Sponsored content

For further information on creating and publishing sponsored content, please click here.

Keeping up with cloud adoption

Risk.net convened a webinar in collaboration with Murex to explore how, as more financial institutions move to the cloud, they can get the most out of their technology investments

The traditional buy versus build trade‑off

Firms undecided between buying from a vendor or building bespoke software can look to Beacon, whose ‘buy-and-build on-top-of’ offering combines the best of both options, writes Alex Sayle, global head of platform engineering at Beacon Platform

Compliance preparations amid uncertain rules

A forum of industry leaders discusses how banks will define individual trading desks under FRTB, whether BCBS 239 compliance projects can help banks meet FRTB risk data challenges, which model validation obstacles banks still face and other key topics

The initial margin challenge – Why the bang just got bigger

With uncertainty abounding as the industry heads into the final phases of implementation of the uncleared margin rules (UMR), Jean‑Paul Botha, delivery lead of financial trade documentation at Thomson Reuters Legal Managed Services, explores the…

Embracing the sea change to come with FRTB

Firms have until 2021 to implement FRTB, and those yet to begin compliance efforts risk putting themselves at a disadvantage. EY‘s financial services risk partners Shaun Abueita and Sonja Koerner explore the current level of readiness within the industry…

Hong Kong ETFs spotlighted amid growing A-share interest

Hong Kong’s exchange-traded fund market takes centre stage in international investors’ foray into Chinese markets, experts say. By Hong Kong Exchanges and Clearing (HKEX)

Beyond Libor special report 2018

Financial markets are sitting on a time bomb. In just over three years’ time, the rate that underpins $350 trillion of financial contracts could disappear. Whether by choice or by regulatory force, transition away from discredited Libor rates is…

Asia embraces intelligent automation

Asia’s adoption of new tools and processes has gained significant momentum, with increased automation now a primary focus for many financial firms. Paul Worthy, head of Japan at Tradeweb, explores how this change has come about, and how firms can use the…

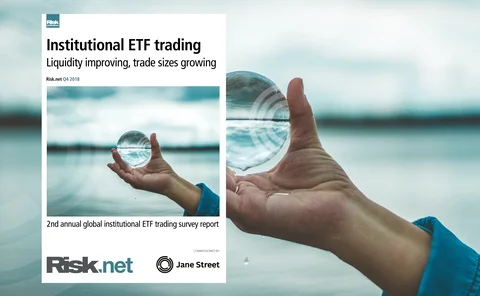

Institutional ETF trading: Liquidity improving, trade sizes growing

Sponsored survey report: Jane Street

Ripple effect: The impact of moving away from Libor

Sponsored Q&A

IFRS 9 versus IAS 39: Opportunities in changes to hedge accounting

With financial reporting in a state of flux amid the introduction of several new accounting standards, many corporates may feel overburdened by the need to ensure accounting compliance to take full advantage of IFRS 9 from the point of adoption. Robert…

Transitioning beyond Libor: Some key considerations

Liang Wu, vice-president of financial engineering and head of CrossAsset product management at Numerix, explores the transition to Libor alternative rates and the impact on curve construction practices

Is Libor going away?

Amid widespread expectation that Libor will soon be discontinued, questions are being asked around whether the transitioning towards risk-free rates will prove too onerous to achieve. Christopher Dias, principal, advisory, at KPMG, explores whether the…

Ibor transition valuation and risk management considerations

The impending move from interbank offered rates to alternate reference rates will require important changes to many valuation and risk management processes and infrastructure. EY Financial Services’ Shankar Mukherjee, Michael Sheptin and John Boyle…

RFR valuation challenges

A new system of interest rate benchmarks for all major currencies is emerging. These new benchmarks will replace interbank funding rates with risk-free rates (RFR). This article by LPA focuses on valuation challenges during the transitional period to new…