Senior Managers and Certification Regime (SMCR)

Rumblings over UK review of ‘bad apples’ regime

Plans to reform Senior Managers and Certification Regime raise concerns over backsliding on conduct in financial industry

New UK fraud rules intensify global focus on third-party risk

Firms will have responsibility to ensure “associated” persons are taking steps to prevent fraud

Does it matter if Tom Hayes is acquitted?

It matters to him, but changes to UK rules are meant to avoid an exact repeat of the Libor case

New BoE rules could force banks to cull multiplying models

Risk Live: Model risk management to become more labour-intensive, as model definition is broadened

Clock ticking on UK plan for regulatory reforms

Changes to SMCR and short-selling rules least likely to be completed before next election

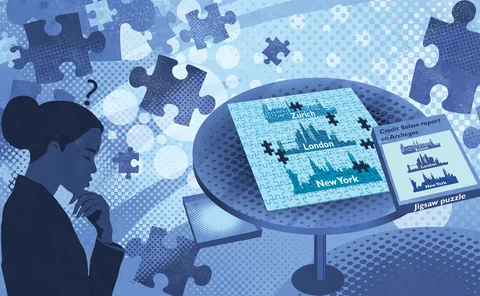

Only regulators can clear up Credit Suisse’s Archegos mess

Shareholders were right to keep officers and directors on the hook until all the facts are known

Archegos revisited: the gaps in Credit Suisse’s story

Ahead of shareholder vote, former execs point to gaps in key report – raising new questions about accountability

FCA move brings regulatory risk to use of hold times

Regulator’s adoption of code, and rejection of extra hold times, means those ignoring it risk scrutiny

New UK op risk rules elevate management over measurement

Under op resilience rules, firms must plan for all severe stresses, whatever their probability

Top 10 op risks 2020: conduct risk

Root-and-branch reform of bank culture remains a work in progress

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

The human touch: SMCR extension reaches smaller firms

Extended to nearly 50,000 firms, UK regime aims to pinpoint responsibility, from money laundering to #MeToo

The problem with GRC

Boards may care more about products and profits than governance, risk and compliance (GRC). But without an effective GRC programme, the fun soon stops when trouble calls, says Michael Gibbs, chief executive of SureStep Risk + Analytics

A behavioural lens could help manage human risk

Human decision-making needs careful watching. For that, behavioural science can help

FCA has active pipeline of misconduct investigations

As expansion of SMR to smaller firms looms, regulator says plenty of bankers are under scrutiny

Royal Commission report sparks conduct risk changes at ANZ

Regulators must work with banks on conduct risk rules to avoid “box-ticking exercise”

FCA may delay enforcement of UK’s conduct regime

Smaller firms won’t be penalised right away, says head of regulatory decisions committee

Mark Yallop on conflicts in fixed income

Banks and their clients need protocol on information sharing, says FMSB chair

Asia-Pacific banks grapple with conduct risk rules

Australia, Hong Kong regimes lead in developing conduct risk guidelines; Singapore lags behind

Top 10 op risks 2018: unauthorised trading

Banks say threat from rogue algos outstrips that of human traders

Banks wrestle with conduct risk capital add-ons

Conduct risk-related additions to Pillar 2 capital raise questions over scope of UK’s Senior Managers Regime