Commodities

Launched in 1994, Energy Risk is an online publication and in-person events company dedicated to the energy risk management and risk transfer business.

Please visit energyrisk.com for more insight and commentary.

Climate risk taxonomy close, but still a moving target – EC

FCA warns of ‘greenwashing’

Banks team up for ‘Ion replacement’ project

Consortium weighs building fixed income software in potential threat to Ion, the dominant vendor

Ice adds insurance to default waterfall

Protection promises partial recovery of guarantee funds at three CCPs

Quants bring ‘triptych’ of variables to risk measurement

Risk and portfolio managers at La Francaise and LFIS are squeezing more information out of stress tests

Cat risk: why forecasting climate change is a disaster

Forecasters are poles apart on climate-driven catastrophes; insurers fear worse ahead

Morgan Stanley, Wells not sold on AI for credit scoring

Risk USA: Lenders warn on AI model risks and use of non-traditional data

Better risk reporting doesn’t need an IT upgrade

By revisiting certain calculations, new insights into risk and profit drivers can be gained, says data scientist

Energy25: Energy firms turn to next-generation analytics

FIS, Enverus and Eka take to the podium in the inaugural Energy25 technology rankings

The greening of Natixis’s balance sheet

Green weighting factor will be used to adjust the credit RWAs of loans

Barclays, IBM test quantum computing for settlement

New research suggests quantum machines will dramatically improve settlement efficiency

When climate risk starts to bite

Energy firms under increased pressure to assess physical climate risk

A behavioural lens could help manage human risk

Human decision-making needs careful watching. For that, behavioural science can help

Funds look to ‘retrain’ traders as automation takes hold

As technology reshapes markets, nearly a third of buy-side staff will need to gain new skills

Ice, CME shore up clearing house recovery planning

Introduction of VMGH and tear-ups comes amid impasse over CCP recovery and resolution rules

FCA chief calls for EU to extend Brexit clearing exemption

Bailey also urges EU to grant equivalence determinations for UK trading venues

An old fight over margin protections rears its head

CFTC rules on margin and loss limits for separate accounts are being torn up for asset managers

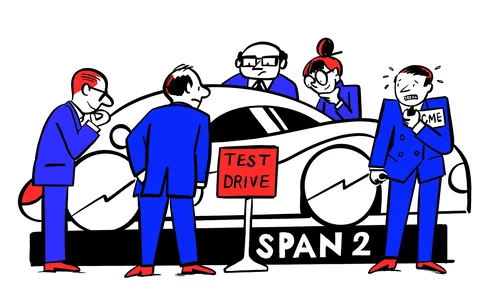

A look under the hood of Span 2, CME’s new margin engine

VAR-based framework has new ways of netting contracts and setting volatility floors and more

CME no longer looking back to Lehman

Changes to rates margin model move CCP into line with rivals

ING issues ESG-linked interest rate swap

Dutch bank takes carrot-and-stick approach on interest rate swap for oil and gas equipment firm

Buy side continues with IM prep despite delays

Firms looking at custodian types, docs and trading strategies to optimise margin

Clients demand access to CCP default auctions

“In a default, we are comfortable taking on risk and can move quickly,” says DRW’s Wilson

The great migration: CCPs ponder life after Span

As CME moves to a value-at-risk methodology, CCPs that license its model look on nervously

Regulators plan to delay IM ‘big bang’ – market sources

Most see final phase of initial margin rules coming a year later, in September 2021

Energy firms grapple with rising customer risk

A case study on developing dynamic risk-based customer screening