Credit data: UK retail sector’s woes continue

High street fails to get over Christmas slump; elsewhere, global PDs remain in flux, writes David Carruthers of Credit Benchmark

If Britain is a nation of shopkeepers, it is not presently a happy one. The UK’s looming exit from the European Union has been widely blamed for damaging confidence among employers, which has had the knock on effect of damping wage growth and, in turn, eroding consumer confidence. The rise in import costs stemming from the collapse in sterling that followed the vote certainly hasn’t helped.

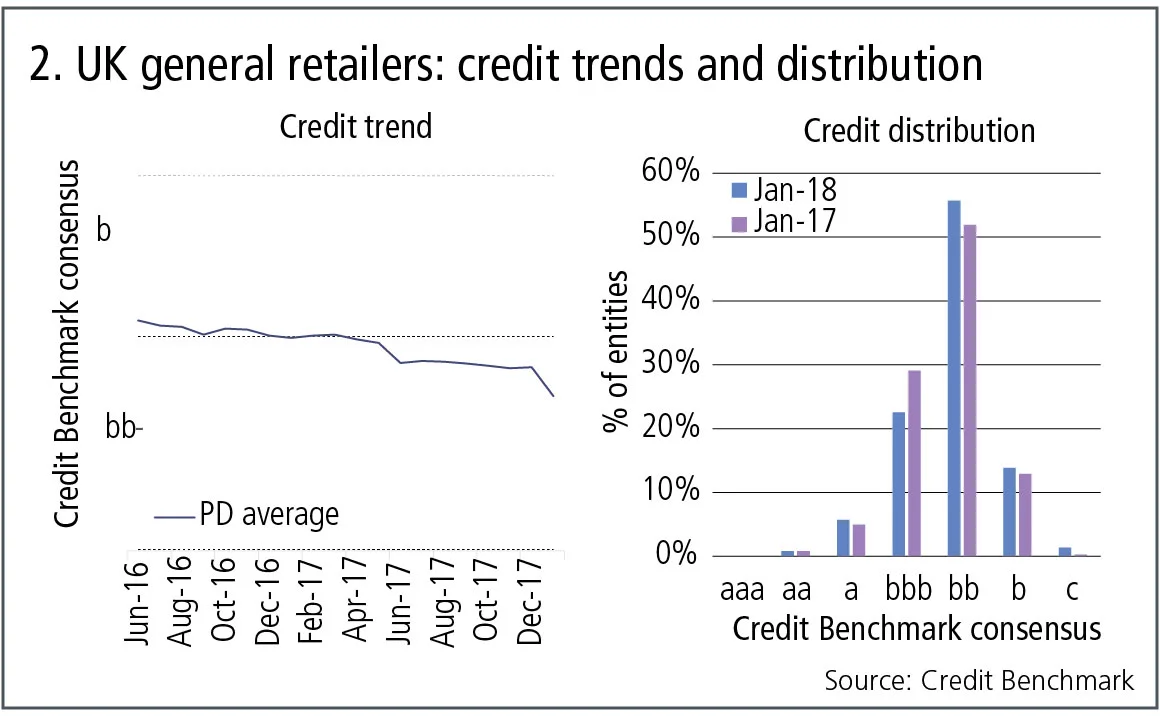

The effects on the high street have been calamitous (see figure 2): the surprise 1.4% drop in UK retail sales data in the key month of December was followed by a flat January, with sales growing just 0.1%. Overall, sales volume growth in 2017 was the lowest since 2013. Rising costs and weak demand, coupled with the impact of the inexorable shift towards online shopping among consumers, has led some British mainstays to consider closing stores (clothes retailers such as Debenhams and New Look) while others have recently fallen into administration (children’s store Toys R Us and electrical goods retailer Maplin).

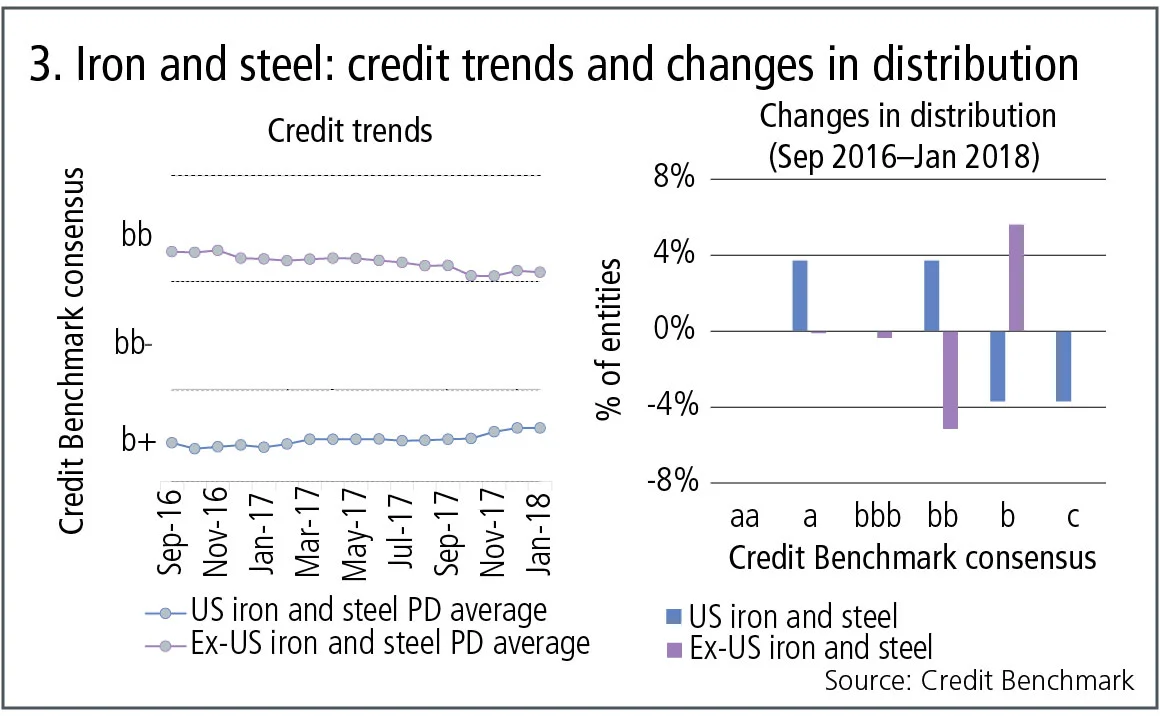

Elsewhere, the credit outlook for global corporates across a range of sectors finds itself in an odd state of equilibrium: upgrades dominate downgrades in three out of nine reported industries; three industries are dominated by downgrades; and three are balanced. The global steel sector – currently wrestling with US president Donald Trump’s imposition of protectionist tariffs – is a case in point (see figure 3). Probabilities of default (PDs) for US steelmakers continue to steadily improve, while that of non-US steelmakers continues to decline – though the former are coming off a much lower base, and are yet to match the latter in terms of average credit quality.

Global credit industry trends

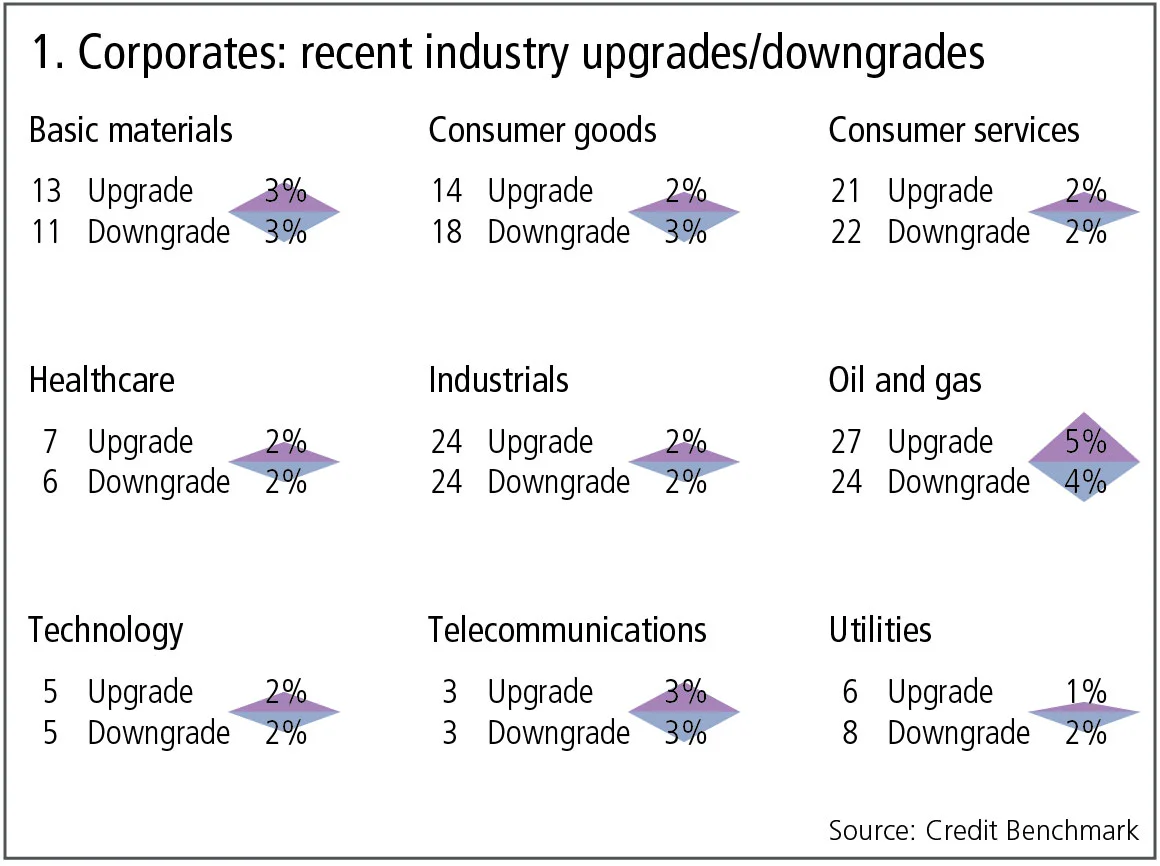

Figure 1 shows industry migration trends for the most recent published data.

Figure 1 shows:

- Overall, 3% of the global corporates obligors have improved and 3% show a deterioration. Compared with the previous month, the imbalance between upgrades and downgrades has decreased.

- Basic materials and oil and gas continue to show a balance in favour of upgrades, continuing their recent patterns.

- In healthcare, upgrades continue to outweigh downgrades after a period where downgrades dominated.

- Consumer goods have returned to their recent pattern of downgrades outnumbering upgrades.

- After favouring upgrades for a number of months, utilities now show a balance of downgrades.

- Consumer services, industrials, technology and telecommunications are balanced or close to balanced.

UK retail

Figure 2 shows credit risk trends and the credit distribution for 370 large UK companies in the general retail sector.

Figure 2 shows:

- The left-hand chart shows that the credit risk of UK general retailers has been increasing over the past 20 months.

- The sector was downgraded from bb to bb– in April 2017. The average probability of default (PD) increased by 20% between January 2017 and January 2018.

- The right-hand chart shows that more than 70% of the UK general retailers are now viewed as non-investment grade, an increase from 65% in January 2017.

US steel

Donald Trump’s presidential campaign promised to protect the US steel industry and boost employment in the Rust Belt; the industry currently employs around 80,000, down from its peak of 700,000 in the 1950s. The latest executive order imposes 25% tariffs on all steel imports, and some mothballed mills are already coming back on stream as a result. Various countries are lobbying for exemptions but the main target is China, which now produces half of the world’s steel.

Figure 3 shows the contrasting credit trends for US and ex-US steel companies since September 2016. This sample officially covers iron and steel companies.

Figure 3 shows:

- Credit risk in US iron and steel has been steadily improving, while credit risk for ex-US iron and steel has deteriorated. If these trends continue, the typical credit rating of ex-US iron and steel companies could drop from bb to bb–.

- US iron and steel has a lower level of credit quality over this period; but based on recent trends the US and ex-US indexes are slowly converging.

- Over the past 15 months, US iron and steel has seen an improvement in its lower-quality names while ex-US iron and steel has seen deterioration in the a, bbb and bb categories.

Global mining

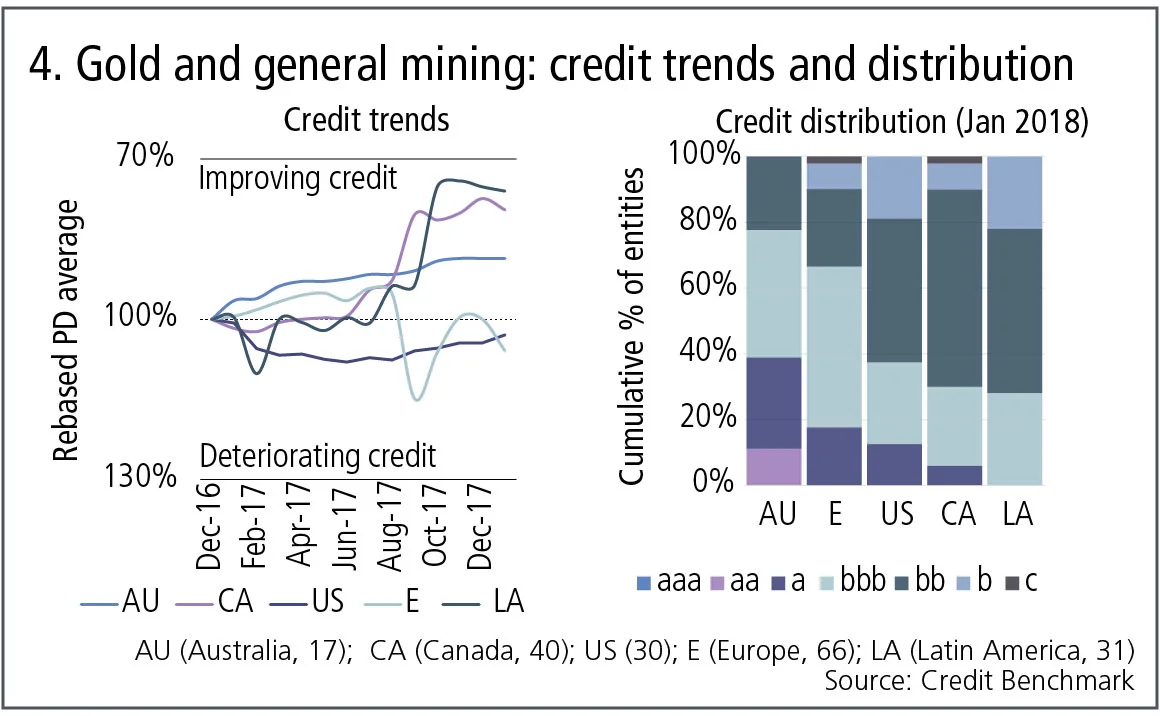

The past few years have been volatile for the global mining industry. Yields are declining as existing ore bodies are worked out, which is constraining supply. At the same time, battery-driven demand for “tech metals” – nickel, lithium, vanadium, cobalt, graphite and a range of rare earths – is set to accelerate. This is mainly due to the wider global adoption of electric vehicles, solar cells and mobile phones; as well as the broader need to store electricity from renewable sources. Figure 4 plots the 2017 credit trends for 184 international companies in the gold and general mining sectors.

Figure 4 shows:

- The left-hand chart shows that credit quality of Canadian and Latin American mining companies has improved in 2017, especially in the final quarter of the year.

- Australian mining companies show a steady upward trend.

- Europe has been very volatile – partly a reflection of the large but diverse sample of companies in the index.

- The US is showing a slight recovery after a decline in the first half of the year.

- The right-hand chart shows that 78% of Australian mining companies are investment grade; for Canada, Latin America and the US, the figure is closer to 40%.

Global media

The global media industry faces some major challenges. Sluggish consumer spending has pushed various companies to cut back on advertising spend in order to restore margins. Procter & Gamble, for example, reduced its digital marketing spending by $100 million in Q2 of 2017. This is one example of a growing trend that questions the value of online advertising in particular – a previously lucrative area for advertising companies. Traditional media companies are suffering from online competition; companies such as Netflix have overturned the traditional business model for film and TV content.

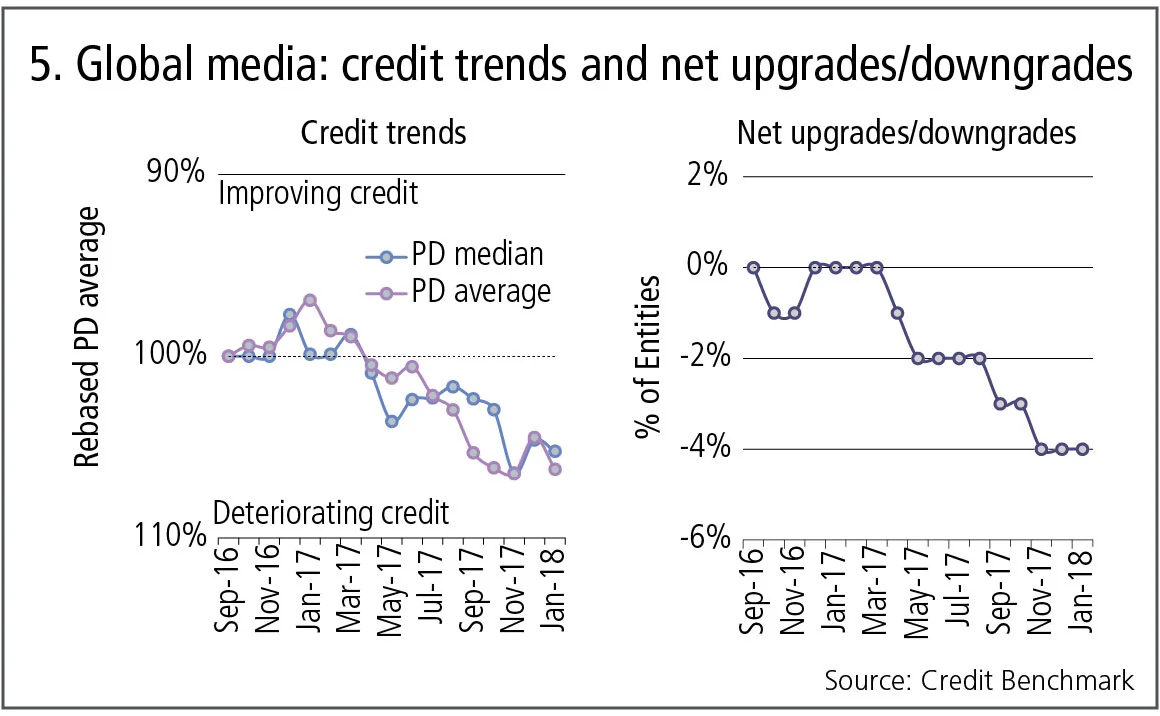

Figure 5 shows the credit trends for the media industry over the past 15 months.

Figure 5 shows:

- The left-hand chart shows that from March 2017, there has been an overall deterioration in both the PD median and PD average of the global media industry.

- Over time, the number of downgrades has outweighed upgrades, with a net 4% of entities being downgraded across the 15-month time period.

About this data

The Credit Benchmark dataset is based on internally modelled credit ratings from a pool of contributor banks. These are mapped into a standardised 21-bucket ratings scale, so downgrades and upgrades can be tracked on a monthly basis. Obligors are only included where ratings have been contributed by at least three different banks, yielding a total dataset of roughly 14,500 names, which is growing by 5% per month.

David Carruthers is head of research at Credit Benchmark, a credit risk data provider.

Editing by Tom Osborn

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

ポッドキャスト:ピエトロ・ロッシ氏による信用格付けとボラティリティ・モデルについて

確率論的手法とキャリブレーション速度の向上により、クレジットおよび株式分野における確立されたモデルが改善されます。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

大げさな宣伝を超えて、トークン化は基盤構造を改善することができる

デジタル専門家によれば、ブロックチェーン技術は流動性の低い資産に対して、より効率的で低コストな運用手段を提供します。

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。