This article was paid for by a contributing third party.More Information.

RFR valuation challenges

Need to know

- Migration to a new overnight risk-free rate (RFR) will change the value of existing positions.

- It will be almost impossible to distinguish between RFR effects and general market movements.

- Change of discounting and price-aligning interest on a central counterparty portfolio will cause a discrete change in reported valuation.

- Understanding the valuation impact is crucial during the migration from legacy benchmarks Eonia and the effective federal funds rate.

A new system of interest rate benchmarks for all major currencies is emerging. These new benchmarks will replace interbank funding rates with risk-free rates (RFR). This article by LPA focuses on valuation challenges during the transitional period to new overnight RFRs faced by market participants trading in euros and US dollars

The post-interbank offered rate (Ibor) system will be based on overnight risk-free rates (RFRs). Derivatives based on these rates will be used to derive term RFRs designated to replace the Ibor rates.

Sonia, the Swiss average rate overnight (Saron) and Tokyo overnight average rate (Tonar) are RFRs already, while secured overnight funding rate (SOFR) and euro markets are still undergoing transformation. The nature of these transitions is such that, between this article being written and published, more information on the transition plan for Eonia/euro short-term rate (Ester) is likely to have become available.

Important milestones

Three types of contractual changes are to be considered at different points in time.

First – and most importantly – the switch of official central counterparty (CCP) discounting on legacy portfolios as part of the overnight benchmark change will result in a change of value.

Second, the renegotiation of bilateral derivatives portfolios – including master agreements and credit support annexes – to reflect the new RFRs will require the ability to determine value effects.

Third, the impact of applying existing or new fallback languages in legacy contracts needs to be evaluated. Not only is this relevant in case no bilateral agreement can be reached prior to a benchmark discontinuation event – such as Eonia cessation – but fallback language can also have a predetermining effect on renegotiations of bilateral agreements. A detailed analysis of this requires the results of ongoing International Swaps and Derivatives Association consultations.

Threefold use of OIS rates

-

Valuation of derivatives and further financial instruments – discounting future cashflows.

-

Underlying financial instruments, such as derivatives.

-

Accrual of interest (funding) for posted collateral.

CCP discounting

This article examines the expected impact on CCP valuations once discounting is switched to RFR, following the steps from the announcement of the RFR to the discontinuation of the legacy benchmark.

Market prices contain all available information at any given time. Hence, the announcement of the new RFR and implementation plan will affect market prices. However, effects resulting from the RFR transition cannot be distinguished from general market movements. A distinct move in valuation will be realised only after a CCP changes its valuation methodology. Until then, there might be a discrepancy between actual portfolio value and CCP reported valuation.

Determining the effect of CCP valuation is not straightforward. The change in discounting is combined with an update in funding (price aligning interest) and implied changes to estimated forward rates. Respective effects are potentially offsetting direct effects from the change of discounting. Thus, all price components – valuation adjustments (XVAs) sensitive to overnight indexed swap (OIS) rates – need to be updated and analysed.

According to LPA’s transition model (see box, Transition model: Introducing a new overnight RFR in CCP discounting), pricing impacts should become apparent once CCPs accept RFR swaps (step 3). The market will slowly become transparent at this point since the CCP provides low-risk contracts without counterparty-specific pricing. Nevertheless, CCPs will still use the legacy OIS-based valuation on RFR contracts. Currently, the US market has passed step 3 and is well on its way to step 4, with CME Group offering full SOFR valuation from 1 October, 2018. This means the US is ahead of schedule towards the milestone of the first quarter of 2020, as defined in the Alternative Reference Rates Committee’s Paced Transition Plan.

Valuation elements

Building a transitional valuation model to deal with the OIS transition requires the following (figure 1):

-

Modelling the Ibor swap curve and forecasting the Ibors. This step is important for the subsequent Ibor to term RFR transition.

-

Managing the current OIS curve. It is important to consider what would happen in the case of a ‘hard’ fallback event.

-

Modelling the spread between OIS and RFR. Update the short-rate-depended XVAs to the new RFR.

-

Valuing the portfolio under alternative hard fallback scenarios. Those scenarios depend on the legal status of portfolio positions. This part of the exercise will support bilateral portfolio renegotiations.

Transition model: Introducing a new overnight RFR in CCP discounting

-

Selection of the new RFR benchmark.

-

RFR benchmark in production.

-

RFR over-the-counter or exchange-traded derivatives products in central counterparty (CPP).

-

CCP – Valuation and price-aligning interest in RFR.

-

CCP – Migration of legacy contracts to RFR.

-

Fallback conversion of legacy benchmark contracts.

What is price-aligning interest?

When a CCP posts collateral to an account, an interest rate is applied to the balance. Likewise, if collateral is required, posted collateral will earn interest. The respective interest rate is called price-aligning interest.

Some quantitative aspects

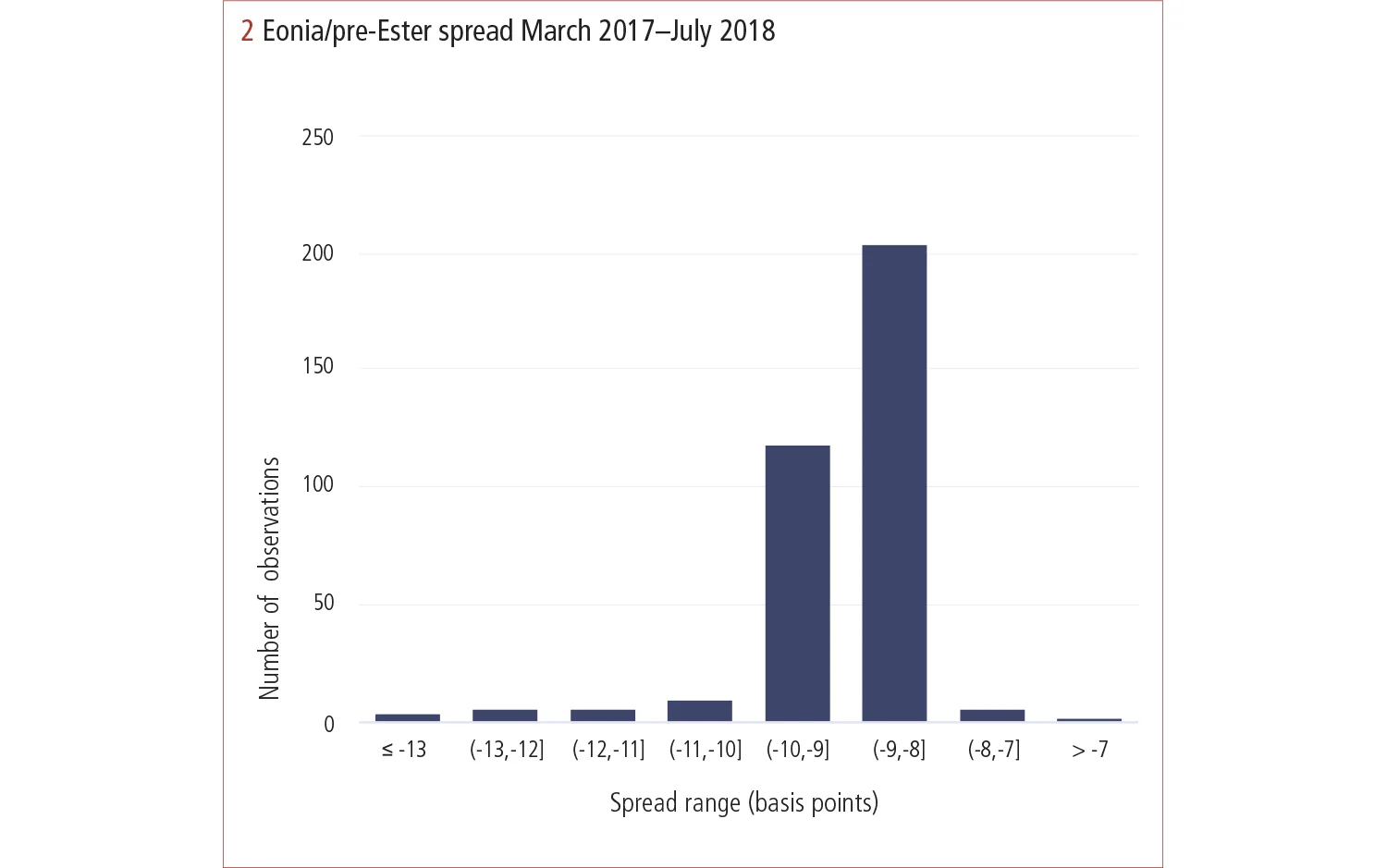

Modelling the impact of a change in overnight indexed swap (OIS) rates is similar to the previous switch from Libor to OIS discounting. Effects of switching OISs are split into two parts: a pure discounting effect and a forward-rate effect. The discounting effect simply results from different rates used for discounting future cashflows, while a changed OIS rate used for calibration changes forward rates and, hence, the future cashflows themselves. LPA considered a parallel shift of 8 basis points based on historical data.

Case study

This case study examines the spread between OIS to RFR, describing approaches for the derivation of the blended discount curve. This is more of an art than a science, and must be challenged as the market evolves.

Assuming a constant spread between OIS and the new RFR based on the rather short history of available data is a good start and can be readily calculated by modern risk management software (figure 2). Nevertheless, this approach does not cover OIS curve dynamics such as changes in level or shape.

The next iteration would be to assume a spread term structure, with the spread depending on the maturity. The existence of a term structure of the Eonia/Ester spread needs further research; however, quantitative aspects suggest progress in this direction. When introducing such a term structure, the model should be validated to ensure the implied-forward RFRs are credible when compared with the forward OIS rates and the implied Ibors.

Alternatively, it might be possible to model the RFR curve directly, using a mix of instruments. The approach would be to model what happens to an existing legacy OIS swap if it undergoes a hard conversion. This approach would require direct modification of its bootstrap instruments, but should be an accurate representation of what is actually traded.

The downside of such an alternative is that it requires hard assumptions on the fallback spread and the exact timing of conversion. This approach may require some changes to the pricing and risk software used. If a clear plan were communicated, the only parameter to be estimated would be the conversion spread between the old and new benchmarks.

Case study

LPA’s analysis is based on the following portfolios:

-

Swap portfolio – Average remaining term 10y/20y, portfolio value from -10%–10% of notional.

-

Swaption portfolio – Average swap start tenor 5y/7y, swap tenor 5y/10y/15y; strike 2.0%.

1. Swap portfolio

2. Swaption portfolio

Conclusion and recommendations

The transition to a new system of interest rate benchmarks poses various challenges for market participants over the coming months and years. The described effects on the discounting of derivatives are particularly interesting but are only one aspect of many. The transition to term RFRs will have a much greater and broader impact from a quantitative perspective. However, for most market participants, the biggest challenges will be operational – for example, IT, processes, negotiations and repaperings. LPA partners with clients to master the transition smoothly.

Read more articles from the 2018 Beyond Libor special report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net