Technology

IFRS 17 – Preparing for the transition

This webinar explores the key elements of the International Financial Reporting Standards, the key challenges of implementing the systems and related data issues, and how the regulatory landscape may look post-implementation

Banking regulator: beef up security in Covid-19 remote working era

OCC security controller warns cybercriminals exploiting wider attack surface created by remote working

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

Covid-19 frazzles AI fraud systems

Seismic changes in customer behaviour see machine learning solutions throw out false positives

Uncharted waters

How pension plans can better equip themselves for a period of economic upheaval. By Matthew Seymour, RiskFirst, a Moody’s Analytics Company

Building a holistic GRC framework in fragmented Asia-Pacific markets

This webinar explores best practices in meeting regulatory and data governance requirements in fragmented markets

Energy Risk Software Rankings: A different world

Energy Risk’s Software Rankings reveal the industry’s technology preferences in a changing world

Three strategic priorities to meet the new FFIEC regulations

This webinar analyses the key challenges and strategic priorities for firms to meet the evolving requirements for operational resilience

Coronavirus is testing op risk managers to the limit

No amount of stress testing can prepare firms for the risks they’re facing, says Ariane Chapelle

Top 10 operational risks for 2020

The biggest op risks for 2020, as chosen by industry practitioners

Top 10 op risks 2020: talent risk

Firms struggle to reduce headcount and fill gaps without cutting corners

Top 10 op risks 2020: organisational change

New tech has created perennial state of flux in banking, as other kinds of shake-ups continue

‘Quantamental’ approach convinces Morgan Creek CEO

Proponent of big-picture investing sees growing role for machines, but with caveats

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Treasurers turn to AI in bid for sharper forecasting

Wider automation could usher in future of ‘hands-free hedging’, but obstacles lurk in data standards and sharing

Exploring new investment prospects in volatile markets

Custom and traditional proprietary indexes have been growing in popularity and actively transforming the investment landscape. Financial products linked to indexes are thriving, enabling more efficient access to the market, whether it is equity, bonds or…

Singapore banks tighten ML governance amid regulatory scrutiny

DBS, StanChart and Deutsche build model inventories and draw up standards around use cases

FX aggregators flirt with scrutiny over brokerage charges

Making dealers pay for trades raises ‘payment for order flow’ questions

Energy25 winners in review

Energy25 aims to capture, define and analyse an important period in the development of energy markets, providing an invaluable yardstick for all participants. More broadly, it represents the latest stage in the strategy of defining, researching and…

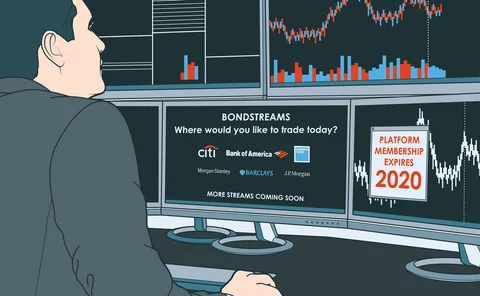

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

Credit risk – The bank data challenge in frontier markets

As the regulatory net tightens, banks working in and across frontier regions are under pressure to source and maintain more accurate data in the assessment of counterparty credit risk, but some are investing in tools to tackle the problem

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Credit data: a sharp turning point in CCP credit risk

The credit risk of CCPs is worsening, even as margin requirements rise, writes David Carruthers