Monthly credit data review: UK corporates’ post-Brexit slide

UK financials show steady post-Brexit decline in credit quality; EU financials now on par

It’s all there in the data, analysts are fond of saying. Since the UK voted to leave the European Union in June 2016, there has been a steady deterioration in average credit ratings for UK corporates and – since the end of that year – for UK financial firms, too. At the same time, EU corporates and financials have both shown steadily improving average consensus ratings, with the result that the credit quality of EU financials now matches that of UK corporates, and could soon move higher.

Elsewhere, hurricanes Harvey and Irma have wrought devastation on the Caribbean and the Gulf of Mexico in recent weeks – and could yet spell trouble for the reinsurance sector, this month’s review of credit quality data suggests (see box: About this data). Traditional US insurers are predicted to bear the brunt of losses – and the range of credit riskiness is already significantly wider for North American firms than their European peers, on average.

Global credit industry trends

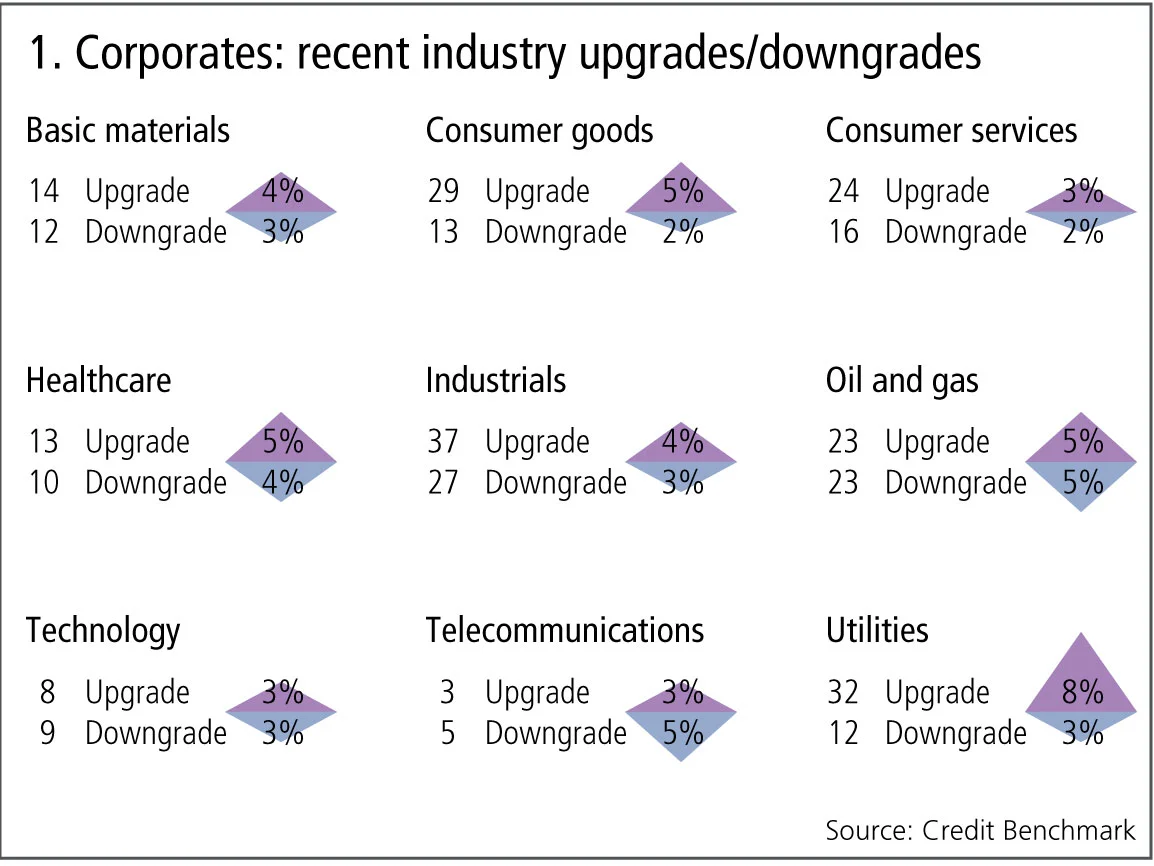

Figure 1 shows:

- Upgrades continue to outnumber downgrades in consumer goods and healthcare, although healthcare is now much closer to being in balance.

- Consumer services now show upgrades outnumbering downgrades – a reversal of recent trends.

- The run of upgrades across the global oil and gas industry continues, but the most recent data shows that downgrades are catching up. Hurricane Harvey is likely to have a significant negative impact on oil companies with exposure to the Gulf of Mexico.

- The recent trend in technology that favoured upgrades also shows a pause this month.

- Utilities continue to show upgrades outnumbering downgrades by more than 2:1.

Brexit update

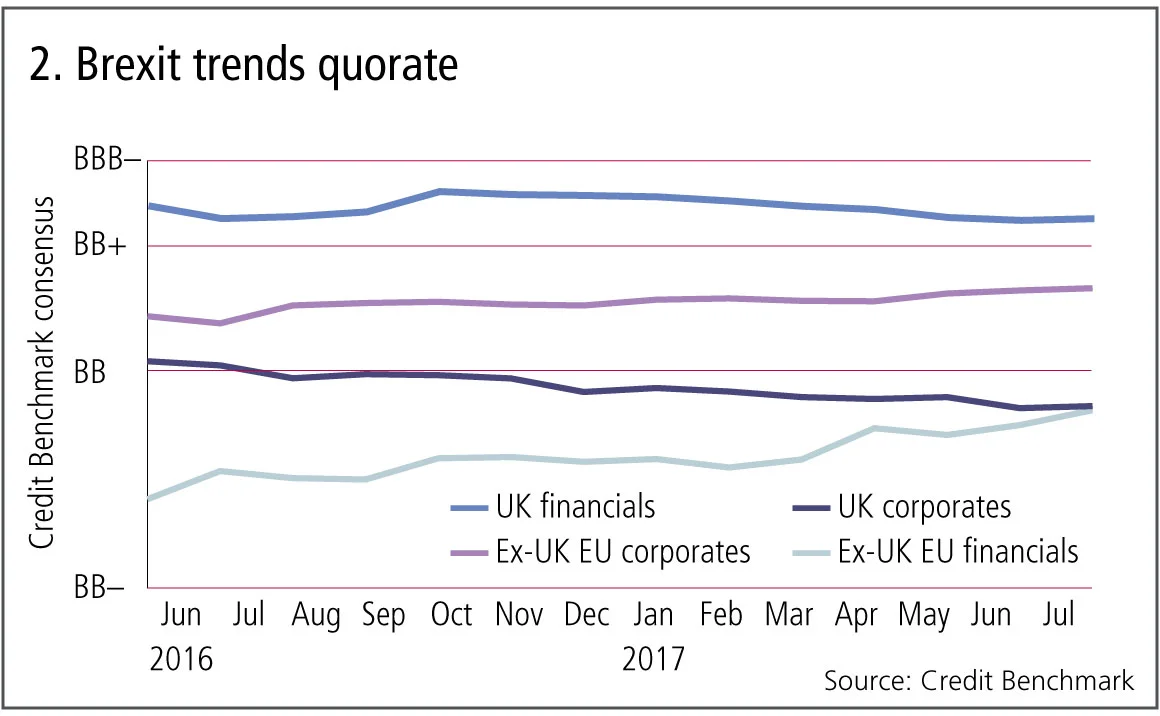

Although the full impact of Brexit is uncertain, overseas earners have clearly benefited from sterling weakness over the past year. However, the general corporate credit picture is more mixed. Figure 2 shows credit trends for corporates and financials in the UK and in the EU ex-UK.

Figure 2 shows:

- There has been a slight, but steady, deterioration in the average credit consensus rating for UK corporates since the EU referendum last year.

- UK financials have also deteriorated, although this trend only became established late last year.

- EU corporates and financials both show a steadily improving trend. The credit quality of EU financials now matches that of UK corporates, and could move higher.

Reinsurance

Hurricanes Harvey and Irma set new records, in terms of strength, duration and damage. The US government will take much of the financial strain, but smaller Caribbean nations will need aid, and the region as a whole is chronically underinsured.

For the reinsurance industry, the news is mixed. Some traditional insurers – especially in the US – will experience large losses. Loss rates have been low over the past decade, which has attracted an inflow of capital into the sector from non-traditional insurance providers, including pension funds and hedge funds. The reinsurance industry expects some of this excess capacity to now drop out, which is likely to mean harder rates.

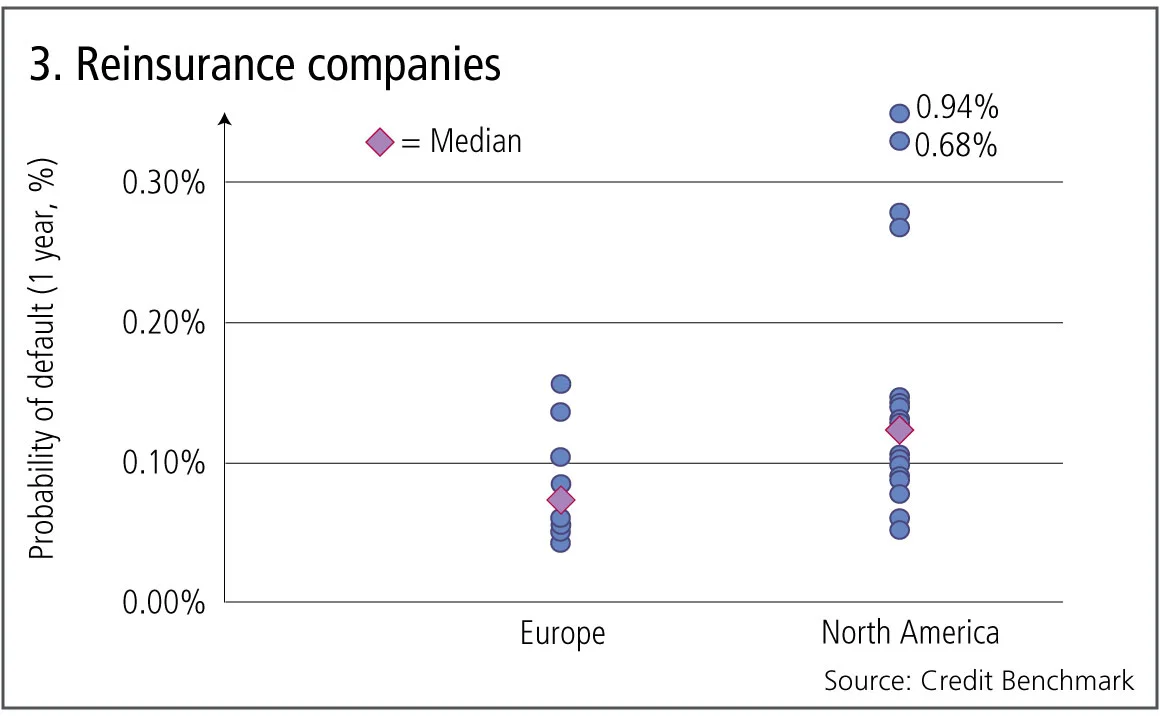

The distribution of credit risks for European and North American insurers is shown in figure 3.

Figure 3 shows:

- European reinsurance companies have median one-year probability of default (PD) of less than 10 basis points.

- The median PD for North American reinsurance companies is more than 50% higher than that of the Europeans.

- The range of credit risks for North American insurance companies is significantly wider, especially in the high-risk tail. This is partly because there are more companies in the sample (19 in North America, against eight in Europe), but the lower bounds are similar for both groups.

- Two of the North American reinsurance companies are below investment grade.

UK pension funds

The Bank of England has hinted the UK base rate may finally be about to move higher. This could also have a positive impact on long rates, including annuity rates. This would be good news for defined benefit pension schemes, which are currently facing large and growing deficits. These, in turn, have been a drag on corporate profitability – so any improvement will have benefits beyond the pensions sector.

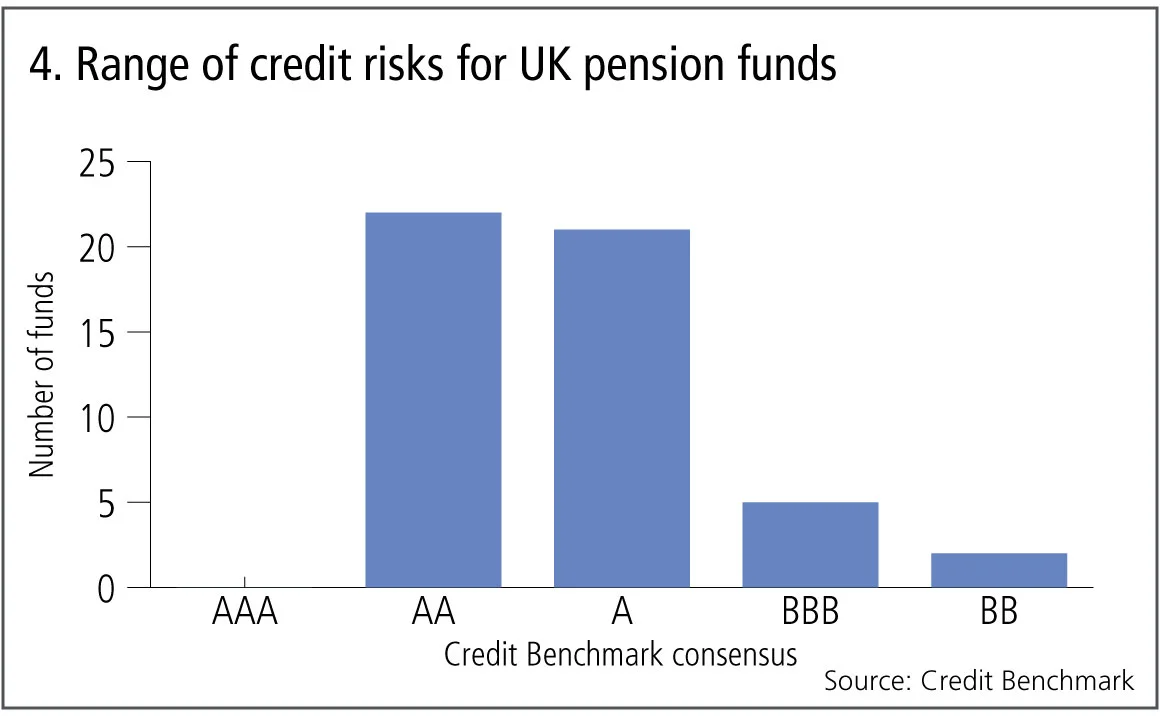

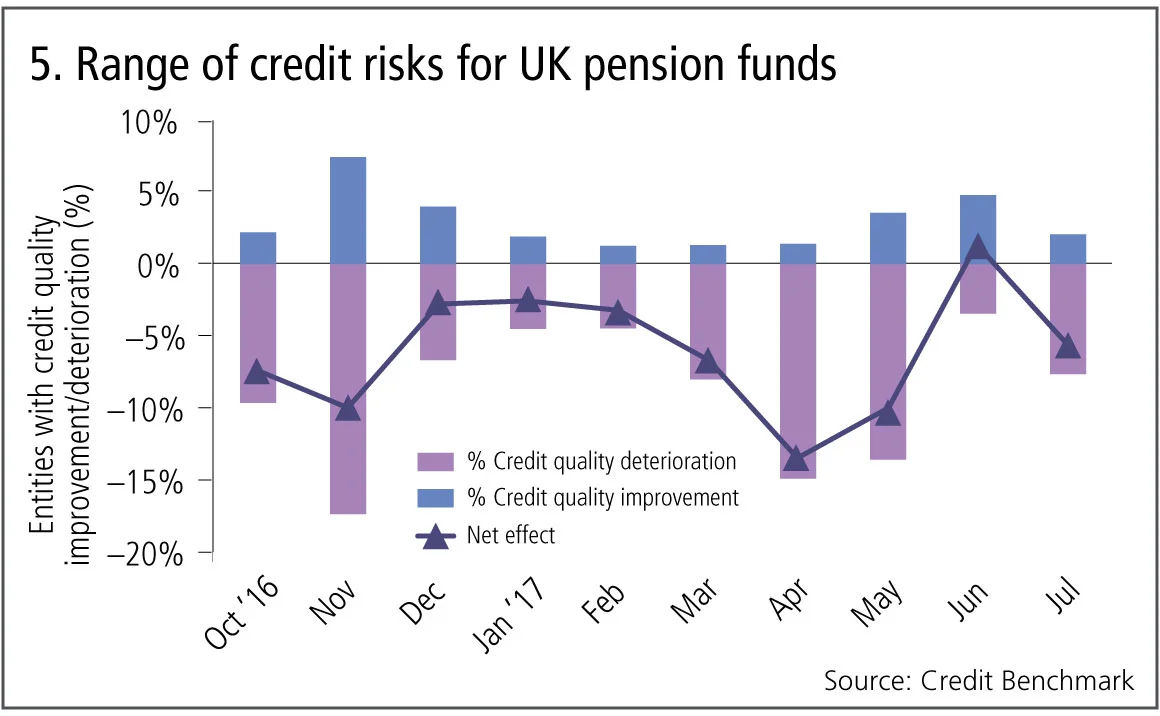

The range of credit risks for 50 UK pension funds and credit risk trends in UK pension funds over the past 10 months are shown in figure 4.

Figures 4 and 5 show:

- There are no funds with consensus ratings of AAA.

- The majority (43) have consensus ratings of AA or A.

- Five are rated as BBB.

- Two out of the 50 are viewed as non-investment grade (BB+ or lower). These are London Borough of Bexley and Tyne & Wear.

- A trend towards credit quality deterioration over the past 10 months.

- This sample includes the Pension Protection Fund, viewed as AA.

Developing economy sovereigns

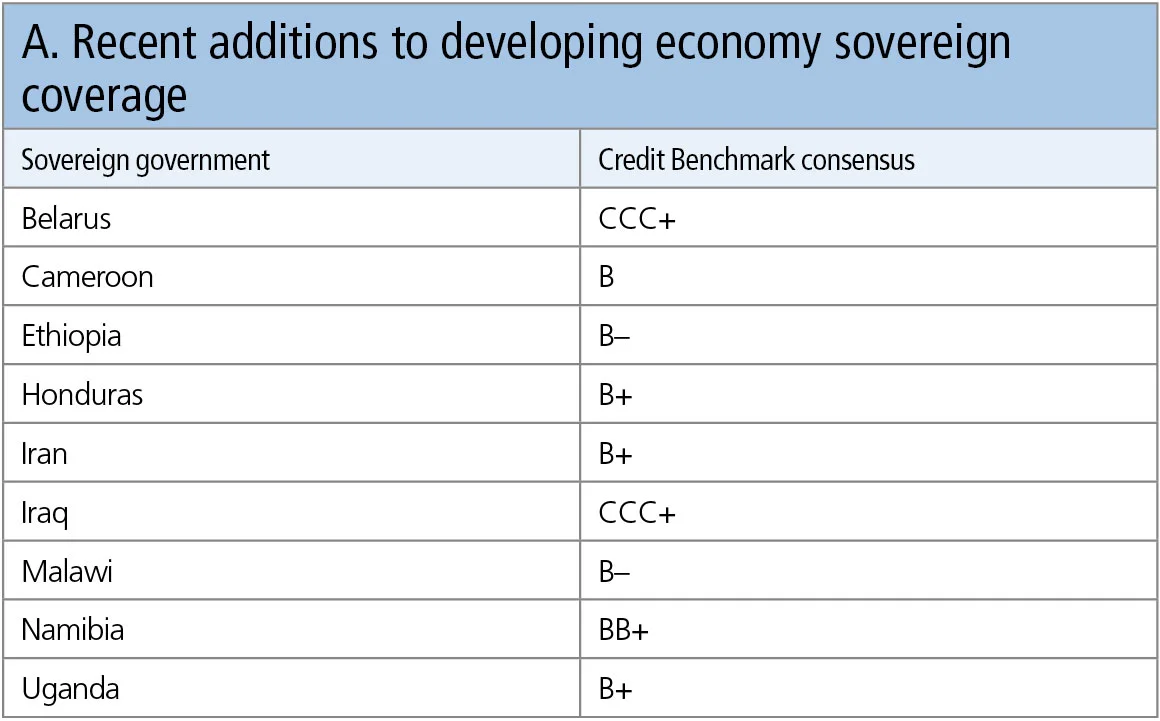

Table A shows the Credit Benchmark consensus for a number of developing economy sovereign nations. Most of these have only now appeared in the bank-sourced dataset, which implies banks are doing increasing business with these sovereign governments. By implication, they are probably also beginning to extend credit to major corporates in these areas.

Table A shows:

- Most of the recent African additions – Cameroon, Ethiopia, Malawi and Uganda – are in the consensus ratings range of B– to B+. Namibia stands out as BB+, just below investment grade.

- Consensus ratings are now available for Iran (B+) and Iraq (CCC+). The case of Iraq, in particular, shows how quickly banks can move into areas of new business as soon as the security situation improves.

- Belarus has recently made the news, conducting joint military exercises with Russia. Russia has recently been moved to investment grade, but Belarus has a long way to go. The current consensus rating is CCC+, the same as Iraq.

More generally, it is worth noting credit views in the B and C categories tend to be more divergent across contributing banks. There are also significant divergences – positive and negative – compared with the main rating agencies.

About this data

The Credit Benchmark dataset is based on internally modelled credit ratings from a pool of 15 contributor banks. These are mapped into a standardised 21-bucket ratings scale, so downgrades and upgrades can be tracked on a monthly basis. Obligors are only included where ratings have been contributed by at least three different banks. The dataset covers more than 10,000 names and is growing by 5% per month.

David Carruthers is the head of research at Credit Benchmark, a credit risk data provider.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

GenAIガバナンスにおけるモデル検証の再考

米国のモデルリスク責任者が、銀行が既存の監督基準を再調整する方法について概説します。

マルキールのサル:運用者の能力を測る、より優れたベンチマーク

iM Global Partnersのリュック・デュモンティエ氏とジョアン・セルファティ氏は、ある有名な実験が、株式選定者のパフォーマンスを評価する別の方法を示唆していると述べています。

IMAの現状:大きな期待と現実の対峙

最新のトレーディングブック規制は内部モデル手法を改定しましたが、大半の銀行は適用除外を選択しています。二人のリスク専門家がその理由を探ります。

地政学的リスクがどのようにシステム的なストレステストへと変化したのか

資源をめぐる争いは、時折発生するリスクプレミアムを超えた形で市場を再構築しています。

オペリスクデータ:FIS、ワールドペイとのシナジー効果の失敗の代償を支払うことに

また:ORXニュースによるデータで、リバティ・ミューチュアル、年齢差別訴訟で過去最高額を支払う;ネイションワイド、不正防止対策の不備。

東京の豊富なデータが市場への影響について明らかにすること

新たな研究により、定量金融において最も直感に反する概念の一つが普遍的であることが確認されました。

資金調達コストの配分:集中型 vs 分散型

サチン・ラナデ氏は、特に担保付融資において、集中化は資本効率と自己資本利益率(ROE)の向上に寄与し得ると述べています。

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics