Swaps data: the big get bigger in cleared swaps

First half of 2018 sees strong growth in cleared OTC derivatives volumes, and a reinforcing of the leaders’ positions, writes Amir Khwaja of Clarus FT

As the second quarter of 2018 ends, with escalating trade tensions dominating the news, continuing uncertainty in European politics and the Federal Reserve maintaining its rate-hike path, it is a good time to take stock of cleared swap volumes.

There is a fairly simple story of growing activity across most of the big cleared products: US dollar and euro interest rate swaps, as well as US and European credit derivatives, and non-deliverable forwards, all posted a big jump in volume compared with the first half of last year.

The exception is yen interest rate swaps, with volumes dropping for both the Japan Securities Clearing Corporation and LCH’s SwapClear. But in another respect, yen swaps confirms the trend – when it comes to market share, the biggest central counterparty in each product has tended to see its position reinforced over the past six months.

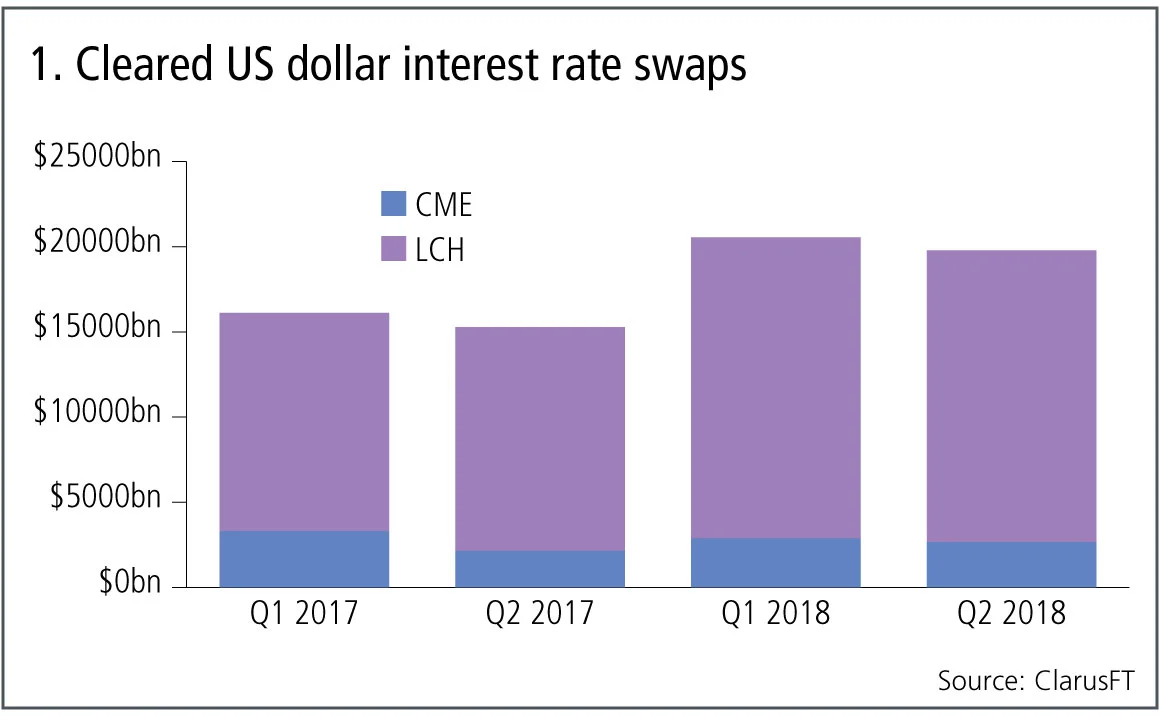

Cleared US dollar swaps

Let’s start with the largest product; cleared US dollar interest rate swaps.

Figure 1 shows:

- Volumes significantly higher in 2018.

- $20.5 trillion in Q1 2018 and $19.8 trillion in Q2 2018.

- LCH SwapClear with 87% share and CME with 13% in Q2 2018.

- LCH SwapClear up 38% in Q1 2018 from Q1 2017 and 30% in Q2 2018 from Q2 2017.

- CME over-the-counter down 13% in Q1 2018 and up 24% in Q2 2018.

- This year has brought two strong quarters, and we also know from underlying data that a number of days in the second quarter of 2018 saw record – or close to record – daily cleared volumes.

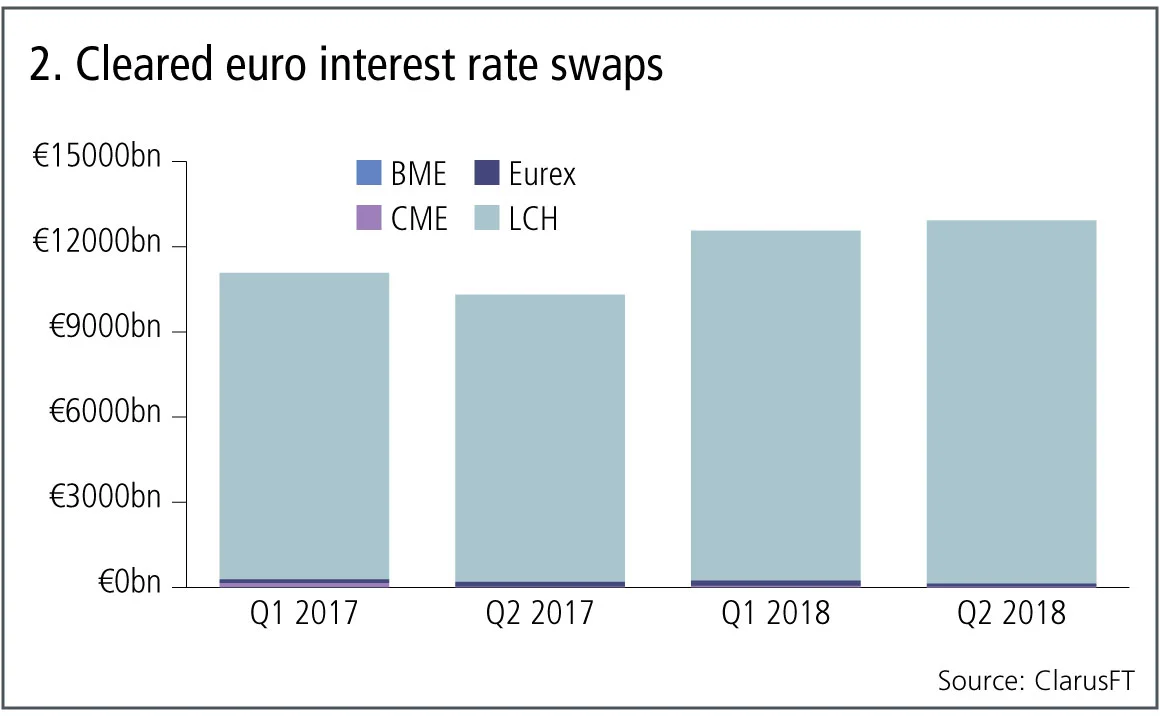

Cleared euro swaps

Next, the second-largest product – cleared euro interest rate swaps.

Figure 2 shows:

- Volumes again significantly higher in 2018.

- €12.6 trillion in Q1 2018 and $12.9 trillion in Q2 2018.

- LCH SwapClear with 99% volume share in Q2 2018.

- LCH SwapClear up 14% in Q1 2018 and 27% in Q2 2018.

- Eurex up 38% in Q1 2018 and down 36% in Q2 2018.

- CME OTC down 61% in Q1 2018 and down 24% in Q2 2018.

- BME with tiny volume in 2017, but little in 2018.

LCH SwapClear continues its long dominance in euro volumes with no evidence of any increase in market share at Eurex – despite some reporting to the contrary.

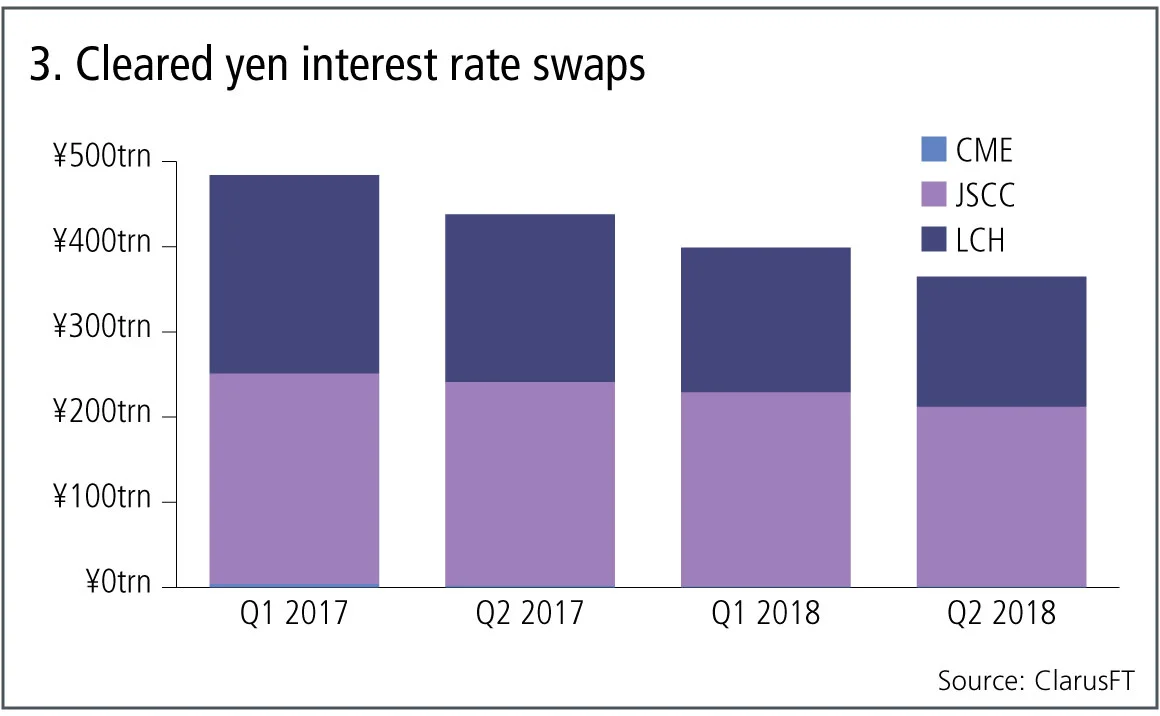

Cleared yen swaps

And now, looking at cleared yen interest rate swaps.

Figure 3 shows:

- Volumes for yen on a downward trend.

- ¥400 trillion in Q1 2018 and ¥365 trillion in Q2 2018.

- JSCC with 58% share and LCH SwapClear with 42% in Q2 2018.

- JSCC down 8% in Q1 2018 and down 12% in Q2 2018.

- LCH SwapClear down 27% in Q1 2018 and 22% in Q2 2018.

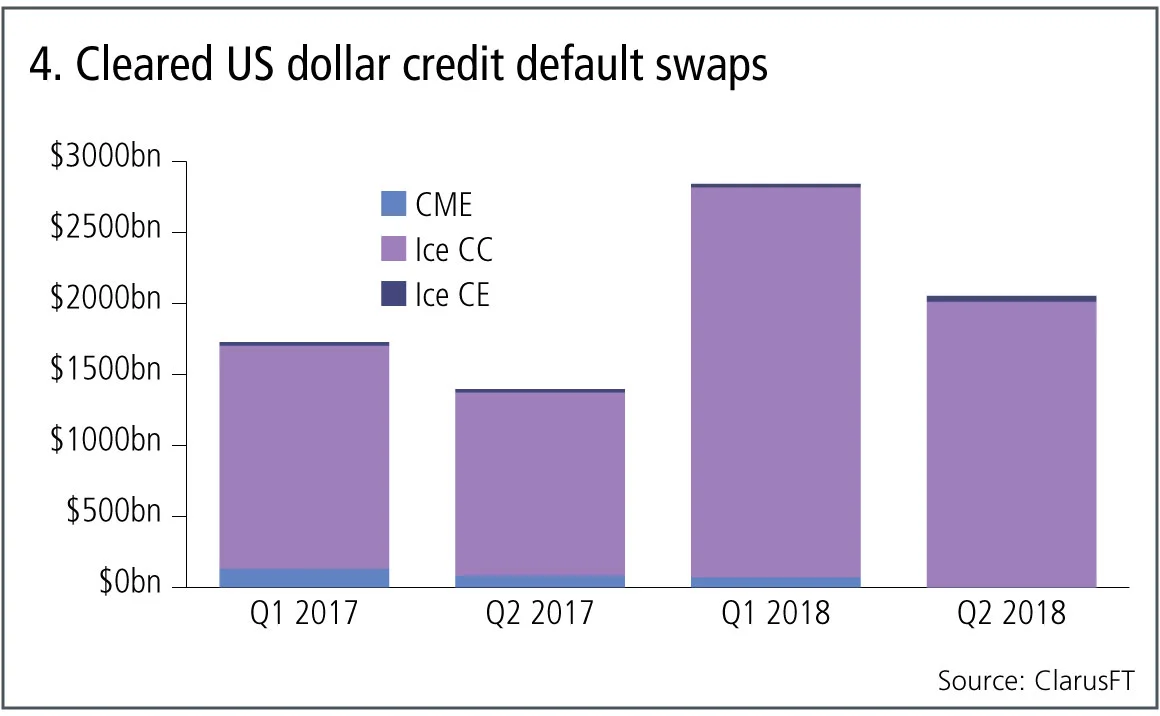

Cleared US dollar credit default swaps

Let’s now switch focus to credit derivatives and the volume of credit indexes and single names in US dollars.

Figure 4 shows:

- Volumes significantly higher in 2018.

- $2.8 trillion in Q1 2018 and $2 trillion in Q2 2018.

- As March is the index roll month, Q1 volume is inflated by roll -volumes.

- Ice Clear Credit dominates with 98% share.

- Ice Clear Credit up 75% in Q1 2018 and 56% in Q2 2018.

- CME shutting down its service in Q2 2018.

Cleared credit derivatives volumes showing even higher growth than cleared interest rate swaps, though a much smaller market with $2 trillion to $20 trillion in gross notional over a quarter.

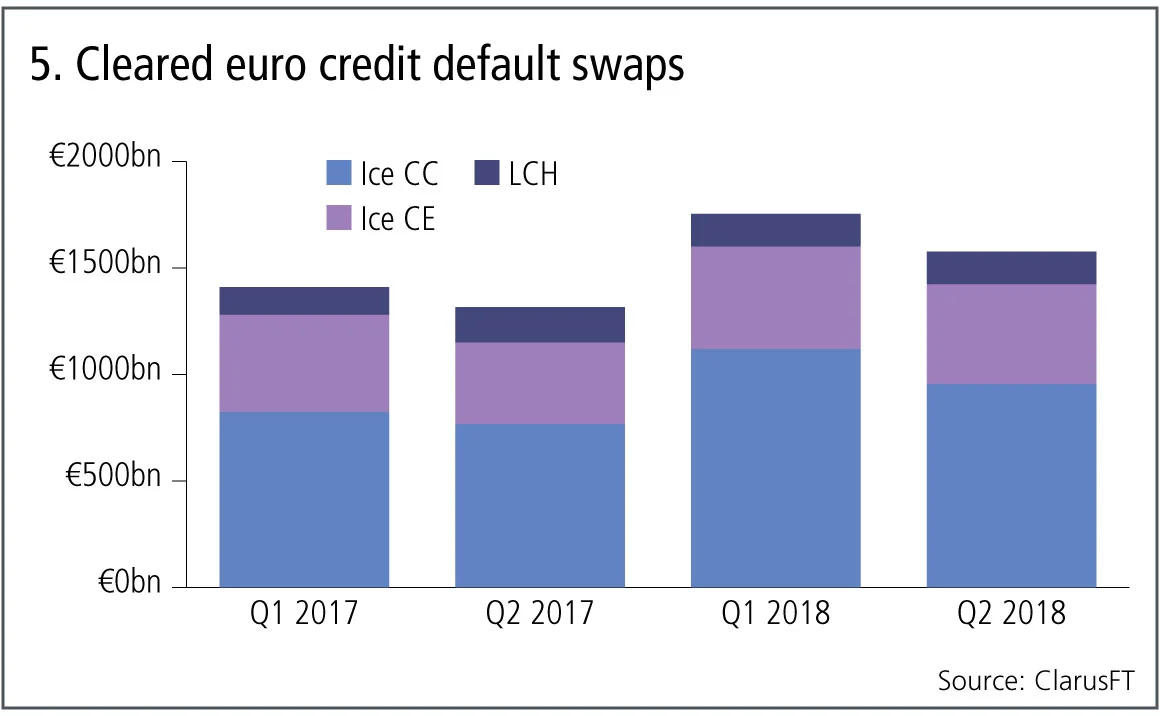

Cleared euro credit default swaps

Next, let’s look at the volume of credit indexes and single names in euro.

Figure 5 shows:

- Volumes also significantly higher in 2018.

- €1.75 trillion in Q1 2018 and €1.6 trillion in Q2 2018.

- Ice Clear Credit with 60% share, Ice Clear Europe 30% and LCH CDSClear with 10%.

- Ice Clear Credit up 36% in Q1 2018 and 24% in Q2 2018.

- Ice Clear Europe up 6% in Q1 2018 and 22% in Q2 2018.

- LCH CDSClear up 17% in Q1 2018 and down 8% in Q2 2018.

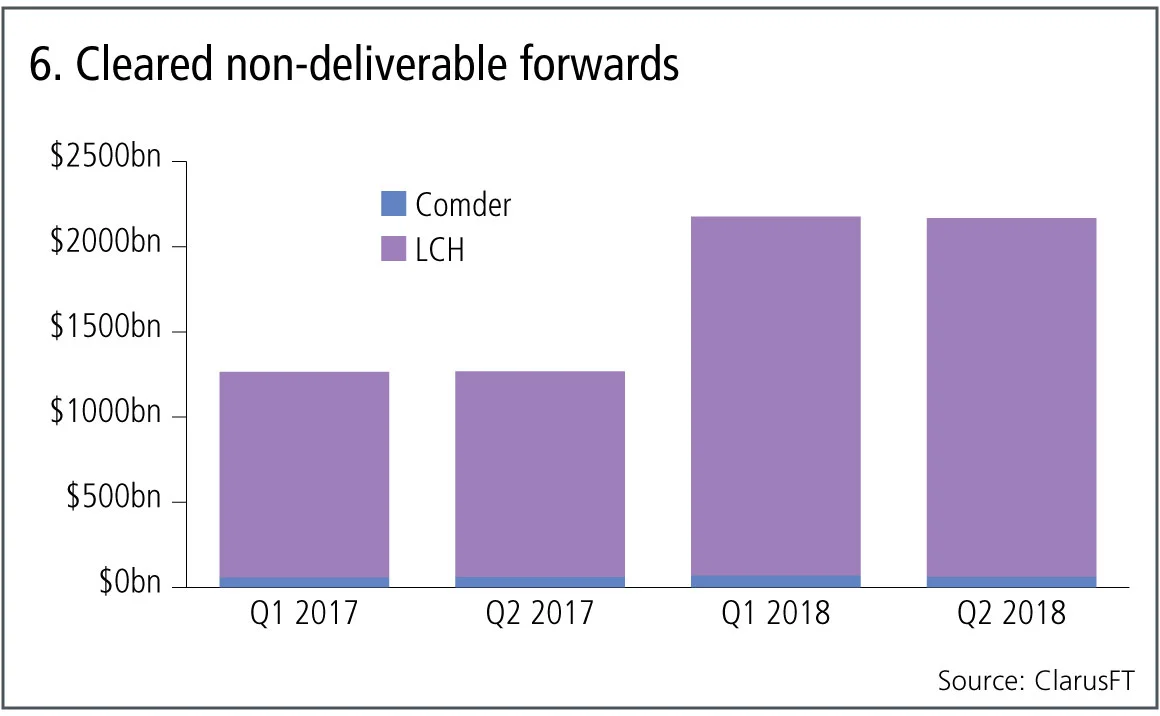

Cleared non-deliverable forwards

Finally let’s look at cleared non-deliverable forwards.

Figure 6 shows:

- Volumes again significantly higher in 2018.

- $2.2 trillion in Q1 2018 and Q2 2018.

- LCH ForexClear dominant with 97% share.

- LCH ForexClear up 74% in Q1 2018 and 74% in Q2 2018.

- Comder up 22% in Q1 2018 and 4% in Q2 2018.

Cleared non-deliverable forwards volumes are exhibiting the highest growth rates of any of the products we have covered today.

In fact, with the exception of yen interest rate swaps, all the other major cleared OTC derivatives we have looked at are significantly up in 2018 compared with 2017. In each case, the bulk of volume growth has been captured by the clearing house with the largest share in that product, and there is no visible material change in market share.

It will be interesting to see whether the upcoming quarters maintain the growth trend.

Amir Khwaja is chief executive of Clarus Financial Technology.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。

オペリスクデータ:FIS、ワールドペイとのシナジー効果の失敗の代償を支払うことに

また:ORXニュースによるデータで、リバティ・ミューチュアル、年齢差別訴訟で過去最高額を支払う;ネイションワイド、不正防止対策の不備。

東京の豊富なデータが市場への影響について明らかにすること

新たな研究により、定量金融において最も直感に反する概念の一つが普遍的であることが確認されました。