This article was paid for by a contributing third party.More Information.

As Covid‑19 impacts the autocallables business, solutions to navigate new challenges are crucial

With pandemic losses impacting derivatives activity, Murex’s MX.3 software solution for autocallables comes to the fore

Equity structured products are big business for the largest financial institutions worldwide. The autocallable is the uncontested number one equity exotics landscape offering.

In a fiercely competitive market, financial institutions often focus on honing a few autocall variations to stand out.

Final clients are usually individuals with different wealth profiles – such as retail clients in South Korea or wealth management clients in Singapore – with one or several distribution intermediaries between them and the product issuer.

There are also strong regional particularities in the type of autocallables sold. South Korea has seen the emergence of Lizard and then the Komodo autocall, which then spread in South-east Asia – the daily range accrual is also very popular in this region. In Russia, half of the term sheets have different observation types for the knock-out and the final payout.

As the Covid‑19 pandemic has severely impacted derivatives activity, the importance of a software solution for autocallables has been underscored.

Managed well, an autocall business can be very profitable. It is also very risky. Issuers love the autocall business – in bullish markets it can early-redeem very quickly, in which case a new investment product can be sold to the same client while rolling the hedge, generating more frequent margins. In turbulent markets, however, it can be quite a different story.

Though quite stable since the financial crisis that began in 2007–08, dividends were a driver of pandemic losses incurred by some equity derivatives desks. These dividends were already announced and were therefore not hedged. Past losses have also been caused by the peak vega – the sudden drop of vega that requires hedge buying options at a high price while they were sold at a low price.

There are several factors required to build a profitable autocallable business:

- Banks need to propose the right array of products, innovate regularly to attract clients and include increasingly popular market variations in their catalogue. Prompt time-to-market is key in these cases.

- Banks need to distribute the product efficiently, enabling trading on single/multidealer platforms with digitalised requests for quotation (RFQs).

- Pricing models are also important – significant losses observed in Asia in 2018 were reported as being partly explained by local volatility modelling limitations.

- Appropriate lifecycle representation and the ability to manage back-office in a straight-through processing way helps eliminate recurrent operational costs and risks, and supports business growth.

- Banks need the correct infrastructure to scale up and seize opportunities.

Currently used by more than 20 clients, including issuers, the MX.3 solution provides support by leveraging its integrated platform model and strong investment in the autocallable business line

Jean-Baptiste Dusson, head of equity derivatives product management, Murex

This has proven essential amid recent market volatility – Murex’s comprehensive set of risk measures, accurate trade representation and overall capacity to manage rising volumes have been important for navigating the new reality.

Real-time portfolio management and overhedge techniques

Going forward, it is essential to have a real-time decision-making tool to efficiently operate and manage specific autocallable risks. Understanding the challenges these aspects present and having the IT solution to overcome them is critical.

As for any non-linear activity, hedging the spot risk is the top priority. When selling an autocallable, a trader is short delta. Near payout discontinuities, to avoid the liquidity risk of suddenly having to buy or sell important quantities of underlying, traders rely on overhedge techniques, which typically include replacing barriers and digitals by conservative call spreads, sometimes applying a bend on the knock-in barrier.

Those pricing adjustments smooth the net present value and the Greeks profile, enabling more secure delta hedging. Traders choose the size of the call spread depending on stock liquidity and digital risk, the cost of which is supported by investors.

Managing vega is also critical – it is more complex than for vanilla products. Using a global vega for an autocall lacks precision. Traders require a topography by strike and maturity to identify where risk is concentrated. Getting this topography right on a sizeable book in a timely manner is a quantitative challenge.

During quiet periods, dividend risk can easily be hedged once properly bucketed by maturity. However, in more turbulent markets, it must be complemented by what-if scenarios, because dividends variations can suddenly become very large.

Real-time portfolio management supported by robust analytics and reliable, scalable architecture is at the core of Murex’s MX.3 solution for steering an autocall business. The solution also includes real-time risk ladders, which provide a good illustration of positions in the autocall books by showing deformation of the main risk figures as market data shifts. It has several views to control operational risks, including barriers and fixings management, upcoming expiries and dividends. Its analysis tool, PL Explain, saves precious time for traders, illustrating their daily profit-and-loss variation by risk factor.

Models that home in on what matters

In recent years, autocallable losses have been attributable to limited capture of spot-volatility dynamics – this is due to an overreliance on local volatility models. Those models are not successful at capturing the path-dependent nature of autocallables.

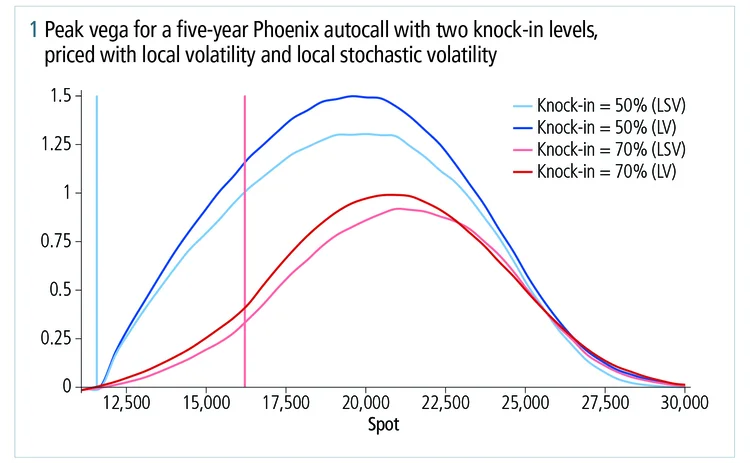

Zooming into the spot volatility dynamics when selling an autocall, one is short vanna, which could be very problematic in bearish times: when the spot goes down, the vega increases to a certain level and then drops sharply until barrier is reached (see figure 1).

Stochastic volatility models capture these nuances. These models enable a good fit to vanilla options, while providing realistic forward probabilities, bridging a gap. Striking the right balance between the local and stochastic volatility dimensions, local stochastic volatility (LSV) models allow for spot-vol dynamics control and match real market behaviour.

Typically, stochastic volatility tends to be higher in Asia, due to the predominant autocall business in the region and the lack of diversification in market participants. Murex researchers have observed this by analysing historical long-term skew stickiness ratio (SSR), a metric introduced by Bergomi to observe the dynamics in a proportion of the skew. While it is close to the SSR induced by a sticky strike dynamic for the S&P 500 and Euro Stoxx 50, it is clearly below for Asian indexes such as the Hang Seng China Enterprises Index and Nikkei. In other words, in markets saturated with autocallable, ‘spot up equals vol down’ is less pronounced.

The autocallable knock-in put is the part of the payout most sensitive to stochastic volatility. Market actors know the longer the maturity and the lower the early redemption barrier, the higher the impact of considering stochastic volatility. The ‘worst of’ feature of multi-underlying autocallables also increases the impact of stochastic volatility. This explains why major players use an LSV model as a benchmark for pricing and taking provisions on their books on a regular basis.

Despite well-known limitations, the local volatility model is still the market standard for intraday risk management. The MX.3 solution features a local volatility model used by Murex clients, which is powered by graphics processing units to accelerate Monte Carlo computations, increasing accuracy, and an LSV model, which serves as a cutting-edge alternative for pricing.

According to our studies, the impact of considering LSV on mono-underlying standard autocall could reach up to 100 basis points compared to standard local volatility pricing

Cherif Ben Mlouka, product manager for equity derivatives, Murex

Trade representation and operations

Managing an autocall business isn’t exclusively a front-office challenge.

As a starting point, you need to have clean representation of trades for easy inputs and to ensure the back-office chain can be optimally automated. Otherwise, it can become very costly.

The MX.3 solution has been enriched to cover regionally specific financial clauses in various formats, from swaps to structured notes, leveraging on Murex’s payout language to meet time-to-market challenges. The lifecycle is managed seamlessly, thanks to the front-to-back integration of the platform. This includes, for instance, the option to exercise the final payout with a physical settlement, but also the automatic move of swap trades to fallback rates in anticipation of the Libor transition. And all this remains true for a client using its own analytics.

To manage the lifecycle of trades, a reliable system is necessary. When thousands of knock-in events activating the put at maturity need to be applied, you have to identify eligible trades, apply events properly, streamline investor notices, generate an accurate new version of the transaction with the put at maturity and anticipate the event-related sensitivities gap to rebalance hedges.

One desk forgot to update some vol surface for a number of months and saw losses in the tens of millions

Jean-Baptiste Dusson, head of equity derivatives product management, Murex

Market data management is also a key aspect and is a source of operational risk when handling numerous correlation, volatility and dividend structures.

Dealing with increasing volumes is critical to maximising profitability. From the digital distribution of the product (quoting on various platforms, responding to RFQs, sales-trader workflow) to trade processing (lifecycle management, including corporate actions), automation is key. Systems must be scalable, and this is particularly the case with risk management, which usually generates important hardware expenses as well.

Running a profitable autocall business and the various processes attached to it – including issuance, pricing, structuring, distribution, trade representation, market data sourcing and calibration, confirmation, settlements, events, and corporate actions, all while being able to manage risk – is a heavy lift. But it can be done. The Murex MX.3 solution makes it possible.

Contact Murex at info@murex.com for more information about its solution to price and manage a large range of autocallables.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net