Valuation adjustments (XVAs)

WHAT IS THIS? The XVAs are a family of adjustments that can be made to the price of a derivatives trade, reflecting counterparty risk (CVA), own-default risk (DVA), funding (FVA), capital (KVA) and margin (MVA). Their theoretical roots and practical implementation are still debated, but pragmatism also matters: banks that ignore XVAs are at risk of mispricing a trade; banks that include them are at risk of never winning a trade.

Penalty methods for bilateral XVA pricing in European and American contingent claims by a partial differential equation model

Under some assumptions, the valuation of financial derivatives, including a value adjustment to account for default risk (the so-called XVA), gives rise to a nonlinear partial differential equation (PDE). The authors propose numerical methods for…

How XVAs hit top US banks’ trading revenues in 2020

JP Morgan led systemic banks on losses due to valuation adjustments

XVAs ate $401m of JP Morgan’s revenues in 2020

Credit valuation adjustment on derivatives cost $337 million alone

Putting the H in XVAs

Barclays quant proposes methodology for factoring hedging costs into derivatives valuations

Technology innovation of the year: Scotiabank

Risk Awards 2021: New risk engine can run nearly a billion XVA calculations per second

Hedging valuation adjustment: fact and friction

Transaction costs’ impact on hedging can now be quantified

The slow corporate embrace of CSAs

Risk.net research finds 28 of 50 large companies now have CSAs – but has the trend run its course?

Review of 2020: chaos on a roll

Vanishing liquidity, the Ronin collapse, XVAs – the pandemic wreaked havoc in risk transfer markets

CVA charges for Canadian dealers edge off Covid highs

At CIBC, CVA charges fell 12% quarter on quarter

A guiding light for corporates lost in the fog of XVAs

Chris Kenyon proposes a framework for optimising XVAs – from the client perspective

Client engineering of XVA

A client’s guide to reducing XVA in times of need

Podcast: Matthias Arnsdorf on a new – and cheaper – KVA

Quant proposes approach anchored by a dealer’s default rate rather than its return on equity

KVA as a transfer of wealth

A capital valuation adjustment designed to preserve a firm’s value to shareholders is introduced

At UniCredit, XVAs amped trading gains in Q3

Italian bank claimed a €110 million benefit to earnings from valuation adjustments

Funding pain prompts calls to rehome FVA

Dealers push to move derivatives funding costs out of P&L following March’s outsize losses

Danske quants discover speedier way to crunch XVAs

Differential machine learning produces results “thousands of times faster and with similar accuracy”

Differential machine learning: the shape of things to come

A derivative pricing approximation method using neural networks and AAD speeds up calculations

Will the exit price be right in new Isda docs?

Industry body is updating unloved procedure for valuing terminated swaps

XVA traders have no time to rest on laurels

Markets have calmed, but they may not be out of the woods yet

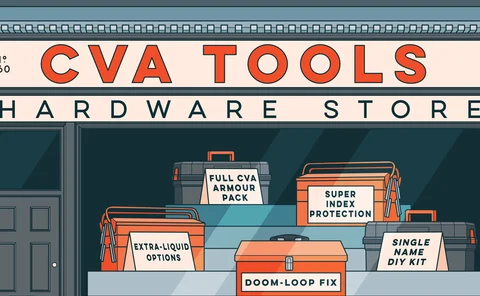

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

Virus volatility swelled CVA charges at Barclays, NatWest in H1

PRA capital relief for market risk eased the CVA burden at some lenders

Commerzbank takes €111m of XVA losses in H1

Valuation adjustment benefits gained in Q2 did not offset huge Q1 losses

HSBC trading unit hit by $355m of XVA costs in H1

Wider spreads continued to eat into derivatives values

Dealers eye model change to cure CVA capital headache

With hopes of EU regulatory carve-out fading, some banks are taking matters into their own hands