Structured products

WHAT IS THIS? Structured products are investments that have multiple components. For retail investors, the most common form is a bond plus an option – these tend to be standardised, sold in small tickets and large volumes. Managing the risks of large structured products portfolios is one of the biggest challenges dealers face.

UBS Asia-Pacific structuring head leaves bank

Felix Maratier to quit the industry and move to Spain

The arcsine law for quantile derivatives

A new pricing model for quantile-based derivatives, such as Napoleon options, is presented

Citi turns to decrement indexes for single-stock autocalls

US bank claims new Stoxx indexes for 23 single names will slash hedging costs and boost coupons

UBS Apac sales structuring exec to join Morgan Stanley

Bilal Al-Ali to head Apac structured sales at the US bank

Too much of a good thing? Banks mull over excess deposits

Surge in non-operating deposits leaves banks with a severe hangover

Callable repack frenzy opens up new options market in Europe

Demand driven mainly by French life insurers looking for alternatives to low-yielding sovereign bonds

Equity derivatives house of the year: Citi

Risk Awards 2021: US bank vaults into the top-tier, with some help from Garry Kasparov

Structured products house of the year: Credit Suisse

Risk Awards 2021: Private bank tie-up provided vital risk-sharing outlet for Covid volatility

Law firm of the year: Linklaters

Risk awards 2021: Lawyers raced against time to draft fallback protocol vital to Libor transition

Haitong set for warrants wins as China sanctions hit US banks

China securities firm doubles HKEX warrant output as US banks pull listed products on vetoed names

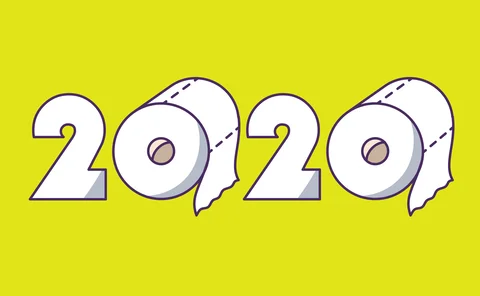

Review of 2020: chaos on a roll

Vanishing liquidity, the Ronin collapse, XVAs – the pandemic wreaked havoc in risk transfer markets

Pricing multiple barrier derivatives under stochastic volatility

This work generalizes existing one- and two-dimensional pricing formulas with an equal number of barriers to a setting of n dimensions and up to two barriers in the presence of stochastic volatility.

Warrants proving a big opportunity for Asia private banks

While the products are booming amid fall-off in principal-protected structures, some distributors are missing out

China structured products could surge after QFII relaxation

Changes to market access scheme allow new hedging methods, but detailed guidelines still pending

TSE outage throws structured notes into tailspin

Trading shutdown on October 1 disrupted observation dates for some structured products

Time to rethink Korean structured products

New battle lines are being drawn in Korea’s structured products market

Autocalamity: can hit product be reinvented?

Spreads on ‘worst-of’ bonds leap 50% as some dealers retreat and others pile on hedges

As Covid‑19 impacts the autocallables business, solutions to navigate new challenges are crucial

With pandemic losses impacting derivatives activity, Murex’s MX.3 software solution for autocallables comes to the fore

SocGen’s Marc Saffon appointed Japan head of markets

Saffon replaces Arnaud Lhoste who returns to Europe

Revised FRTB deadline poses further challenges for Asia‑Pacific banks

Essan Soobratty, product manager for regulatory data, New York; Eugene Stern, global head of product, market risk, New York; and Vicky Cheng, head of government and regulatory affairs, Asia‑Pacific, Hong Kong, at Bloomberg explore the additional…

China Minsheng Bank MStar shines in volatile markets

Sponsored content

Top banks defer €1.6bn of profits on hard-to-value trades in H1

BNP Paribas set aside €532 million alone in H1

SocGen mulls sale of structured product books after big losses

Rival Natixis also plans to place parts of its equity derivatives business in run-off mode

BNP tags €10bn of equity derivatives as hard-to-value

Over 12% of exposures classified as Level 3 at end-June