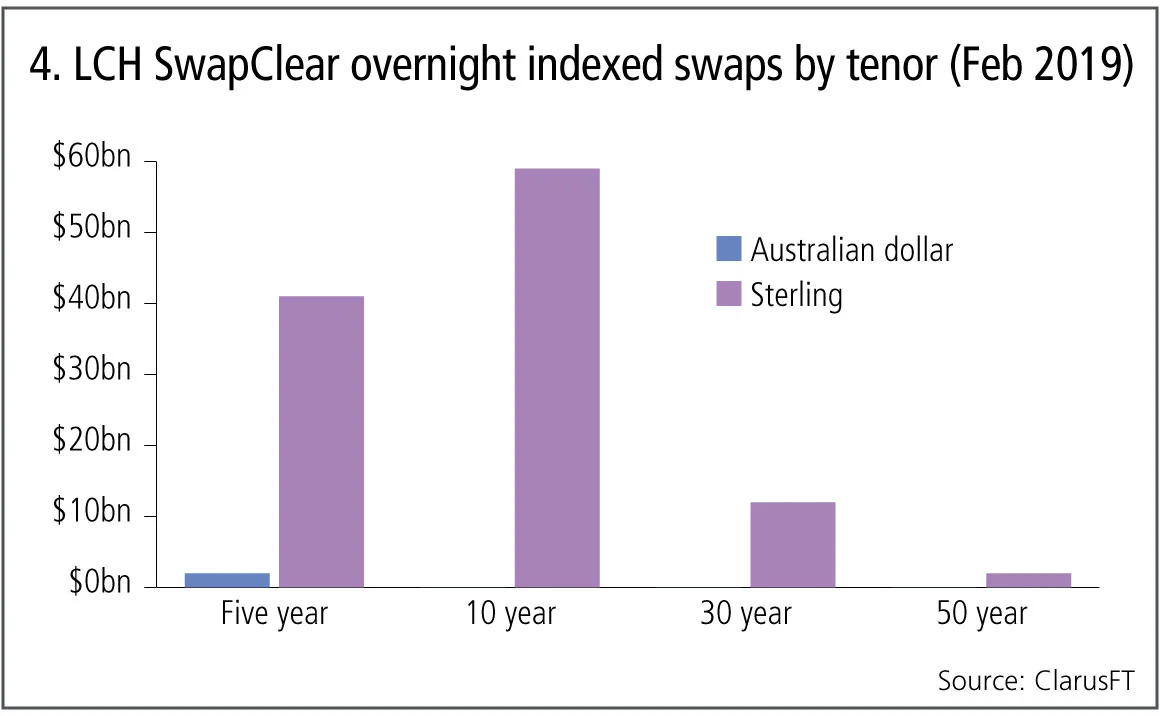

Now, let’s look at the maturities that are traded.

Figure 4 shows:

- This chart excludes tenors below two years, which have the bulk of the volume and would dwarf the remaining tenors if included.

- For the Australian dollar, there is just $2 billion in the two- to five-year bucket, and nothing in longer tenors.

- Sterling has $41 billion single-sided gross notional in the five-year, $59 billion in the 10-year, $12 billion in the 30-year and $2 billion in the 50-year.

Little to no trading happens in Aonia above two years. Sterling has some volume in each of the five-, 10- and 30-year tenors, but there is a long way to go compared with the $2 trillion in volume below two years.

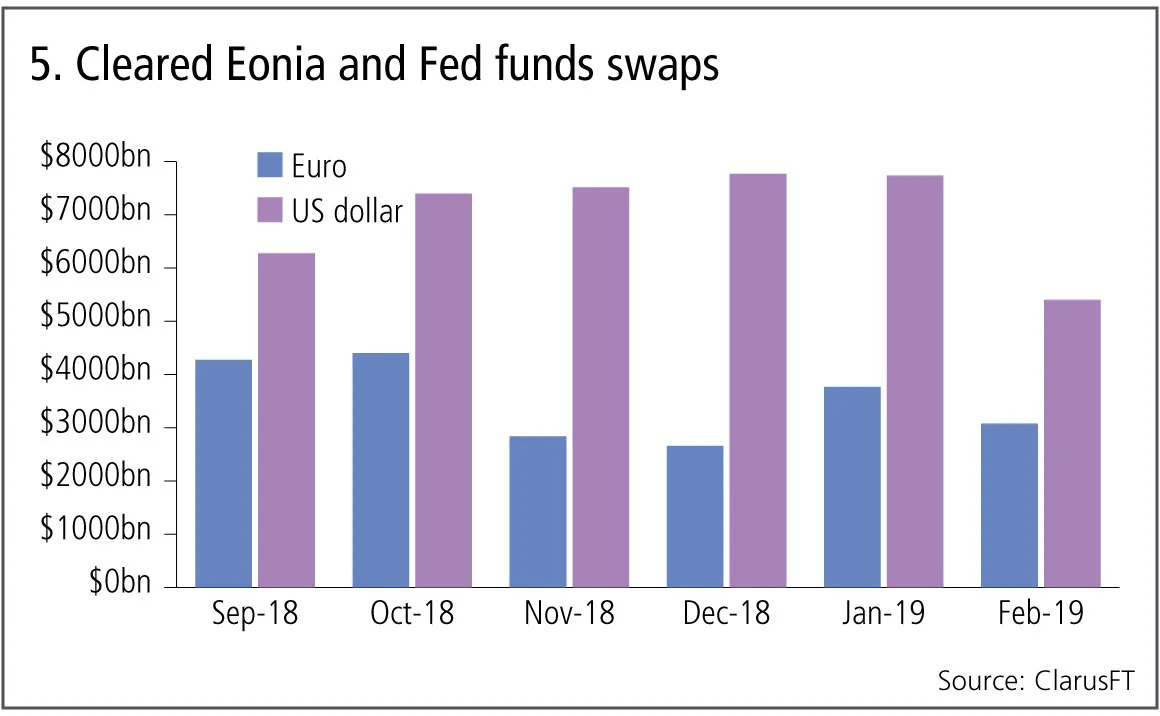

Eonia and Fed funds swaps

Finally, there are two extremely well-traded overnight index swap rates that have not been chosen as replacement RFRs for their respective currencies: Eonia and Fed funds.

Figure 5 shows:

- The chart shows cumulative volume at LCH, CME and Eurex by -currency for each month.

- Fed fund swaps gross notional hit $7.7 trillion in December and -January, but fell sharply in February to $5.4 trillion.

- Eonia gross notional stood at $3.8 trillion in January and $3.1 trillion in February.

This shows how far SOFR has to go. It will take some time to get from the current $3 billion a month to anything approaching the $7 trillion traded in Fed funds. The euro short-term rate (Ester), which is yet to be published, has an even bigger mountain to climb. It will be interesting to see how long it takes for these new RFRs to surpass existing overnight index swaps and Libor swaps.

Amir Khwaja is chief executive of Clarus Financial Technology.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。

オペリスクデータ:FIS、ワールドペイとのシナジー効果の失敗の代償を支払うことに

また:ORXニュースによるデータで、リバティ・ミューチュアル、年齢差別訴訟で過去最高額を支払う;ネイションワイド、不正防止対策の不備。

東京の豊富なデータが市場への影響について明らかにすること

新たな研究により、定量金融において最も直感に反する概念の一つが普遍的であることが確認されました。

資金調達コストの配分:集中型 vs 分散型

サチン・ラナデ氏は、特に担保付融資において、集中化は資本効率と自己資本利益率(ROE)の向上に寄与し得ると述べています。