CMBC MSTAR shines in volatile markets

A custom multi-asset approach to offer consistent returns.

Investors in China are continuing to turn away from once-favoured products that offer an implied guarantee return – instead flocking into floating-return solutions linked to global financial markets.

Outstanding structured deposits jumped 26% to CNY12.14 trillion ($1.72 trillion) in the first four months of 2020, according to data from the People’s Bank of China. Throughout the year, lacklustre performance in the onshore fixed income market has encouraged more investment in floating-return products that offer access to multiple asset classes and geographies.

China Minsheng Bank (CMBC) has been developing a wide range of underlyings and payouts, offered via a standard structured deposit format: equity indexes, foreign exchange pairs, rates, commodities, mutual funds and quantitative indexes.

“Over the past three years, we have seen increasing interest from local clients for a more diversified, global exposure,” says Wu Chu, a derivatives trader at CMBC. “Quite simply, the onshore market has not been able to provide the capacity, nor the diversity of assets, to satisfy the demand. By partnering with a renowned provider such as Societe Generale, we have been able to use our complementary expertise to significantly grow our offering.”

Diversification is another reason for the growing popularity of these products onshore, one that has become increasingly important amid the market fallout from the Covid‑19 pandemic.

Investors prepared to sacrifice the fixed interest yield from a traditional cash deposit can gain higher returns through exposure to proprietary indexes that perform better than standard benchmark indexes in times of market stress.

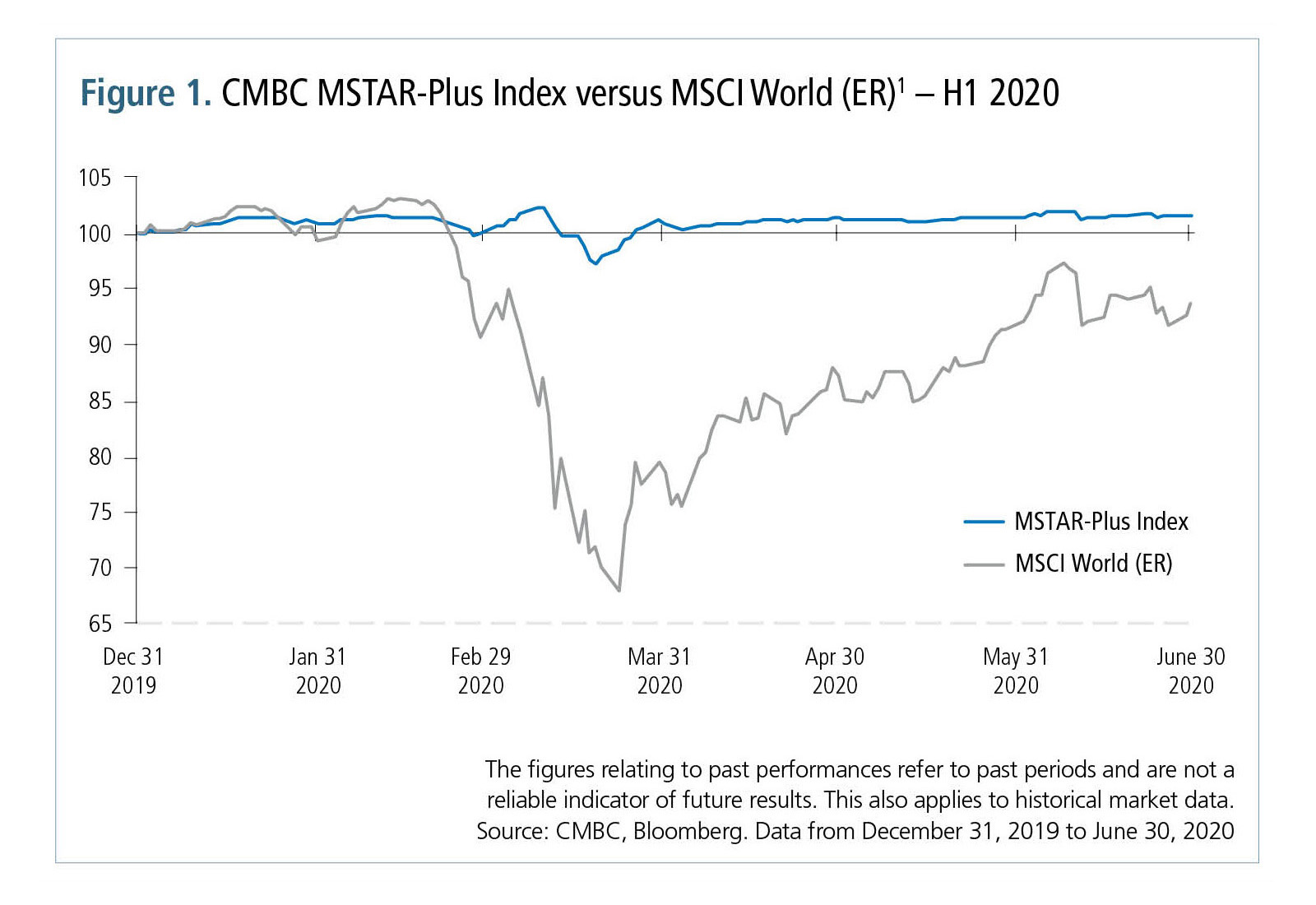

Despite challenging conditions over the past six months, CMBC’s flagship MSTAR-Plus, for example, performed well. A robust investment process that focuses on genuinely diversified strategies proved its value when it mattered most. At the end of the first half of 2020, the flagship MSTAR-Plus Index was up 1.5% year-to-date and averted a significant drawdown (figure 1).

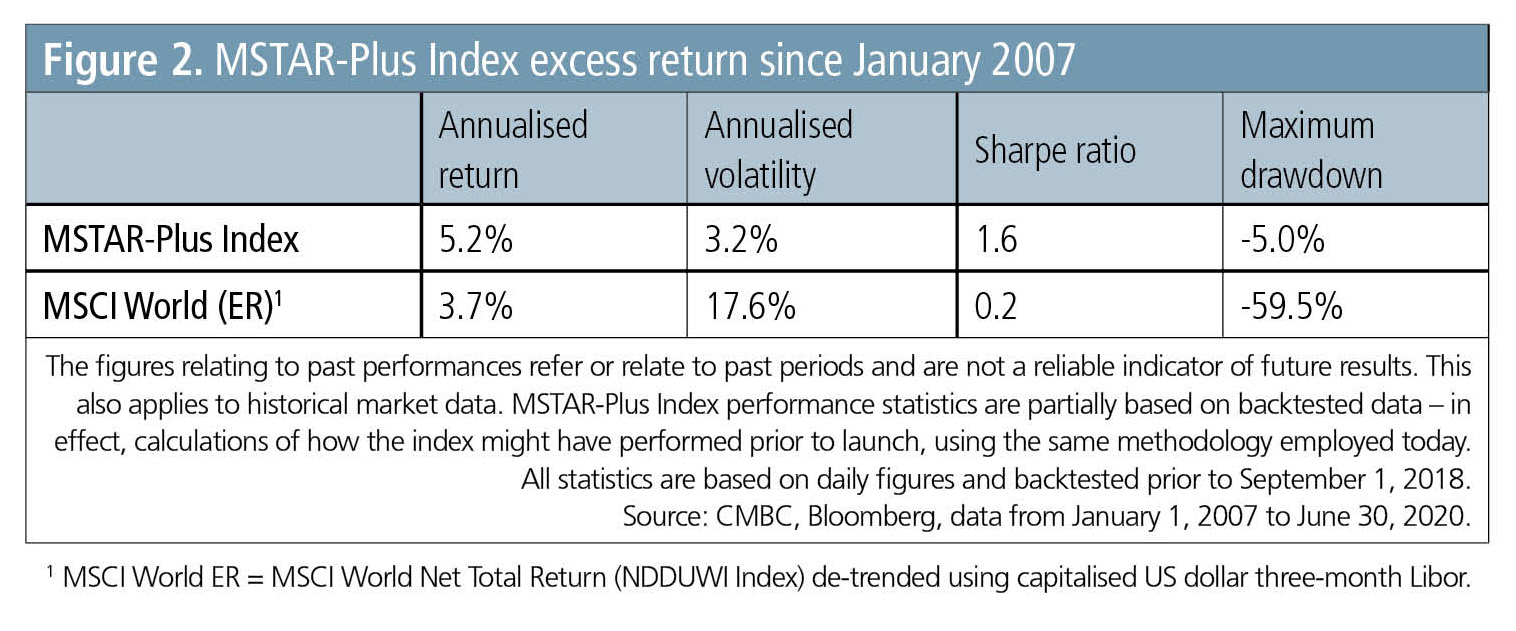

Over the long-term, the MSTAR-Plus Index has also provided a very attractive excess return (figure 2).

The index is designed to capture an underlying beta return that is then combined with a number of alpha strategies designed to improve returns while retaining market neutrality, says Chu.

“By constructing an alpha plus smart beta strategy, we have been able to offer a very attractive risk/reward proposition to our clients,” she says. “Take, for example, our MSTAR-Plus Index: we employ two smart beta strategies, which generate returns rotating between asset classes. These are complemented by three alpha strategies, which gain excess returns from market-neutral strategies.”

One example of these alpha-generating market-neutral strategies is a unique commodity curve and liquidity arbitrage provided by Societe Generale. Its low correlation to the other alpha and smart beta components within the portfolio helped mitigate risk in the first quarter of 2020, including benefiting from the oil price crash in April.

In addition to refining the underlying strategies, CMBC also focuses on innovating payouts that generate stable and attractive returns.

“We believe a good structured deposit product is determined by two key factors: the underlying and the payoff,” says Chu. “We have a dedicated structured products team that consistently monitors the market conditions, and partners with the top investment banks on the street to design and innovate structures according to different market situation. For example, our main partner, Societe Generale, was able to provide consistent pricing throughout 2020 – even as market volatility spiked.

“As the market continues to grow, our goal is to keep offering innovative products that fit with the evolving expectations of our clients.”

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net