Loans

Lloyds and Riverside rehitch revolving loan to Sonia

£100m Sonia facility overcame late operational hurdles to be among the first done since the onset of coronavirus

Covid-19 disruptions expose Libor loan fallback flaws

Amending legacy loans during a crisis will prove challenging, ARRC member warns

Libor webinar playback: spotlight on loans

Panellists from McKinsey, the LSTA and UBS discuss efforts to switch lending to new benchmarks

BoE to publish ‘golden source’ compounded Sonia index in July

UK to align with US in effort eliminate interest calculation mismatches and turbo-charge adoption

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

Equity gains bolster EU hedge funds’ portfolios

Funds were net sellers of equities, but market gains added +10% to balance sheet values

Chinese banks set for mass loan repricing

Options launch slated for February to help industry switch to new benchmark by August

FCA dismisses Libor credit component concerns

UK regulator bemused by distress raised by US regional banks to Fed

Luxembourg regulator probes loan investments by Ucits

Lawyers say CSSF has already told a number of funds to prepare to sell their holdings

Asia moves: Natixis hires Asia M&A chief, Deutsche Bank picks north Asia head, and more

Latest job news across the industry

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Corporate defaults push Danske Bank’s NPLs up 16%

Single-name exposures caused bulk of Q4 impairments

Intesa Sanpaolo cut €2.4bn of bad loans in 2019

Non-performing loan ratio falls to 3.6%

EU insurers pile into loans, funds and private equity

Fund investments make up 12% of exposures as of Q3 2019

Libor replacement jumble may hike hedging costs

Use of term rates and credit adjustments will create new basis risks that could be costly to hedge

US Bancorp trimmed toxic assets in Q4

Non-performing asset rate falls to 0.28%

At Goldman Sachs, loan-loss provisions top $1bn

Loans up 11% in 2019, but provisions for credit losses surge 59%

EU compounding confusion creates headaches for banks

With the fallback possibly illegal in some EU states, loan system updates may become more complicated

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

Risk weight tweak could fix IFRS 9 capital clash – research

Practitioner suggests way to cancel out double-counting of Basel credit loss provisions

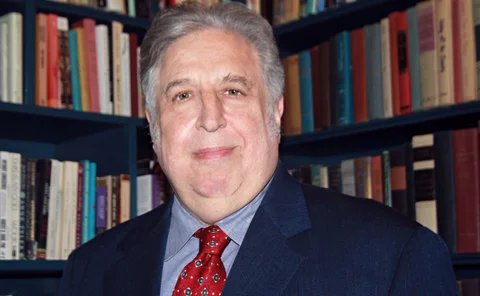

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Compounded rate out of favour, finds Japan survey

Users prefer forward-looking term rate to replace yen Libor, but dealers bemoan “lack of understanding”

Euribor fallbacks could hit thin legal ice

In Italy and Germany, compound interest – the foundation of Euribor fallbacks – is actually illegal

CLO stress test shows losses for US insurers could top $6.9bn

Under one stress scenario, BBB tranches could suffer losses